Good day! You are reading this article of mine entitled ‘Is Broad Financial Legit?’.

Each day, the number of investors worldwide increases. Consequently, the number of firms offering these services also increase. This ‘Is Broad Financial Legit?’ article will allow you to become knowledgeable about the practices of this company.

Nowadays, a lot of people are trying to protect and secure their financial life. Which, in its very essence, is an excellent thing to do. Quite frankly, these certain group people are heavily outnumbered by those that are still in the dark.

As such, as early as now, I recommend pursuing the concept of investing. Specifically, the precious metals industry, as it is one of the fastest growing market out there. That is why, this ‘Is Broad Financial Legit?’ article is here to give you tips and evaluations.

Moreover, you will encounter some terms such as self-directed IRA and custodians while reading this article. Fear not, because these will be explained thoroughly all throughout this good read.

Meanwhile, if you are looking for a good review of Broad Financial, then you came to the right website! Reassuringly, all I will provide are up-to-date information about this company.

So, without further ado, let us start this ‘Is Broad Financial Legit?’ article!

Broad Financial Review Quick Summary

Name: Broad Financial

Website: https://broadfinancial.com/

CEO: Brian Finkelstein

Account minimum: No minimum

Fees: Varies

Rating: 4/5

What is Broad Financial?

To start, Broad Financial came into the industry in 2004. Surprisingly, they initially put their focus on real estate. But, as time went by, they extended their service reach to various investment opportunities by 2009.

Little by little, their client base were slowly growing. Perhaps, the introduction of investments on traditional assets (bonds, stocks, mutual funds) managed to tickle the fancy of many. After all, who does not want to own these assets?

For starters, the task of opening an investment venture is hard and challenging, if done alone. Because of this, self-directed IRAs (individual retirement accounts) emerged as a potential helping factor for every investor.

In simpler terms, this is an account that allows one to invest in various assets in order to save for the future. Admirably, this type of investment venture offers a lot of benefits and advantages to the holders.

Going by this, Broad Financial introduced their own IRA services, which we will tackle later. Now, investors all over America can safely use their money as funds for potential assets. For example, real estate or precious metals (gold and silver).

Although, they are not an IRA custodian, let us get that out of the way. Custodians are institutions and organizations that are eligible to facilitate and manage IRA-utilized assets. Think of it as a form of highly-regulated bank.

A few years back, Broad Financial has a partnership with a custodian in the West Coast. However, due to some reasons, they halted this mutually beneficial partnership. Currently, they are working with Madison Trust Company, which is their sister company.

At this point, you might be wondering about the offerings of Broad Financial. Well, stick to the coming sections to evaluate if they are worth tackling or not. If you want to skip to my recommended IRA firm, please read this Goldco review.

Services Offered

As previously mentioned, Broad Financial is an expert with it comes to IRAs. Do note, they are also giving out free educational resources to their clients. For example, they have their own YouTube channel explaining various concepts. How neat is that!

Continuing, they have three services: (1) Checkbook IRA, (2) Self-directed IRA, and (3) Solo 401(k).

First, a checkbook IRA allows one to invest in assets without the need for a custodian. Previously, we have talked about the need for one when it comes to alternative assets. However, with checkbook IRA, you will have direct and total control.

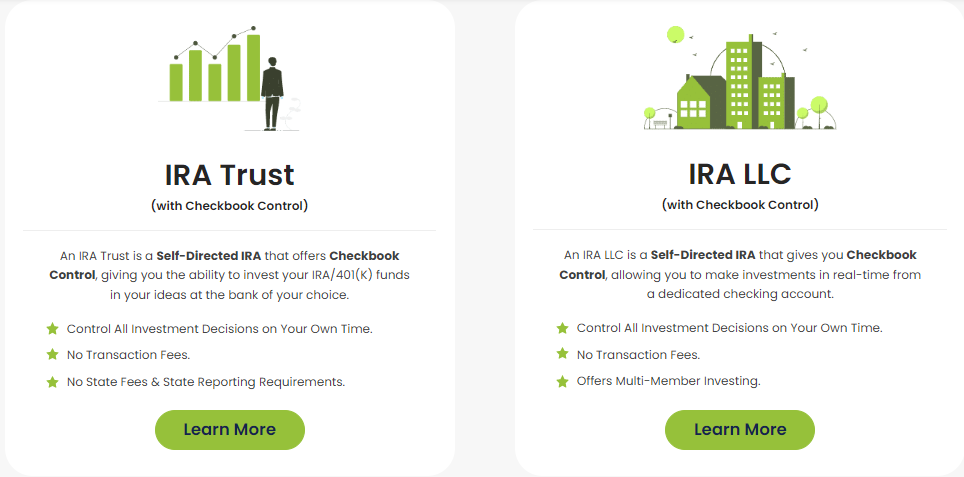

Under these, you have two sub-options, (1) self-directed IRA Trust and (2) self-directed IRA LLC. The former allows you to invest funds on assets with no state tax fees. Meanwhile, the latter lets you hold your assets in a financial portfolio all the while being secured by a liability protection.

For a complete table list of the pros and cons of these types, do visit their checkbook IRA page.

Next, a self-directed IRA lets you diversify your portfolio with various types of assets. Similarly, you have an IRA Trust and IRA LLC.

Lastly, you have the option to open a 401(k) solo account. Primarily, this type of service is more suitable for entrepreneurs looking to secure their future, in a financial way. Account holders can invest in any asset by using their own terms and conditions.

All in all, Broad Financial is a legitimate name when it comes to IRA. Put side by side, they are atop of other companies in terms of superiority and familiarity with this service. Sadly, they still have some other things lacking.

To cite, they have no offerings for precious metals. Nowadays, IRA companies double as a bullion dealer. In this way, they allow their clients to buy metals directly from them, and then proceed to storing or funding them in their firm.

Fortunately, Broad Financial is already an excellent company when it comes to IRA. Surely, in the future, the probable addition of other offerings will solidify their name in the industry.

For now, it comes second to my preferred gold IRA firm, Goldco.

Prices and Fees

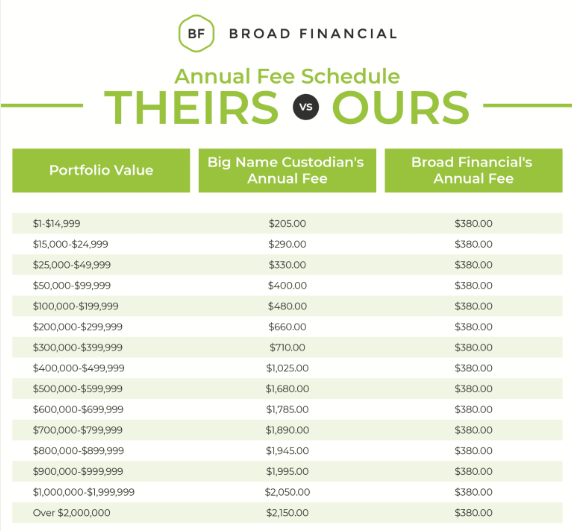

Personally, a company’s transparency about fees and prices is a good indication whether they can be trusted or not. Broad Financial, with all their services, are transparent as transparent gets.

Do note, these are the fees cited by their website at the time of this writing. That is why, I will constantly update this article if any changes comes up. For their setup and transaction fees, please take a look at the picture below.

Moreover, there is $100 setup fee for self-directed IRA and $1,295 for accounts with checkbook control. The custodial fees is at $95 on all account types.

As of the moment, there are no reports about scams or any fraudulent activities by this company.

How Does It Work?

To formally open an account with the help of Broad Financial, these are steps you need to follow:

- Open an IRA account – after carefully choosing the type of investment venture you want, you can then contact their representative. Afterwards, you will fill out some forms and accomplish requirements for your individual account.

- Fund your account – fortunately, Broad Financial facilitates transfers and rollovers from existing accounts. In common setups, you can also fund your account thru an initial contribution.

- Establish an IRA LLC or IRA Trust – the next step will involve a creation of a specialized, IRS-compliant LLC or Trust to facilitate all necessary paperwork. On top of that, you will be provided with a designated checking account.

- Invest – at this point, you can now invest in any IRA-eligible assets of your choosing!

Customer Rating and Reviews

- Better Business Bureau – 4.9 out of 5 based on 53 reviews, A+ rating, accredited since 2005

- Yelp – 4.5 out of 5 ratings based on 26 reviews

- Google Reviews – 4.8 out of 5 based on 245 reviews

- Shopper Approved – 4.8 out of 5 rating based on 948 reviews

- SiteJabber – 5 out of 5 rating based on 782 reviews

Pros and Cons

Pros

- Excellent offerings of IRA services

- Allows investments thru Bitcoin

- Outstanding client reviews and ratings

- Reasonable fees

- High degree of price transparency

- Trustworthy and honest

- Lots of educational resources

Cons

- Missing some offerings such as precious metals

- Bitcoin IRA information and fees are unclear

- Isolated reports of poor customer service

- Not suitable for investors that requires a middleman

What is AuSecure Gold IRA?

Overall, this ‘Is Broad Financial Legit?’ articles rates this company as a legitimate and reputable one. After all, its services are more than enough to interest some savvy investors.

IRA companies are sprouting here and there, and at a considerable pace too! As such, what separates Broad Financial from a considerable lot. Reason number one, they are familiar and are experts when it comes to IRAs!

Furthermore, the offerings they have are partnered with educational resources to help their clients. And if that is not enough, they are very transparent about the fees they charge their customers.

Still, even a good company such as Broad Financial have their own weak suits. For example, they are currently facilitating Bitcoin IRAs. Yet, there are no clear information about it in their website

Unfortunately, those investors that are interested in assets such as precious metals will do better to conduct business with other firms. But, that thought of one day finding a metal offering in their page is what makes me excited.

Frankly speaking , Broad Financial is a solid choice when it comes to your IRA concerns. Although, it still does not hold a candle when compared to Goldco. Among the IRA companies out there, this is the best in terms of fees, products, and services!

As always, you have my gratitude and appreciation for taking the time to read this ‘Is Broad Financial Legit?’ article. For any comments and suggestions, do leave them at the section below.