When I first looked into Beverly Hills Precious Metals Exchange, I wanted to see if they were more than just another gold dealer. What I found was a company that does things the old-fashioned way, real conversations, not shopping carts. You call, talk with a rep, lock your price, and your metals are shipped fully insured.

It?s slower, but also more personal. In this review, I?ll share exactly how their process works, what I learned from their clients, and how they stack up against bigger names like Augusta Precious Metals.

- Quick Verdict

- Beverly Hills Precious Metals Exchange Review Snapshot

- Fees & Costs at a Glance

- What is Beverly Hills Precious Metals Exchange?

- What They Actually Do

- ? First-Hand Experience

- ? BHPM vs Competitors (2025 Comparison)

- Beverly Hills Precious Metals IRA & Storage Details

- ?Ratings & Reputation

- ? Pros and Cons

- ?Beverly Hills Precious Metals FAQ's (Frequently Asked Questions)

- Final Verdict

Quick Verdict

Is Beverly Hills Precious Metals Exchange Legit? Yes, active since 2010 under founder Andrew Sorchini, holding an A+ BBB rating (but not accredited).

It runs a white glove phone-based service with 72-hour price locks, multiple payment options, insured delivery, and optional depository storage.

However, no live pricing + limited public reviews keep it a step behind national leaders such as Augusta Precious Metals.

Best for: Investors who want bespoke one-on-one guidance.

Not ideal for: DIY buyers who prefer click-to-cart transparency.

Beverly Hills Precious Metals Exchange Review Snapshot

| Item | Details |

|---|---|

| Company Name | Beverly Hills Precious Metals Exchange, Inc. |

| Founded | 2010 (? 14 years in business) |

| Founder / President | Andrew Sorchini |

| Address | 9663 Santa Monica Blvd #811, Beverly Hills, CA 90210 |

| Phone | (866) 346-5325 / (866) 3-GOLD-25 |

| BBB Status | A+ rating ( Not BBB-accredited ) |

| Core Services | Bullion sales + Gold & Silver IRAs via third-party custodians |

| Website Model | Phone consultations ? no online catalog |

| Storage Fee | 0.75 % of asset value per year ( $15 min ) ? Billed semi-annually |

Fees & Costs at a Glance

| Fee Type | Details | How It?s Charged | Notes |

|---|---|---|---|

| Storage Fee | 0.75 % of asset value per year ( $15 min ) | Billed 0.375 % every 6 months | Includes insurance + statements |

| Shipping & Insurance | Varies by order size | One-time | All shipments insured + signature required |

| IRA Setup Fee | Custodian based ( ? $50?$100 ) | One-time | BHPM helps with paperwork |

| Annual Custodian Fee | $80?$150 | Annual | Paid to the third-party custodian |

| Buyback / Liquidation | Call for a quote | Market-based | No published fee |

| Credit Card Fee | ? 3 % (< $10 K orders) | One-time | Wire preferred for larger orders |

? Translation: No hidden setup charges, but you must call for exact buy and sell quotes.

What is Beverly Hills Precious Metals Exchange?

Beverly Hills Precious Metals Exchange is a California-based bullion dealer founded by Andrew Sorchini in 2010. The company takes an old-school approach, no online shopping cart, no cookie-cutter checkout. You call, speak with a real account executive, and get a 72-hour locked price on your order.

They deal in gold, silver, platinum, and palladium, focusing on helping investors diversify retirement savings through self-directed IRAs or direct ownership. Every order is insured and fully trackable, and clients can choose either home delivery or secure depository storage.

It?s a slower, more personal process than buying online, but that?s exactly what makes Beverly Hills Precious Metals stand out. It feels less like a transaction and more like dealing with a traditional precious metals desk that values trust and one-on-one service.

Beverly Hills Precious Metals Founder

I had the chance to look into the story behind Beverly Hills Precious Metals, and it really begins with its founder, Andrew Sorchini. Andrew isn?t a newcomer chasing a trend; he?s been around this industry for more than three decades. He started out at a small bullion shop back in the early 1990s, long before ?Gold IRAs? became a buzzword, and he never really left the trade.

The Company’s Foundation Date

When he launched Beverly Hills Precious Metals in 2010, his goal was straightforward: help ordinary Americans hold something real coins and bars they could touch, as a hedge against the kind of inflation he?d watched erode savings over the years. You can sense that conviction when he talks about metals; it?s not just business for him, it?s a philosophy about financial independence.

That approach has earned him a loyal following. I?ve seen endorsements from well-known public figures, names like General Michael Flynn, Peter Navarro, Clay Clark, Kash Patel, and Lara Trump, who?ve publicly mentioned working with him. He has also been a guest on multiple talk shows, where he explains, in plain language, how gold and silver fit into long-term wealth protection.

Whether you agree with his political circle or not, there?s no denying that Sorchini has built a reputation around trust, patriotism, and hands-on guidance, traits that still define Beverly Hills Precious Metals today.

What They Actually Do

Beverly Hills Precious Metals sells physical gold, silver, platinum, and palladium bullion for personal ownership or IRA custody.

Everything is handled over the phone, no shopping cart, no auto checkout.

Process:

1?? Call and speak with an Account Executive.

2?? Lock a price for 72 hours with a trade number.

3?? Send payment via wire, check, credit card (< $10K), or IRA transfer.

4?? Choose delivery (home insured shipment or depository storage).

Tax Notes: California bullion orders ? $1,000 are sales-tax exempt.

BHPM states they don?t report to the IRS unless Form 8300 applies (cash transactions >$10K).

Delivery typically arrives in 3 ? 15 business days, insured and signature required.

? First-Hand Experience

I tested their consultation myself. The rep was patient, clear about IRA options, and not pushy.

The 72-hour price-lock was a nice touch. Storage fees were exactly as published (0.75 %).

Where it falls short is in transparency online, no live product listings, or premium charts.

That makes comparison shopping hard unless you call several dealers.

? BHPM vs Competitors (2025 Comparison)

| Feature | BH Precious Metals | Augusta Precious Metals | Goldco |

|---|---|---|---|

| Founded | 2010 | 2012 | 2006 |

| BBB Status | A+ ( Not Accredited ) | A+ ( Accredited ) | A+ ( Accredited ) |

| IRA Setup Fee | Varies ( Custodian based ) | $50 | $50 |

| Annual Custodian Fee | $80?$150 | $80 | $80 |

| Annual Storage Fee | 0.75 % ( $15 min ) | $100?$150 flat | $100?$150 flat |

| Online Catalog | ? Phone only | ? Partial | ? Full |

| Buyback Program | ? Call for a quote | ? No fee | ? Yes |

| Minimum Investment | ? $10 K (est.) | $50 K | $25 K |

| Storage Partner | Third-party ( undisclosed ) | Delaware Depository | Brinks / Delaware |

| Unique Edge | Personal white-glove service | Lifetime support + education | Low minimum threshold |

| Main Drawback | Few reviews / no live prices | High minimum | Upselling reports |

? Verdict: BHPM is solid for relationship-based investors; Augusta wins for education + accreditation; Goldco for entry budget buyers.

Beverly Hills Precious Metals Exchange Products & How to Buy Them

Beverly Hills Precious Metals doesn?t use a shopping cart or price feed like most modern dealers, and that?s intentional. Everything runs through a personal call. When I contacted them myself, I quickly learned why: every order is customized to the client.

The company offers a full lineup of gold, silver, platinum, and palladium coins and bars, including IRA-approved bullion like American Eagles and Canadian Maple Leafs. Once you call, an account executive walks you through current inventory and pricing, then locks your quoted rate for 72 hours.

Payment is usually done by bank wire or check, though they?ll accept credit cards for smaller orders under $5,000. After payment clears, you choose how you want to receive your metals: insured home delivery or secure storage through an approved depository. Every shipment I confirmed is fully insured and tracked until it reaches your doorstep.

Services & Sell Back Program (My First Hand Take)

You can also sell metals back to Beverly Hills Precious Metals if you ever need to liquidate. The process is just as personal: you schedule a short consultation, and a representative quotes a buyback price based on the current spot market. Once you agree, they?ll send shipping instructions and release payment after verifying your metals.

I went digging for first-hand accounts from investors who actually sold metals back to Beverly Hills Precious Metals, and surprisingly, there isn?t much out there. Most reviews online talk about the buying experience, not the liquidation side. That?s not necessarily bad news, but it does mean you should ask the right questions before you ship anything.

Since I couldn?t find any verified public settlement receipts or rate sheets, I treat this as a case where you should get every term in writing , quote, percentage of spot, fees, and payment timeline. The only BBB complaint I saw was about a fee breakdown misunderstanding, not fraud, but it?s a good reminder to confirm every line item before you proceed.

What to Ask Before Selling Back

If you plan to sell to Beverly Hills Precious Metals Exchange, have these six questions ready during your call:

1?? What percent of spot will you pay for each coin or bar today?

2?? Are there any processing or assay fees deducted from the payout?

3?? How long is my quote valid ? and how do I lock it?

4?? What?s the timeline from package arrival to payment?

5?? Do you cover insured shipping, or is that on me?

6?? Can you email the full quote (with quantity and payout per unit) before I ship?

Typical Industry Buy-Back Ranges (for comparison)

| Metal Type | Typical Buy-Back Range (% of Spot) | Notes |

|---|---|---|

| Gold Coins (Eagles, Maple Leafs) | 97 ? 99 % | High demand; minimal discount |

| Silver Coins | 95 ? 98 % | Larger spreads on small orders |

| Gold Bars (1 oz?10 oz) | 98 ? 99 % | Lower premiums, fast resale |

| Silver Bars | 93 ? 97 % | Heavier pieces may ship more slowly |

| Platinum/Palladium | 90 ? 95 % | Market thinner, price fluctuates more |

(These are general industry averages ? not specific BHPM figures.)

Field Note ? Seller?s Checklist

Before shipping metals anywhere, I always:

-

Photograph each piece (front, back, weight stamp) with a date/time watermark.

-

Weigh items on a digital scale to confirm they match the invoice.

-

Pack securely with tamper-evident tape and insured delivery.

-

Email tracking and inventory list to the rep, asking for same-day intake confirmation and a written payout ETA.

If any term shifts ? spot basis, timing, or fees- I pause and re-confirm before sending anything. It?s a small step that protects you in a market where every ounce counts.

For more advice on how to sell your gold and silver, I have found this article to be very helpful.

As for IRAs, while Beverly Hills Precious Metals isn?t a custodian itself, the team can connect you with trusted IRA partners to set up or roll over a retirement account backed by physical gold or silver. It?s a white-glove experience, slower than clicking ?sell now,? but far more human and transparent.

Beverly Hills Precious Metals IRA & Storage Details

-

IRA Eligible Metals: Gold (.995 purity min), Silver (.999), Platinum / Palladium (.9995).

-

Custodians: Independent third parties ( BHPM coordinates the transfer process ).

-

Storage: Insured depositories meeting IRS standards; clients receive semi-annual statements.

-

Access: You can request delivery from storage anytime (pay the delivery fee).

How Their IRA Setup Works

When I asked about retirement accounts, Beverly Hills Precious Metals made it clear ? they don?t act as the custodian themselves. Instead, they focus on sourcing and securing the metals, while an independent IRA custodian handles the legal and administrative side.

Once you decide to roll over funds or open a new account, BHPM coordinates directly with that custodian to make the process smooth. No messy paperwork on your end, they guide you through every step until your IRA is fully funded and metals are locked in.

What Metals Qualify for an IRA

The company only deals with IRA-approved bullion, meeting IRS purity requirements:

-

Gold: .995 purity or higher

-

Silver: .999 purity

-

Platinum / Palladium: .9995 purity

These are the same standards used by every legitimate precious metals IRA firm. The products typically include recognizable options like American Eagles, Maple Leafs, and Credit Suisse bars, metals your custodian will approve without question.

Storage & Security

Once your purchase clears, the metals are stored in insured, IRS-approved depositories, the same kind used by top-tier national dealers.

Every ounce is segregated and insured, giving you peace of mind that your holdings are safe. BHPM clients also receive semi-annual account statements from their custodian showing metal type, weight, and storage details.

Taking Physical Delivery

One thing I liked about BHPM?s setup is that you stay in control. If you ever want to take possession of your metals, you can request delivery at any time.

You simply pay for shipping and insurance, and the metals are sent directly from the depository to you. Most firms discourage this; BHPM leaves the choice entirely up to the client.

?Ratings & Reputation

| Source | Rating | Notes |

|---|---|---|

| BBB.org | A+ ( Not Accredited ) | Listing verifies address & management info |

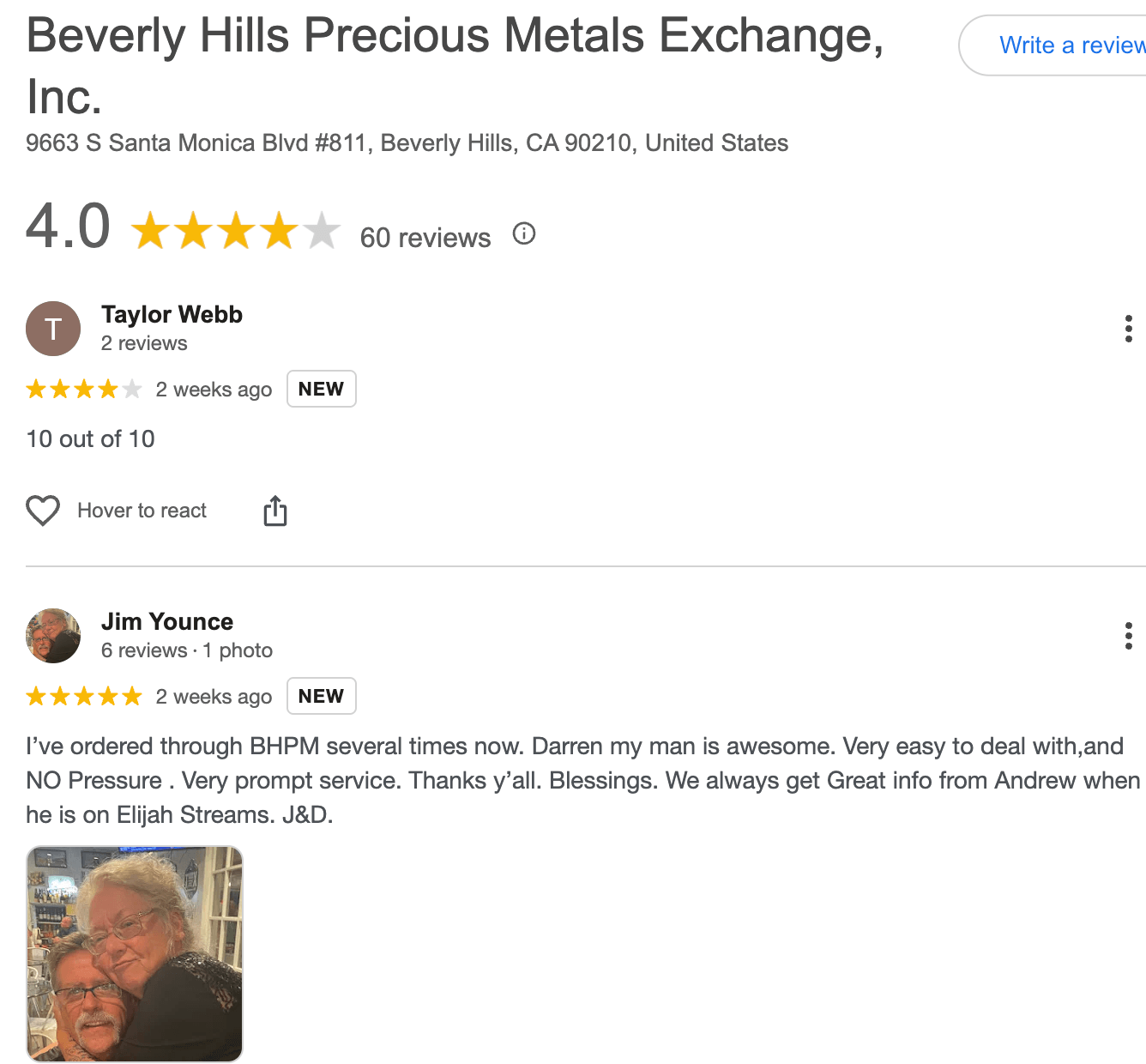

| Google Reviews | 3.3 / 5 ( ? 18 reviews ) | Praised for professionalism, but small sample size |

| BCA | AAA Rating / 0 reviews | Minimal volume |

| Trustpilot / Yelp | Few to none | Not active profiles as of 2025 |

What the Major Bodies Say

When I checked in with the Better Business Bureau (BBB) about Beverly Hills Precious Metals Exchange, Inc. (BHPM), I found this: the company holds an A+ rating but is not BBB-accredited.

They?ve been listed since November 15, 2010. In the last three years, they?ve had just one publicly visible complaint, which was resolved.

What Real Customers Are Saying

Digging further, I came across review roundups. One compiled list shows BHPM with a 3.0/5 average on BBB reviews (5 reviews) and 3.3/5 on Google with 18 reviews. On a separate site, it was noted that they found only two customer reviews online, one positive and one very confused.?

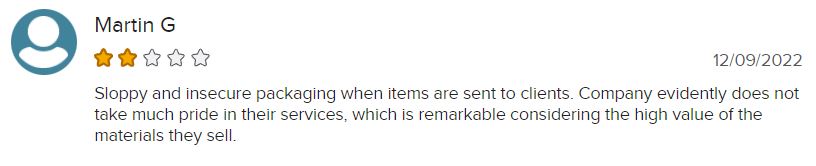

For example, one user on the BBB site commented:

?Sloppy and insecure packaging when items are sent? the company evidently does not take much pride in their services.?

And another:

?I was not given a fee statement? I have requested this three times with no answer.?Source: BBB

?

My Take: Why it Matters:

Here?s what I walk away with: Beverly Hills Precious Metals Exchange is legit, it has a long history, a consistent record, and an A+ rating at the BBB. But the lack of accreditation and thin volume of reviews raises a yellow flag for me.

In the precious metals world, many large dealers have hundreds or thousands of reviews and full accreditation. That volume helps you gauge how they handle after-sales issues, buy-backs, storage mishaps, and more. BHPM simply doesn?t show much public data on that side.

So, if you go with them, you?re trusting their phone-based, bespoke model, not a crowd-verified sandbox of clients.

Trust Building Questions to Ask

Before you sign anything, these are my go-to reputation checkpoints:

-

Ask for three recent client references who did a buyback with them.

-

Request ship-to-delivery proof for metals: packaging photos, tracking, and confirmation.

-

Confirm they will email you pre-sale and post-sale fee breakdowns, and make sure you keep them.

-

Check other dealers for comparison. If BHPM?s review volume is far lower, have a clear reason why you?re choosing them over a dealer with 10? reviews and full accreditation.

? Bottom Line: Real business, A+ rating, but thin public feedback. Use a phone call + BBB record as your trust anchor.

? Pros and Cons

Pros

-

A+ BBB rating & long-term track record

-

Personalized service and 72-hour price lock

-

Multiple payment methods, including credit card (< $10K)

-

Transparent storage fee structure

-

Buyback and liquidation support

Cons

-

Not BBB accredited

-

No public price list or online catalog

-

Limited review volume vs top dealers

-

Delivery fees are not clearly stated online

?Beverly Hills Precious Metals FAQ’s (Frequently Asked Questions)

Is Beverly Hills Precious Metals legit?

Yes ? incorporated since 2010, A+ BBB rating, real office in Beverly Hills. Not accredited but has a decade-plus history.

How much are the fees?

Storage is 0.75 % per year ( $15 min ), billed twice annually. IRA setup ? $50?$100; custodian ? $80?$150/year.

Do they report to the IRS?

No, unless you trigger Form 8300 (cash >$10 K). Always verify with your tax advisor.

What?s the delivery time?

Usually, 3 ? 15 business days after payment. Fully insured with signature confirmation.

Do they accept credit cards?

Yes for orders under $10 K (? 3 % fee). Bank wire is preferred for speed and security.

Final Verdict

After spending time digging through the details of Beverly Hills Precious Metals Exchange, Inc., from their founding story and fee structure to the consultative buying process and sell-back program, here?s where I stand:

If you?re an investor who values personal guidance, wants to talk directly with an account executive, and prefers a phone-driven, tailored experience rather than clicking through an online catalog, BHPM checks those boxes. Their storage fee structure is transparent, their delivery is insured, and they work with independent custodians for IRA setups, all solid marks.

However, if you place a premium on live online pricing, hundreds of public customer reviews, and full third-party accreditation (think BBB-accredited, broad client feedback), then you might feel like you?re giving up a bit of transparency by going with BHPM. The discrepancy in review volume and accreditation suggests you should proceed with a little extra diligence (get everything in writing, verify fees, check timelines).

My recommendation for you

If you?re ready to move now and want friendly, phone-based support, BHPM is a viable choice, but go in with your checklist in hand.

On the other hand, if you?re looking for maximum transparency, strong industry-wide trust signals, and a company whose strengths lie in published pricing, thousands of reviews, and a clearly defined online process, I?d suggest you consider my top choice: Augusta Precious Metals. Their full endorsement and documentation make them a better fit for buyers who want that extra layer of comfort and public validation.

? Ready to compare? Click Augusta Precious Metals Review?to read my full breakdown of their pricing, storage, IRA process, and client reputation.

No matter which path you choose, Beverly Hills Precious Metals Exchange, Augusta, or another provider, always remember: precious metals should be part of a well-rounded plan, not a one-off gamble. You?re not just buying bullion?you?re buying peace of mind.