Hello and welcome to my ‘Yamana Gold Review’

Presently, most people have little to no idea about mining companies, even metal investors. As such, with this ‘Yamana Gold Review’, we will be able to ascertain, to a certain degree, the capabilities of this company.

Frankly speaking, the mining industry, albeit operating globally, seems to be a covert operation of some sorts. For example, almost anybody you will meet in life have no idea on how investments with mining companies work.

Apparently, there are some investment opportunities that these mining companies offer. Moreover, you can exploit that fact above that it is indeed a relatively unknown financial venture. That is why, this is the best time for you to invest!

But before that, personal researches and constructive information gathering is needed. After all, you will certainly perform poorly if you only work around a few bits of information regarding these.

For that reason, this article’ will work you through essential information as well as provide meaningful evaluations. As a savvy investor and fellow enthusiast, let us take the time going through this good read.

So, without further ado, let us start this ‘Yamana Gold Review?’ article!

Yamana Gold Review Quick Summary

Name: Yamana Gold

CEO: Daniel Racine

Account minimum: Not stated

IRA: Not available

Rating: 3.5/5

What is Yamana Gold?

As a start, Yamana (also known as Yamana Gold) is a Canadian-based precious metals producer. In other words, they are what you have already heard as ‘mining companies’. And as the term suggests, they excavate and mint precious metals.

Although it was not known until 1995, the company was actually founded in Toronto in 1994.

Specifically, they put more focus on mining and creating products from gold and silver. Currently, the global market is beaming with investments and transactions revolving these two. Although, they are still allotting resources for metals such as platinum and palladium.

By mining, Yamana Gold acquires precious ores and solid metals for various purposes. First and foremost, the majority of these are made into quality-grade metals. Which, after some processing, can be used as assets for self-directed IRAs.

On the other hand, they also have a small portion in which they will sell to other companies. By using this, Yamana Gold allows themselves to create good relationships with other organizations and companies.

As of this writing, Yamana Gold has mining-friendly jurisdictions on Canada, Brazil, Chile, and Argentina. On top of this, they have already made plans for expansions and optimization initiatives across other lands.

At this point, you might be wondering on how to actually invest with Yamana Gold. Well, there are a lot of things we need to discuss. But before that, if you want to skip to my preferred company for investing, do visit Goldco.

For starters, this company is among the giants of the precious metals industry. Perhaps, you have already encountered the name of this gold IRA firm before. Personally, this is the only company out there that I would entrust my assets with.

Products and Services Offered

As mentioned, Yamana Gold is inherently different from the way self-directed IRA companies conduct business. To cite, they do not directly sell and purchase metals for their clients. Moreover, they are not IRA custodians that will handle your accounts.

On another note, you can invest with this company by securing stocks under their brand name. Fortunately, this company is listed in both New York, Toronto, and London Stock Exchange.

For its current share price, please take a look at this list.

- New York Stock Exchange - $5.85 (-0.04) as of March 31, 2023 4:00 PM

- Toronto Stock Exchange – $7.89 (+0.01) as of April 3, 2023 4:00 PM

- London Stock Exchange – GBX 475 (+0.00) as of July 07, 2023 06:49 BST

Admirably, Yamana Gold has maintained a strong track record of continuously producing results. Apart from this, they are known for putting its shareholders' interests first by focusing on growing sustainable dividends.

Moreover, they have a wide portfolio and have maintained stable growth. As such, this suggests that they will more than likely stay afloat in the industry for some time.

Essential Points

Due to them working differently from other investment companies, it is imperative to take a glance at what they have accomplished. To add, a conclusive summary on why you should invest on them is in this section:

By 2021, Yamana has managed to practice excellence at a high degree. For example, they are still continually looking for way to improve health and safety, environment, and community performance. Take a look at these numbers:

- 9% decrease in absolute GHG emissions

- 8% decrease in total water withdrawal and consumption

- 72% of utilized water was recycled

- ZERO discharges of process water

- 0.74 total recordable injury rate

- 43% of board members are women

- 66% of board members are from local regions

- $7+ million in community investments and donations

Now, you might be wondering on the investment part of Yamana. Should you invest in this company? If so, what are the things that might interest you in doing so. Per their website, these are the things that Yamana assures you.

- Asset Quality – assets are assured of quality and are eligible for investment opportunities. Particularly, it is excellent for diversifying portfolio.

- Management Strength – board members as well as representatives are more than qualified to cater to your needs.

- Ability to Deliver Results – consistent track records and commendable track performance.

- Country Risk Profile – conduct business legally and follows rules of law for mining.

- Financial Strength – records show that cash flows are documented and balance sheets are well-monitored.

- Return to Shareholders – dividends are constant and sustainable.

- ESG Performance – committed to perform at a high degree.

Yamana Gold merge with Gold Fields Ltd.

On May 31, 2022, Yamana Gold reached an agreement with Gold Fields Limited in which Yamana shares will be traded in the United States as Gold Fields Limited shares.

This resulted to Yamana Gold's current value at 6.7 billion dollars.. Moreover, its shares will be traded as 0.6 Gold Fields shares.

However, this also resulted to challenges to both companies. Since the merge, Yamana Gold's stock increased by 12% but Gold Fields Ltd. suffered a decrease of 23%. But because of their merge, they are bound to each other.

Yamana Gold stakeholders own 39% of the partnership, while Gold Fields stakeholders own 61%. Since Gold Fields issue 0.6 of its shares, this means that the remaining shares will be diluted. This will lead to the decrease of the stock's price.

Together, both Yamana Gold and Gold Fields are predicted to grow in the future.

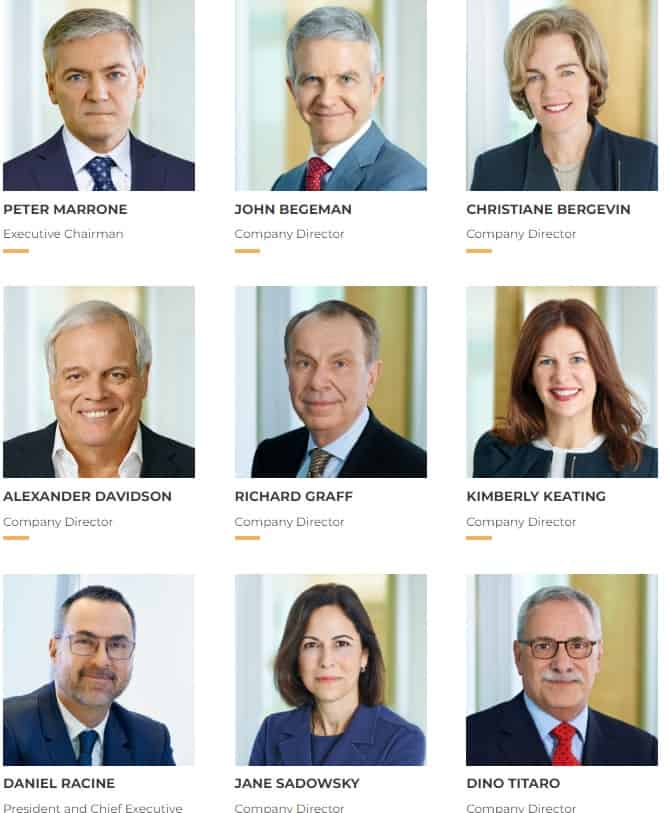

Company Management Team

For a company to be legit, they must provide information on their management team. Luckily, Yamana Gold does this. Below are the list of the people who are behind the success and the services of Yamana Gold.

Customer Ratings and Reviews

Now, do have an open mind while you read this section. They have little to no web presence as a metals mining company as well as reviews. On top of that, they are not affiliated with any outstanding organizations.

These elements most likely contribute to the lack of evaluations from reputable firms and their own clients. Nevertheless, they also do not have any reports of fraud or scams as of late. Take note, they have been reported for asset misuse in the past.

As a result, it can be said that their platform and online presence are not yet at a high level. In order to draw in a lot of investors, it would also be a fantastic idea to include bullions in their inventory. Or, at least make some advertisement about their firm.

Still, if any noteworthy ratings are received, I will update this article. For the time being, I advise doing business with Goldco, a reputable provider of gold IRAs.

Yamana Gold Global Major Gold Portfolios

Currently, Yamana Gold own production and development mines all around the world. For now, they have 5 various segments that are dedicated for long-term land positions and value creation. Below are the locations of the mines.

- Brazil

- Fazenda Braseilerio

- Jacobina

- Chapada exploration pipeline

- Chile

- El Penon

- Minera Florida

- Argentina

- Gulacamayo

- Mexico

- Mercedes

- Canada

Pros and Cons

Pros

Cons

Should You Invest?

To conclude, this ‘Yamana Gold Review’ was able to ascertain that this company is legit and works legally. Although, the phrase above saying it is the best mining company, there are some things that says otherwise.

For example, there are a lot of commendable things about them. Surprisingly, they are present in three major global stock exchanges. Moreover, they have secured contracts and agreements on several nations.

Nevertheless, there are some red flags about this company. The major one being that they were accused of mishandling client funds. Because of this, they were forced to change some major parts of their business structure.

Last, they have little to no online presence. One thing I can recommend to them is by doing advertisements or have a partner IRA custodian. Personally, I do not recommend investing in venture you know little about.

As usual, I extend my gratitude to you for reading this Yamana Gold Review of mine. For comments and suggestions, do leave them in the appropriate section below. For my company suggestion, Goldco tops my list.