‘Money is Power!’. You may have already encountered this idiom at least once in your life. Be it written in a publication or spoken by somebody; you take an instant pause to reflect on it.

To some degree, this statement holds meaning. Money can't buy everything but everything needs money. This highlights the fact that money, or wealth and asset, is essential.

Due to some circumstances, you may want to expand your ways of saving and investing, which is a good decision, and you stumble upon an unfamiliar term; self-directed IRA.

What is this? How can I participate in this? How does a self-directed IRA work? These are some of the questions that we will be answering in this article of mine.

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) are created for individuals, specially those that are nearing retirement, to help them open up a savings account with generous tax advantages.

Similar to a 401(k) and gold account which is for employees, any potential client and retiree looking to open an IRA account can save and invest even for a long term.

You can start opening an IRA account thru various means: a bank, online brokerage firm, investment company, reputable online organization, or directly to trusted IRA dealer.

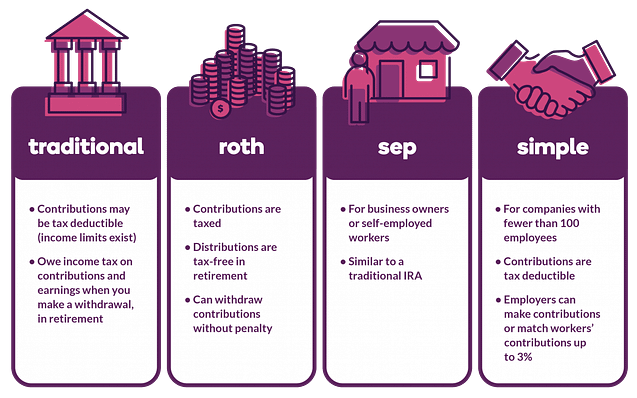

It has many different types and forms, including but not limited to, traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs among others. Rest assured that they will give you distinct benefits!

Although IRAs are meant to serve as a part of a retirement plan, one should remember that money cannot be withdrawn at a certain age without incurring a percentage of tax penalty.

What Is A Self-Directed IRA?

"Aren't all IRAs self-directed?" You might already be wondering the answer to this question, and quite frankly, you are right. All types of IRAs are well-within the decisions and choices by the client.

A self-directed IRA gives you a freedom of choice. If the client does not want to invest on regular and traditional assets such as stocks, it allows the investor to do alternative assets.

These alternative assets ranges from precious metals (gold, silver, etc.), real estate, livestock, bonds and mutual funds, etc. The options you have will be close to limitless.

One requirement you need to accomplish is to find and secure a relationship with a custodian. These custodians are responsible for opening your account and storing your assets.

But be wary! A lot of institutions nowadays are claiming they are self-directed IRA, but they actually limit your opportunity to invest and often times the client needs their permission to do something.

This defeats the concept of 'self-directed'. If you want aware and ready for any opportunity for further investment, this top rated IRA firm can help you start your account.

Types of Self-Directed IRAs

If you have a traditional IRA in a certain company or firm, you can transfer and move them to become self-directed IRA to another custodian tax-free!

As mentioned above, their are four common and most sought type of self-directed IRAs. Here are some background information in which potential investors must read.

1. Traditional IRA

The Employee Retirement Income Security Act of 1974 (ERISA) introduced the traditional IRA as an individual retirement plan (IRA). It was established in order to assist more Americans in saving for retirement.

The maximum IRA contribution in 2022 will be $6,000, or $7,000 if you are at least 50 years old. Traditional IRA contributions are tax deductible.

Early distributions are taxed and subject to a 10% penalty if taken before the age of 59 1/2. After 72 years of age, you must take an annual necessary minimum distribution.

2. Roth IRA

The Roth IRA was created by the Taxpayer Relief Act of 1997, and it is an after-tax IRA that allows anyone in the United States with earned income under a certain threshold.

For 2022, under $140,000 if the client is single and $214,000 if married and file jointly to make after-tax contributions of $6,000 or $7,000.

All Roth IRA distributions are tax-free if you have had a Roth IRA for at least five years and are at least 59 1/2 years old. In addition, there are no mandatory distributions with a Roth IRA.

3. SEP IRA

The Simplified Employee Pension IRA (SEP IRA) was established by the 1978 Revenue Act to provide a contributory retirement plan for small firms. A profit-sharing plan, in essence, is a SEP IRA.

The maximum SEP IRA contribution in 2022 will be $61,000, and it must be done before taxes. Contributions must be provided to all qualified employees and are based on a percentage of income/salary (20% or 25% if W-2)

4. SIMPLE IRA

The Savings Incentive Match Plan for Employees (SIMPLE IRA) was established by the Small Business Job Protection Act of 1996.

Any employer with less than 100 employees can establish a SIMPLE IRA plan. Its deferral limit is lower than that of a 401(k) plan.

Unlike a 401(k), however, the SIMPLE IRA plan holds contributions for each employee in an IRA-style trust rather than a single plan like a 401(k) or other qualified retirement plan.

Employee deferrals will be limited to $13,500 in 2022, with a $3,000 catch-up contribution for individuals over 50.

Starting a Self-Directed IRA

Firms and companies would be more than happy to have a client ask them of the process of creating a self-directed IRA account. If you are looking to create one, this part can enlighten you.

The process is fairly simple and straightforward, provided that you have compiled all the needed requirements and you have already understood the essence of opening your own IRA account.

1. Information Gathering

The first part of creating your own self-directed IRA account is to provide the necessary information needed. This is for the custodian's assurance that your are eligible to open one.

This normally entails a copy of your identification, some valid identification cards, personal information, credit card number, and social security number.

Just be careful during these part of the process. Be vigilant for any unwarranted activities and actions by the one who is doing the transaction with you so as to avoid information leakage.

2. Completion of Application

The completion of application will be done through either digital or paper works. At this phase, you must have already managed to accomplished all the forms with your utmost knowledge.

Any concerns and queries towards the custodian's processes and business engagement can be addressed during this step. They will give out essential information in order to help you.

3. Personal Account Choices

Personal Account Choices is directly related to what you and your chosen custodian has agreed upon. The forms and requirements that you have accomplished must lead into the opening of your account.

Aside from self-directed IRA, you can also open a 401(k) rollover account, a direct transfer, fund contribution, among other formal transactions which will be reflected on your accounts.

Rules and Regulations

As all things in our society, there must be rules and regulations to be followed so as not to disrupt the natural flow of things. The same is true with your self-directed IRA accounts.

Failure to comply or acknowledging these rules and regulations can possibly result to termination of your account. If not, expect to be hit by a penalty or some other form of consequence.

1. Impermissible Transactions

Even if doing self-directed IRAs, there are still some limitations set by firms and companies regarding your activities. An example would be the incapability to invest on some form of asset, like real estate that is near your home.

These types of transactions will be stipulated in your terms and conditions or any papers that you signed. If not, asked any team from the custodian you chose.

2. Disqualified Persons

Disqualified persons are those being labelled as someone who is in the other side of your investment spectrum that might have a conflict of interest or other views regarding self-directed IRAs.

You cant buy and sell investments from relatives, the investment company wherein your IRA is provided, or a physical institution that is closely related to you, and your own being.

3. Self Deals

This is pretty much self-explanatory. You can't do business with your own self! This is logical so as to avoid and prevent any tiptoeing on a gray area and abusing the power of self-directed IRAs.

You can't buy and sell assets to yourself, you cannot take any form of asset and use it for personal gains, and most of all, you cannot take and give out loans to yourself.

Pros and Cons

You have already a custodian in mind, you also look at your assets and you deem yourself ready to invest and create your own self-directed IRA account. What is left is actually opening it!

Or probably not. Be meticulous and weigh variables and factors first before jumping into the self-directed IRA account train. You must be able to pinpoint its plus sides and the ugly ones.

To help you in your decision-making process, here are some of the pros and cons of opening and owning a self-directed IRA account.

Pros

1. Wide array of investment alternatives

As mentioned earlier, self-directed IRA has a lot to offer to you. It gives you a better grip of the situation by giving you a lot of options. Not many services give you this type of business flexibility.

If you think you are not seeing yourself doing option 1 for the long run, you can check for option 2, and so on and so forth while allowing you to enjoy the same tax benefits as owning a regular IRA account.

2. Portfolio diversity

A lot of people nowadays are doing whatever gimmick and potential wealth generating activating which can in turn lead into what's called as diversification of portfolio, which is a great mindset to have!

Owning a self-directed IRA will improve your investment reach. Other institutions and organizations will be more willing to conduct business with you just by seeing your financial portfolio.

You are retiring from a job that you know too well just like the back of your hand. At the same time, you managed to create an account that is in line of your past job. That is the beauty of self-directed IRA.

Experience, knowledge, passion, hobby, whatever it is that drives you forward. You can use these things to propel you into creating self-directed accounts that are fruitful.

An example would be investing in precious metals. Let us say that you have ample knowledge regarding this type of asset and you know for a fact that they will generate a steady revenue, then you must go for it.

Through owning a self-directed IRA, your focus will be directed to areas wherein you can better help yourself be more successful in the long run.

Cons

1. Fees are generally high

It goes without saying that since self-directed IRAs operate differently than your regular IRAs, partnered with complicated offerings, one can expect that maintenance and annual fees will be very high.

In line with this, managing and keeping records of your investments can be pretty hectic and complicated. You will need some money to pay for fee as well as the time and patience to manage your account.

2. High-risk investments

Investments done by creating your self-directed IRA account comes with a big risk. All the more if you are investing in a type of asset that you have little to no knowledge of.

Traditional assets are also more volatile and complicated when compared to those that are in regular IRAs. Things such as bonds and stocks, lien certificates, and cryptocurrencies are unpredictable.

3. Overwhelming policies

You have read above about the rules and regulations to be followed, as well as the actual process of creating your account can be hard to follow especially if you are a rookie investor.

Making sure that you do not break the policies as well as abiding to your contract will surely take a lot even from a patient person. You might want to be wary of these written rules.

Final Words - Should I Invest?

How does a self-directed IRA work? This article has answered this question in a comprehensive manner. The new question is whether or not you should invest.

Take note that you can do regular IRA and self-directed IRA. If are able to create and sustain these two, then nobody is stopping you. After all, two is better than one.

However, should you choose to open your own account, do make sure that you have sufficient knowledge on what you are about to enter and the asset you are going to invest into.

It has its own advantages, but its several flaws might dissuade you. The risk is pretty high and some things may get complicated along the way. Not to mention its many rules and regulations to be followed.

Nevertheless, if you are looking to start an account and a custodian to help you, a top rated and recommended IRA firm that could help you in every step of the way can be found here.

Thank you for reading this "How Does A Self-Directed IRA Work?" article. Any comments and opinions are appreciated. Do leave them in the appropriate section below.