The Basics

Inspira Financial was founded in 2000 as the Millennium Trust Company. The company rebranded to Inspira Financial in 2023.

Inspira is unusual in that not only do they provide gold and silver IRA services, but they also support self-directed retirement account investing in other alternative asset classes, as well, not normally supported by traditional investment companies. Inspira also provides flexible spending account (FSA) and health reimbursement arrangement (HRA) services for employers.?

Currently, Inspira’s website boasts more than 8 million accounts and over $63 billion in assets under their custody.?

That said, the company has had some fulfillment problems of late. Better Business Bureau users have tagged Inspiration Financial with a dismal 1-star rating across 197 reviews, as of November 2025. And the company has been the target of a lawsuit accusing them paying certain investors returns significantly below industry benchmarks. ?

What Investors Like

-

The company offers an established platform for alternative-asset IRAs (not just gold/silver but real estate, private placements, etc.).

-

The ability to combine traditional assets with precious metals under one self-directed IRA roof.?

-

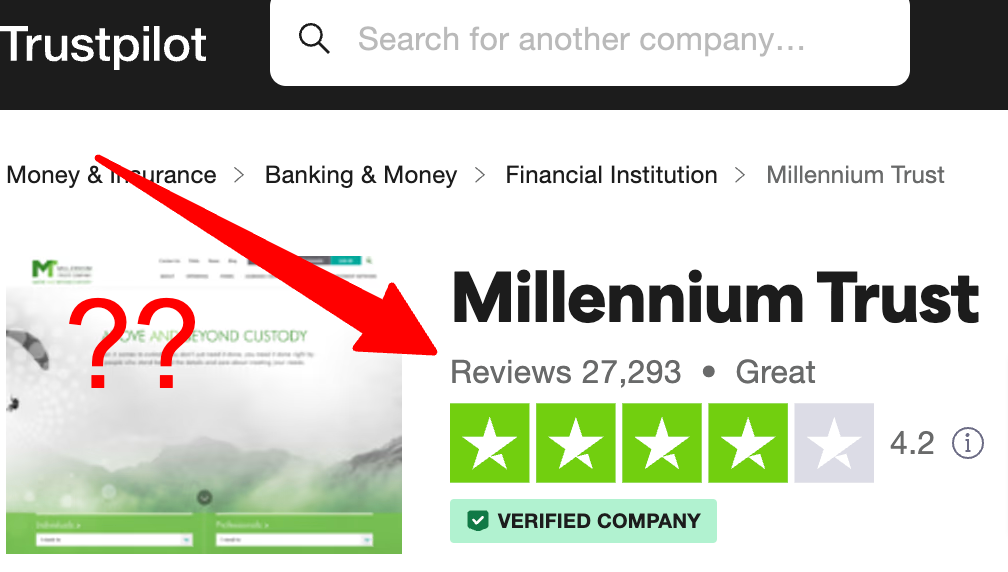

On Trustpilot, Millennium Trust has a relatively strong rating, scoring ~3.7/5 based on over 65,000 reviews, as of November 2025.?

What Investors Should Be Cautious About

-

On the Better Business Bureau (BBB) side, the ratings are quite weak: one source reported a rating of just 1/5 for MTC, reflecting many user complaints.

-

Fees, while predictable in some respects, can be higher than more specialized precious-metals custodians. Independent reviews note that while their structure is transparent, the overall cost may be above average.

Some users report frustration with customer service responsiveness and account transfer / rollover delays, indicating that while the firm is a large player, execution may vary.?

JASON’S NOTE: It may be that the company has spread itself too thin, and is trying to do too much, rather than simply focus on executing gold and precious metal transactions and IRA rollovers.?

Enforcement / Compliance Notice

While Inspira Financial is a legitimate, state-regulated trust company (in Illinois) and not flagged as a known fraudulent provider, it does have publicly disclosed incidents that warrant investor awareness:

-

In 2024, a civil action was identified: Inspira Financial Trust LLC (formerly Millennium Trust Company) was named in litigation alleging that the company accepted IRA funds without passing on competitive yields when a bank (Capital One, N.A.) transferred accounts to it, thereby allegedly violating state consumer-fraud laws.

-

Though these are not the classic ?precious-metals fraud? red flags seen elsewhere in the industry, they point to execution risks and the importance of asking detailed questions about how your account will be handled,? especially in precious metals situations where you?re relying on third-party depositories, rollovers from 401(k)s, and the custodian?s compliance infrastructure.

What This Means for Your Gold/Silver IRA Decision

-

If you choose Millennium Trust, ensure you get a written fee schedule for the precious-metals portion of your self-directed IRA (including annual custodian fee, storage & insurance fee, set-up/roll-in fee, and any depository mark-up).

-

Confirm which depository will be used for your metals (segregated vs commingled storage) and which dealer you will use ? MTC is the custodian, not the dealer.

-

Pay close attention to the rollover/transfer process (especially if moving from a 401(k) or existing IRA) documentation delays or account freezes are a common complaint in reviews.

-

While MTC is broadly reputable, the weaker BBB reviews and service/processing complaints mean you should treat this as a ?good but not flawless? option, comparing it against specialists focused exclusively on precious-metals IRAs may yield lower cost or more responsive service.

-

Given that precious-metals IRAs often involve higher fees, less liquidity, and more moving parts (metals dealer ? depository ? custodian ? IRS reporting), an investor must place a premium on the reliability of the custodian as well as the dealer.

Inspira Financial Review Quick Summary

Name: Inspira Financial?

Founded: 2000

CEO: Dan Lazlo

Persident: Matt Marek

Price:?Varies

Rating: 3/5 (TrustPilot), 1/5 (BBB.org)?

Inspira Financial Products and Services

1. Self-Directed IRAs (Alternative Assets)

-

Inspira offers self-directed IRA accounts, allowing investors to hold traditional assets and ?alternative? assets (such as real estate, private equity, and certain precious metals) under one custodian umbrella. This product is of particular interest to investors who want more flexibility than a standard brokerage IRA or a gold IRA company that only does precious metals.?

-

Custodial services: Inspira handles the paperwork, IRS-reporting, account administration, and holds the assets in custody.

Important note: While the custodian capability exists, you still need to ensure the metals meet IRS eligibility, the storage facility is properly registered, and all rollovers/transfers are executed correctly.

2. Automatic Rollover / IRA Acceptance Services

-

Inspira provides services for automatic rollover IRAs ? accounts that receive rollover or termination distributions from employer-sponsored retirement plans (401(k), 403(b), etc.) and hold them in IRA form rather than cashing them out.

-

This service helps plan sponsors and record-keepers move terminated participant assets into IRAs in a smoother way, preserving tax deferral and avoiding leakage.

-

For an investor, this means Inspira is positioned to handle the ?holding tank? or rollover account stage ? which could be relevant if you?re moving from a 401(k) into a metals IRA.

3. Health & Wealth/Benefits Solutions

-

Inspira offers health-benefits-adjacent products: Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), and other consumer-directed benefit accounts.

-

Although not strictly related to gold or precious-metals IRAs, this suite shows the breadth of services the company provides ? blending ?health, wealth, retirement & benefits.?

-

The company is a large platform player rather than a boutique precious-metals-only custodian. They aim to provide a much broader range of services than most precious metals dealers.?

Things to Check/Be Aware Of

-

Although Inspira supports self-directed IRAs with alternative assets (including precious metals), you are still responsible for ensuring that your IRA transacts only in IRS-eligible bullion. You must also only use an IRS-approved depository/vault facility that accepts those metals under IRS rules. You cannot take direct possession of precious metals you own within your IRA. Doing so could cause severe tax consequences and penalties.?

-

Review the fee schedule for your precious-metals IRA: setup/rollover fees, annual administration fees, storage/insurance fees (charged by the depository), additional fees if you take distributions in kind, etc. It’s important to track your expenses as a whole, including vault/storage fees, monthly account/statement fees, account setup fees, custodial fees, and others, as well as the price of any bullion you purchase.?

-

Confirm which storage facility is used and whether the metals are held in segregated versus commingled form ? this is often not handled uniformly across custodians. Segregated is better.?

-

Because Inspira is a large platform with many services beyond precious metals, customer service responsiveness or precious-metals expertise may not match a boutique precious-metals specialist ? you should ask specific questions about how they handle metal IRAs.

-

Given the company?s broad service offering, prices/fees and turnaround times may differ significantly depending on account size, asset type, etc.

?

Millennium Trust Company Fees

Here are the fees that apply to most accounts:

- Annual maintenance fee: $100

- Alternative asset annual holding fee:

- $350 (one holding)

- $450 (two holdings)

- $550 (three holdings)

- $650 (four or more holdings)

There’s a link to their complete fee schedule here.

JASON’S NOTE: The flat rate schedule for their alternative asset annual holding fee tends to favor larger accounts. For large accounts, this is preferable to a percentage-based fee.?

Complaints and Customer Reviews (Updated November 2025)

Better Business Bureau:?As of November 11th, 2025, Inspira’s ratings on the Better Business Bureau website are a dismal 1-star across nearly 300 reviews.?

And take a look at some of the negative reviews that were left on BBB:

The company fares much better on TrustPilot, with 3.7 stars across over 65,000 reviews as of November 2025.?

?But why do they have so many high reviews on TrustPilot but not on BBB?

Quite the contrast to the BBB rating, huh? Seems sketchy, no?

And what do people say on Yelp? Well, as of November 2025, Yelp Reviewers scored Inspira Financial with just 1.1 stars over 231 reviews.?

If you’re looking for an alternative to Inspira that has many positive reviews without the execution problems check out Augusta Precious Metals & Goldco

Final Words and Verdict

Verdict: Not a scam, but would not recommend to most investors at this point. The firm may be a good match for self-directed IRA die-hards who like to hold assets across multiple alternative investment asset classes, and want to hold real estate, gold, silver, private placements, and other asset classes all under a single roof.?

But even then, I’d advise investors to tread very carefully, and make them prove themselves before committing large amounts of money.?

I would also not recommend them for HSA and other health benefits services, due to a long record of poor reviews and transaction delays.?

Overall Rating: (2/5).

Comments? Questions? Concerns? ?Weigh in in the comments section below!?

Check out some of our other reviews and guides.