Hello and welcome to my ‘Best Gold Bars To Buy For Investments’ article!

Currently, people are diversifying their portfolios in many ways. To cite, some choose to dabble on gold. Thus, this ‘Best Gold Bars To Buy For Investments’ article will be of great help!

Also, I will be mentioning the benefits you get from using gold as asset for an investment opportunity. But, do remember, there are still some risks to it. Needless to say, this good read will mention both in fair degrees.

So, without further ado, let us start this ‘Best Gold Bars To Buy For Investments’.

Gold - A Timeless Asset

Since then, people have been using the concept of using gold. In contrast, other metals such as silver and copper, are seen as just alternatives. Some, dare I say, would consider these metals obsolete when put next to gold.

In a sense, gold came to be associated with wealth, rank, and power. Unsurprisingly, these associations are well-justified. For example, gold was once used as a currency.

Nowadays, people are utilizing it for a far better agenda, investing! Luckily, a lot of precious metals company are around to help you in this search of yours. Additionally, self-directed IRA custodians are also here if you want to make better use of your gold.

To explain, let us say that you are looking to open your own gold IRA (a form of self-directed IRA). Logically speaking, you need to own gold bullions to fund your investment retirement account.

For that reasons, it is imperative to know the best gold bars for investment out there. Hence, the information written on this article will be of great aid to you.

As a fellow enthusiast, I can’t wait to share to you my choices for investment ready gold bars!

Benefits and Risks

Before anything else, let me give you a quick rundown on why gold is good for you. Alternatively, if you are still unsure, you can take a look at the downsides. In this way, you can determine if the pros heavily outweigh the cons, at least on a personal level.

To start, let me just clarify one thing. Personally, gold investments pique a major part of my heart. For that reason, I advocate the usage of gold for investments. Going back, here are some of the benefits of owning gold.

- Diversifies portfolio and economic holdings

- Retains its intrinsic value

- Hedge against inflation

- Value will continue to rise as supply falls

- Good way to protect yourself from deflation

Out of these things, you need to pay attention to gold being a hedge against inflation. Why? Gold is a fantastic investment due to the market's volatility and unpredictability. Moreover, it keeps its value during unfavorable economic occurrences.

On the other hand, you must understand that nothing in this world is risk-free. Gold, for example, has its own risk and downsides. For a savvy investor, this may not be a new news anymore. But, this is an important reminder for those rookies out there.

- Scams and fraudulent activities abound

- Value may fluctuate due to government and private policies and regulations

- Gold bars used in investments, such as IRAs, cannot be stored at home

- Some bullion dealers may not have an item that you want

Recommended Gold Bars for Investments

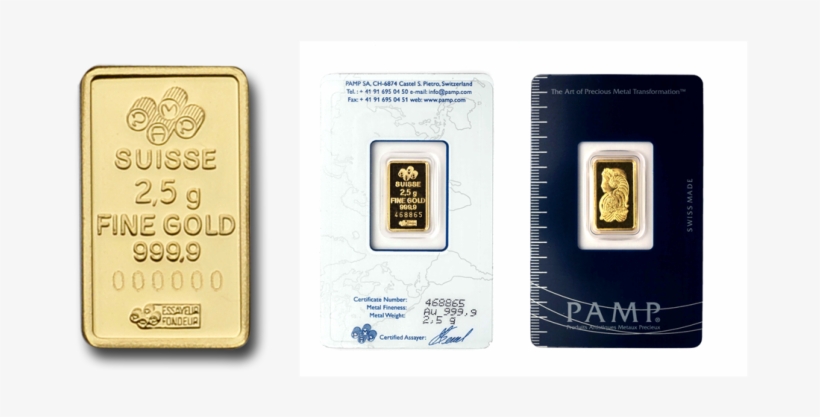

1. PAMP Suisse Gold Bars

To start, PAMP (Produits Artistiques Metaux Precieux) Suisse Gold Bar is one of the most prestigious gold manufacturers in the world. Specifically, it is renowned for its simple yet alluring designs.

Like others, PAMP revolves its design around weight, purity, and serial number of the gold. Moreover, they have the brand emblem carved at the top of the gold bar.

In addition to gold bars, the factory also makes gold ingots and the Liberty Series. Furthermore, they have a broader variety of gold products than other producers.

Interestingly, PAMP offers eight different weights of 99.99% pure gold. In this way, investing in self-directed IRAs are open to a diverse set of bar options. The list of weights are as follows:

- 40 oz.

- 1 kilogram

- 500 grams

- 250 grams

- 100 grams

- 50 grams

- 10 talas (111 grams approx.)

- 1 tael (37.51 grams)

2. Credit Suisse Gold Bars

Currently, one of the most well-known gold brands now available is Credit Suisse Gold Bars. Of course, this famous gold brand will most likely come from a prestigious company, right?

Indeed, these gold bars are produced by Credit Suisse Group, a bullion-focused company. Hailing from Switzerland, this gold bar is an eye-candy for gold IRA investors.

As seen, the Latin words "ESSAYEUR FONDEUR" are carved on each bar. Base on my research, it roughly translates to "melting tester". This is an indication that each gold bars are of the highest quality.

Similarly, these gold bars have a guarantee 99.99% purity, just like PAMP. Also, they are considered to be 24-karat gold due to this purity. Lastly, they come in different weights, ranging from 1 gram to 1 kg.

3. Perth Mint Gold Minted Bars

Next, the Perth Mint is the national mint of Australia. Thus, this company is expected to produce bars for the nation's usage. Admirably, they create some of the world's most exquisite bullion coins.

In comparison, they only have 1 gram, 5 gram, 10 gram, 1 oz, and 10 oz weights. But, their gold bars is still at 99.99% purity. In addition, the seal is an indication of authenticity.

Remarkably, there are no reports of scams and rip-offs online about this type of gold bar. In a sense, it gives investor a sense of security specially during these times of economic uncertainties.

What's more, the container of the gold bars itself is a thing to look at. Essential information about the gold bars can be found at the front or back of this dark green assay cards.

4. Johnson Matthey Gold Bars

Only available on the secondary market, Johnson Matthey gold bars is a rare item on the precious metals industry. Regrettably, this case is due to them no longer producing gold or silver bars.

Nevertheless, it it still on my list of preferred gold assets for investments. Because the supply of it is not increasing, its market value continues to rise at a steady state.

Put side by side, it is rather unknown and indistinctive to many rookie investors. Hence, it is a rare gem to find, and even rarer to be purchased. That is why, this gold bar is a great asset for investment!

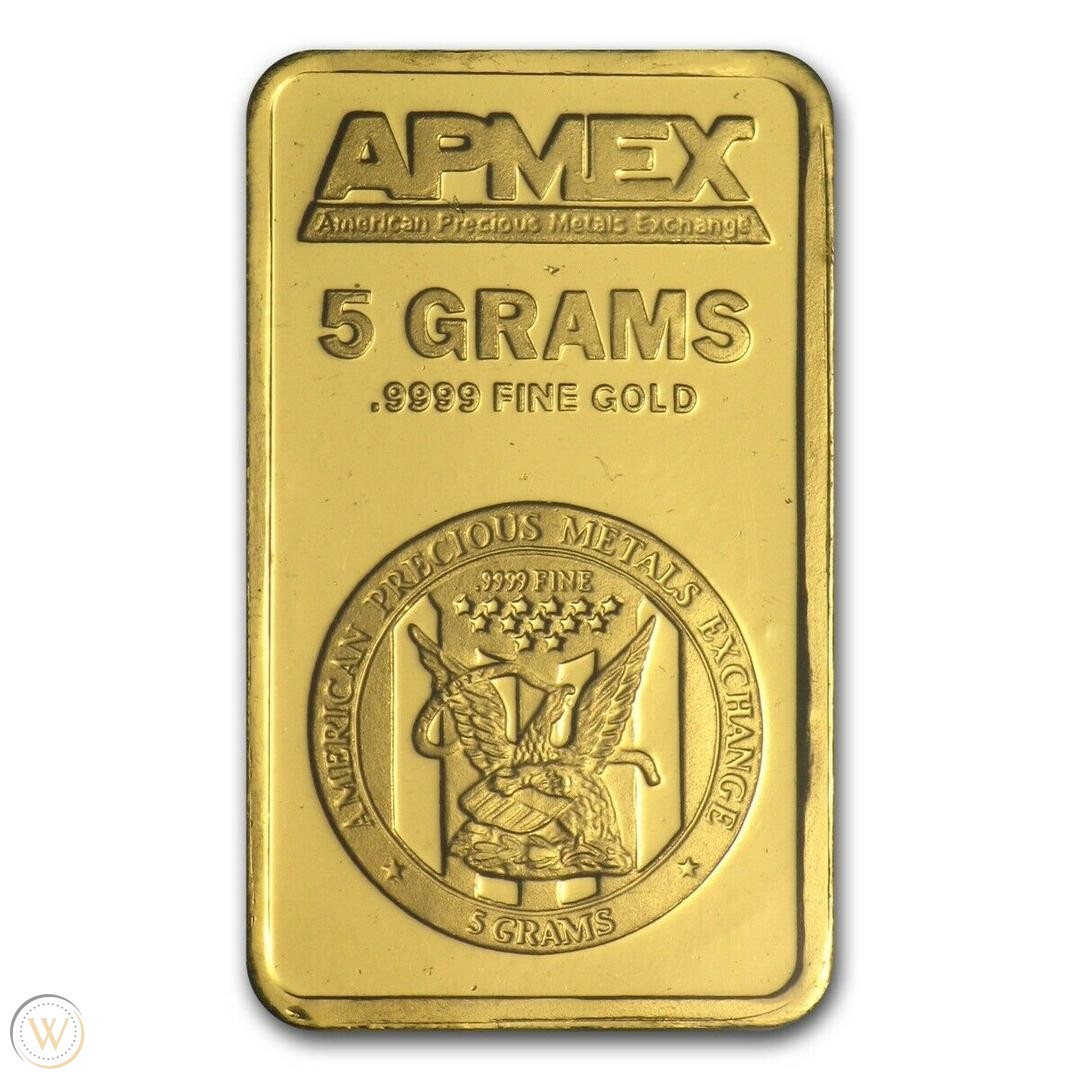

5. APMEX Gold Bars

Next in line, one of the few producers and retailers of gold bars worldwide is APMEX. Apparently, in addition to selling gold bars, they also produce gold bars under their own brand and with their logo.

Plus, you can select the condition of the gold bars by visiting their website (uncertified, TEP-packaging, and assay cards). If you are lucky, you will also be able to promote yourself in particular offers.

However, APMEX's gold bars are typically a few dollars more expensive than other brands. More than likely, this is due to their distinctive branding strategy

For instance, their gold prices range from $25 to an astounding $2,500, depending on the weight, purity, and condition that you have chosen for the gold.

6. Valcambi Suisse Gold Bars

Finally, the last gold bar I would recommend to you is Valcambi. Arguably, they are best known for their "Combi Bars," which are 50 pieces of 1-gram gold bits pierced from a 50-gram gold bar.

Astonishingly, each bar can really be divided into 50 separate 1 gram bars, making it a portable, divisible, and widely accepted form of cash.

Likewise, the front face of the gold makes it simple to see the regular information. Moreover, they also produce regular 1 oz gold bars and different weights.

On top of that, the purity of all gold bars sold by Valcambi is guaranteed to be 99.99%. Not to mention, due of their utility, you may rely on their Combi Bars during market fluctuations.

Should You Buy These Gold Bars?

To conclude, this 'Best Gold Bars To Buy For Investment' article contains a list of my recommended gold bars. Not to mention, this good read also contains the pros and cons of investing in gold bars.

To summarize, purchasing gold bars is an excellent strategy to diversify your portfolio when investing in gold. In another way, it also is an excellent strategy to safeguard oneself from varying circumstances.

As such, finding the top gold bars on the market right now is so essential. Similarly, consider your investment in gold bars both in the short and long term.

Take note, these are my preferences for investment-ready gold bars. Although, it is best to keep in mind that gold bars will always come with some risk, as everything else.

For that, deal with competent and reputable gold bullion dealers. With that, this is a good opportunity to introduce you to one of the top-rated companies in the industry.

Goldco revolves around providing their clients with excellent customer service. Meanwhile, they also offer quality precious metals.

As usual, thank you for reading this 'Best Gold Bars To Buy For Investment' article of mine. For any comments and suggestions, do leave them in the appropriate section below.