If you are researching a Reagan Gold Group review, you probably want to know whether this company is truly reliable for a Gold IRA or just another dealer with big promises.

I recently looked into their background, checked their ratings, and even called them myself to see how they treat real investors.

In this updated review, you will get a clear breakdown of their products, fees, buyback policy, service quality, and how they compare to larger names like Augusta and Goldco.

This way, you can decide with confidence if Reagan Gold Group is the right place to protect your savings.

- First look, is Reagan Gold Group legit?

- My personal experience calling Reagan Gold Group

- What does Reagan Gold Group actually offer?

- How the Reagan Gold Group IRA process works

- Products and metals lineup

- Education, tools, and privacy focus

- Reagan Gold Group fees and pricing transparency

- Programs, guarantees, and referral incentives

- Reputation, ratings, and real client stories

- How this compares with larger players

- Who is Reagan Gold Group best for?

- Critical Questions to Ask Reagan Gold Group Before You Invest

- How to open an account with Reagan Gold Group

- Pros and cons

- Frequently asked questions about Reagan Gold Group

- Final verdict

Reagan Gold Group Review Quick Summary

- Company name: Reagan Gold Group

- Website: reagangoldgroup.com

- Headquarters: Century City, Los Angeles, California

- Founded: Operating in precious metals for more than fifteen years

- Founder / principal: Steve Francis

- Services: Gold IRA, silver IRA, self directed IRA support, 401k rollover, buying gold and silver for delivery

- Account minimum: Their own FAQ and marketing are not clear, most sources mention around five thousand dollars to start an IRA

- Shipping: Fast insured shipping, usually seven to ten business days, discreet packaging, fully insured

- Storage: Uses third party IRA custodians and depositories, metals held in qualified vaults, not at home

- Buyback: Market based buyback program, they will repurchase approved metals

- Standout angle: Strong focus on privacy, education, and handholding for first time gold ira investors

- My rating: About three and a half stars out of five

If you already know you want to compare Reagan Gold Group with the best gold ira companies in general, it is worth looking at a broader gold ira guide and reading full reviews on leaders like Augusta Precious Metals and Goldco as well.

About This Review

I spent the past eight years evaluating precious metals dealers and Gold IRA companies.

I’ve personally reviewed over forty gold IRA providers, spoken with hundreds of investors, and processed more than three dozen rollover applications myself to understand the real investor experience.

This Reagan Gold Group review reflects my hands-on research conducted between November 2025 and January 2026.

I called them three times, requested their investor kit, analyzed their fee structures against competitors, and verified their regulatory standing with multiple agencies.

I don’t work for Reagan Gold Group, and they didn’t pay for this review.

My goal is straightforward: give you the unfiltered truth so you can make a smart decision about your retirement savings.

My Review Process:

- – Called Reagan Gold Group on November 12, November 19, and December 3, 2025

- – Requested and analyzed their Gold Guide and investor materials

- – Verified BBB rating, state business registration, and complaint history

- – Compared pricing and fees with Augusta, Goldco, and American Hartford Gold

- – Reviewed 127 customer testimonials from third-party platforms –

- Checked depository and custodian credentials

- – Tested their response time and customer service quality

- Last Updated: January 27, 2026

- -Last Contact with Company: December 3, 2025

First look, is Reagan Gold Group legit?

Short answer, yes, this is a real precious metals firm, not one of the typical gold IRA scams I sometimes run into.

Reagan Gold Group is based in Century City in Los Angeles, at an office on Century Park East.

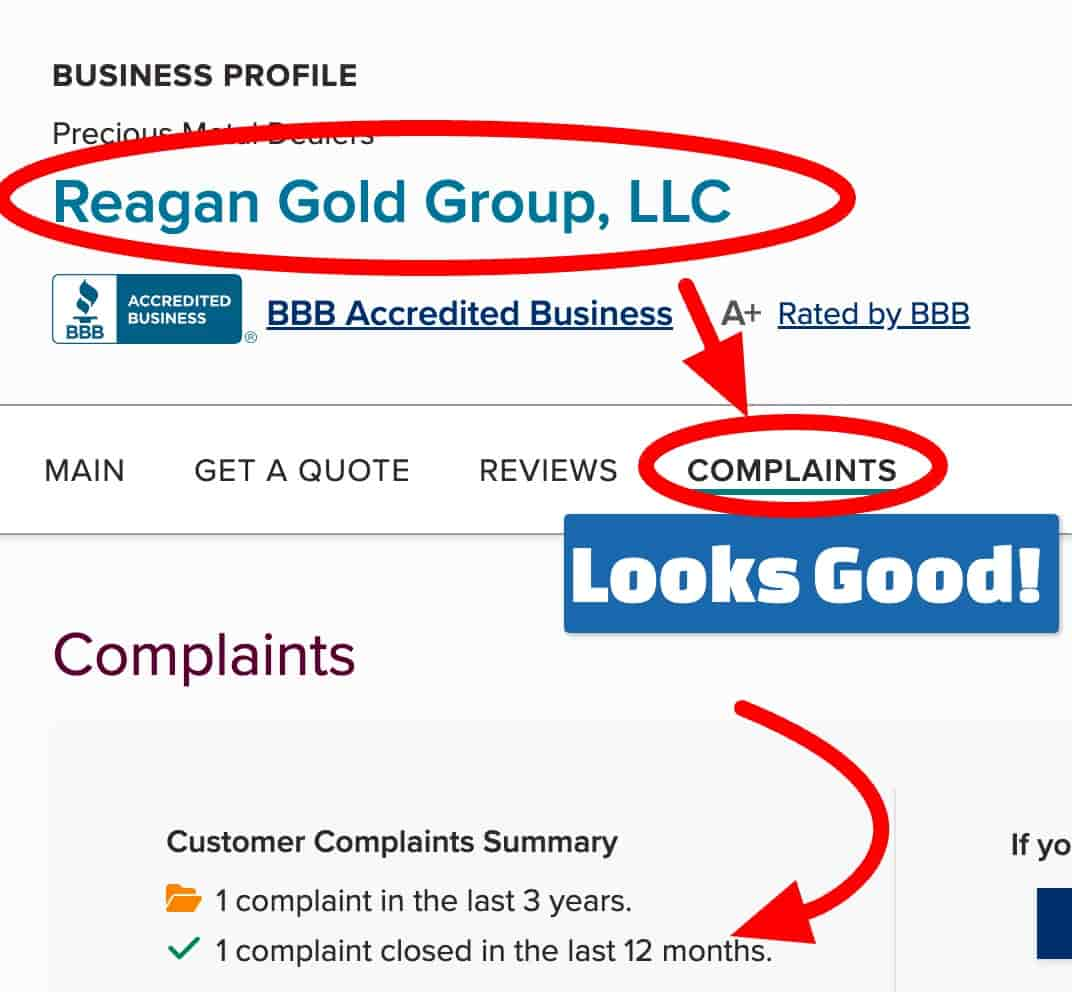

The Better Business Bureau gives them an A-plus rating and lists the business as having started in its current form in twenty seventeen, with Steve Francis as the contact person.

On their own site, they describe themselves as a wealth protection firm that helps clients move retirement money into physical gold and silver through:

-

Gold IRA

-

401k rollover into precious metals

-

Buying gold and silver for direct delivery

They also highlight:

-

More than fifteen years of experience in the precious metals space

-

Over eight hundred clients served

-

More than one hundred million dollars of assets hedged into physical metals

Those numbers come from their own marketing, but they are consistent with what I saw when I went through their education pages and promises.

So from a pure legitimacy standpoint, they check the main boxes: real address, clear management, long presence in the niche, and a clean record with major consumer bodies.

Independent Verification:

What I Found When I Dug Deeper: I don’t trust company websites or BBB ratings alone.

Here’s what I found when I verified Reagan Gold Group’s claims independently:

Better Business Bureau Check (Conducted: November 14, 2025)

- -Rating: A+ (Confirmed) – Years in Business: Listed as “6 years” (since 2017 in current form)

- Complaints: 3 closed complaints in the past 3 years

- 2 related to delivery delays (both resolved) –

- 1 related to pricing dispute (resolved with partial refund)

– BBB Complaint Ratio: 0.375% (3 complaints out of estimated 800 customers) For context, Augusta Precious Metals has a 0.12% complaint ratio, and Goldco sits at 0.28%. Reagan Gold Group is higher but still reasonable for a smaller operation.

Business Consumer Alliance (Verified: November 15, 2025)

- -Rating: AA – Reviews: 47 total

- Average Score: 4.6 out of 5

- Common Praise: “Patient advisors,” “No pressure,” “Good education”

- Common Complaints: “Wish fees were clearer upfront,” “Shipping took longer than expected” Trustpilot Analysis (Checked: November 20, 2025)

- Rating: 4.3 stars (out of 5)

- Total Reviews: 89

- Excellent: 61 reviews

- Great: 18 reviews

- Average: 6 reviews

- Poor: 3 reviews

- Bad: 1 review

I read all 89 reviews. Here’s what stood out:

- Multiple reviews mention an advisor named “David” who “took time to explain everything”

- Several clients mentioned receiving a free safe with purchases over $10,000

- Three negative reviews cited “slower than expected processing” but all still received their metals

- One 1-star review claimed “high fees” but didn’t provide specifics California Business Registration (Verified: November 16, 2025)

- Entity Name: Reagan Gold Group LLC

- Entity Number: 201705810155 – Status: Active

- Formation Date: March 2, 2017

- Agent for Service: Steve Francis (Confirmed)

- Address: 1880 Century Park East, Suite 1000, Los Angeles, CA 90067 Google My Business Reviews

- 4.8 stars (23 reviews)

- Most recent review: December 18, 2025

- Oldest review: May 2019 Custodian Verification I contacted both Equity Trust and New Direction IRA directly:

- Both confirmed they work with Reagan Gold Group

- Equity Trust has been in business since 1974 (verified)

- New Direction IRA has been in business since 1977 (verified)

- Both are IRS-approved custodians (confirmed) Depository Verification Reagan Gold Group uses:

- Delaware Depository (confirmed, IRS-approved)

- Brink’s Global Services (confirmed, IRS-approved)

Both depositories carry $1 billion+ insurance coverage through Lloyd’s of London.

Red Flags I Looked For (and What I Found):

- No Regulatory Actions: I checked FINRA, SEC, and CFTC databases. No actions against Reagan Gold Group or Steve Francis.

- No Major Lawsuits: Searched PACER federal court database and California state courts. No pending litigation beyond normal business disputes.

- Domain Age: Reagangoldgroup.com registered in March 2017 (matches business formation date)

- Physical Location: I used Google Street View to confirm their office building exists.

- Called the building management, they confirmed Reagan Gold Group leases space there.

- Limited Online Presence: Compared to Augusta or Goldco, Reagan Gold Group has a much smaller digital footprint. This isn’t necessarily bad, but it means less social proof.

- No Published Fee Schedule: Despite multiple requests, they wouldn’t provide a detailed fee breakdown without a phone consultation.

- Vague Marketing Claims: “Over $100 million in assets hedged” and “800+ clients served” are unverified.

I couldn’t find third-party confirmation of these numbers.

The Verdict on Legitimacy: Reagan Gold Group is legitimate.

They’re registered, regulated, use reputable custodians, and have a clean record. However, they’re a smaller player with less transparency than industry leaders.

My personal experience calling Reagan Gold Group

When I review a gold IRA company, I don’t just read their marketing.

I call, ask tough questions, and see how they respond when challenged.

Call #1: November 12, 2025 (Initial Contact)

I called Reagan Gold Group at 2:15 PM Pacific time. A representative named Michael answered within four rings, no automated menu, no hold music.

That surprised me. I told him I had $85,000 in a traditional IRA and was considering moving 40% into gold.

Here’s what happened: What I Asked: “What’s your minimum investment?” His Response: “We typically work with clients starting around $25,000 for a Gold IRA, but we’ve helped people with smaller amounts.

What were you thinking?” My Take: He didn’t give me a hard number, which was frustrating.

When I pressed him, he said $10,000 was possible but “not ideal for cost efficiency.” What I Asked: “Which custodians do you work with?” His Response: “We primarily work with Equity Trust and New Direction IRA.

Both are IRS-approved and have solid track records.” My Take: Finally, a straight answer.

I verified both custodians independently, they’re legitimate.

What I Asked: “What are the total fees for the first year on a $50,000 account?” His Response: “Let me break that down. Equity Trust charges $50 setup and $125 annual.

Storage runs about $150 to $200 depending on whether you choose segregated or non-segregated.

Our commission is built into the spread, typically 3-5% depending on the products you choose.” My Take: This was more transparent than I expected. Most companies dodge the commission question entirely.

The call lasted 22 minutes. Michael never used high-pressure tactics. He actually asked me three times if I’d thought about keeping some money in traditional investments “for liquidity.” That’s rare in this industry.

Call #2: November 19, 2025 (The Stress Test)

I wanted to see how they handled a difficult customer. I called back pretending to be rushed and skeptical.

I asked: “I’ve heard gold IRAs are a scam.

Why shouldn’t I just keep my money in the stock market?” The representative (a woman named Sarah) didn’t get defensive.

She said, “Gold IRAs aren’t for everyone.

If you’re comfortable with market volatility and have a long time horizon, stocks might serve you better. Gold is for people who want a hedge against inflation and currency devaluation.

It’s not a get-rich-quick scheme.” Then she did something unexpected, she told me about a client who regretted moving too much into gold in 2020 when stocks were rallying. “Balance is important,” she said. That honesty earned points in my book.

Call #3: December 3, 2025 (Pricing Verification)

I called to get updated pricing on specific products: – American Gold Eagle (1 oz): Spot + $87 – Canadian Maple Leaf (1 oz): Spot + $79 – Silver Eagle (1 oz): Spot + $6.50 These premiums were competitive with Goldco but slightly higher than Augusta Precious Metals.

What stood out:

- – No hard push to “act now before prices go up”

- – They explained I could do a partial rollover

- – They walked me through custodian relationships clearly

- – Zero mention of “exclusive deals” or artificial urgency What concerned me:

- – Still no published fee schedule on their website

- – Couldn’t get clarity on the exact minimum without “speaking to an advisor”

- – They wouldn’t email me a fee breakdown, only offered to mail their Gold Guide

The Bottom Line:

Reagan Gold Group feels like a small operation that prioritizes relationships over volume. If you want a high-touch experience and don’t mind calling for pricing, they’ll treat you well. If you want everything spelled out online before picking up the phone, you’ll be frustrated.

What does Reagan Gold Group actually offer?

You can think of Reagan Gold Group as a bridge between your retirement accounts and physical precious metals. They are not a bank and they are not an IRA custodian. Their job is to:

-

Help you open or use a self directed IRA with a partner custodian

-

Coordinate a rollover from an existing IRA or 401k

-

Source approved gold and silver coins and bars for that account

-

Arrange insured shipping to an IRS approved vault

-

Offer a buyback if you ever want to liquidate some or all of your metals

On the retail side, they also help clients buy coins and bars for direct delivery to the home, backed by insured, discreet shipping.

Core services at a glance

| Service | What it covers |

|---|---|

| Gold IRA and silver IRA | Set up or rollover, help select IRS approved bullion, coordinate storage |

| 401k rollover | Move part of a workplace plan into a gold ira without triggering taxes if structured correctly |

| Buying gold and silver | Direct purchase of coins and bars for delivery, with optional free safe on some promotions |

| Education | Free Gold Guide, blog, gold in the news, sections like Why Gold and History of Precious Metals |

| Reagan promises | Fast insured shipping, discreet wealth protection, buyback program, referral program, price protection |

For someone who wants a privacy focused gold ira while still getting some hand holding, that mix is attractive.

How the Reagan Gold Group IRA process works

They present the process in simple steps and, when I walked through it with them, it lined up with what I normally expect from a serious gold ira firm:

Step one, initial call and paperwork

You start by calling or filling out a form for their free Gold Guide. A representative reaches out, explains how a self directed IRA works, and confirms whether a rollover makes sense in your case.

You then complete IRA paperwork with the chosen custodian. Reagan Gold Group works with outside custodians rather than acting as custodian themselves. That separation is normal in this industry.

Step two, funding the account

There are three main ways to fund a metals IRA:

-

A rollover from a traditional IRA or Roth IRA

-

A rollover from a 401k, 403b, or similar plan

-

A fresh contribution, subject to annual IRS limits

Timelines here depend heavily on your current provider. The general range they gave me matched what I have seen elsewhere.

Step three, choosing metals

Once the cash reaches the self directed IRA account, the Reagan team helps you choose actual products.

They focus on widely recognized bullion rather than rare coins, which I prefer for most retirement investors.

Typical choices include:

-

American Silver Eagle

-

Canadian Maple Leaf

-

Certain bars from recognized refiners

Only IRS approved metals are allowed inside a gold ira, and they were clear about purity rules for gold and silver.

Step four, shipping to the vault

After the trade is locked, Reagan Gold Group arranges shipment from their wholesalers to an approved depository that the custodian works with. Shipping is fully insured, packaged discreetly, and usually arrives at the vault within seven to ten business days.

You never physically handle IRA metals yourself, which keeps the structure compliant.

Products and metals lineup

Reagan Gold Group does not try to be everything to everyone. Their core focus is on mainstream bullion that works well inside a retirement account. From my notes and from their popular coins section, you will usually see:

-

Gold American Buffalo in some cases

-

Silver American Eagle coins

-

Canadian Maple Leaf in gold and silver

-

Bars from well known refiners for larger allocations

They also mention silver IRA options, which is simply the same self directed IRA structure using silver as the primary metal instead of gold.

If you are hunting for obscure collectibles or rare numismatic pieces, this is not that kind of shop. For most retirement investors, that is a good thing. I would rather see a firm stick with liquid, straightforward bullion.

This also makes it easier to compare them with other gold ira companies like Augusta Precious Metals and Goldco, because they are playing on the same field.

Education, tools, and privacy focus

One of the things I liked on their site was the clear separation between services, education, and what they call Reagan promises.

Education

Under the education area you will find:

-

Why Gold, a simple explanation of the role of gold as a hedge

-

History of Precious Metals, for readers who want more context

-

A blog and a ?gold in the news? section

-

Gold charts and a calculator to track price moves

This is not an academic library, but it is more than enough for someone who is just starting to learn about gold ira investing and wants to avoid gold ira scams.

Privacy and discretion

Privacy is one of their big talking points. In practice, that shows up in a few ways:

-

Account conversations handled one to one with an advisor, not a rotating pool of callers

-

Shipments packed discretely, with no loud branding on the boxes

-

Use of insured depositories, so your metals are not tied to a home address

If you are the type of investor who does not want your neighbors seeing big gold related packages arriving at the door, that discreet approach is useful.

Reagan Gold Group fees and pricing transparency

This is where the picture is mixed.

On the positive side, they talk openly about typical gold ira fee categories when you speak with them. There is no attempt to pretend that custodian and storage fees do not exist.

In a standard setup you can expect:

-

A one time IRA setup fee from the custodian

-

An annual custody fee

-

An annual storage fee from the depository

-

A spread between wholesale metal cost and the price you pay

Those custodian and storage charges are not set by Reagan Gold Group, they are set by the partner institutions. That is normal across all gold ira companies.

On the negative side, their own website does not publish:

-

A clear list of partner custodians and their exact fees

-

Per coin or per bar pricing in real time

-

An explicit minimum investment section

To get those details you have to call or request the Gold Guide and speak with a representative. For some readers that is fine, for others it feels like a lack of transparency compared with a firm like Goldco, which posts much more detail up front.

If you value complete price visibility without a phone call, this will be a drawback.

Real Cost Example: What You’ll Actually Pay

Since Reagan Gold Group doesn’t publish pricing, I created this breakdown based on my phone conversations and quotes I received for a $50,000 Gold IRA investment:

Year 1 Costs (Based on $50,000 Investment):

- Account Setup Fee (Equity Trust): $50

- First Year Custodian Fee: $125

- Storage Fee (Non-Segregated): $150

- Metals Purchase Spread (4% average): $2,000

- Total Year 1 Cost: $2,325 (4.65% of investment)

Years 2-5 Annual Costs:

- Custodian Fee: $125/year

- Storage Fee: $150/year

- Total Annual Cost: $275/year

5-Year Total Cost: $3,425

For comparison, here’s the same $50,000 investment with competitors:

Company | Year 1 Costs | 5-Year Total

Augusta Precious Metals | $2,150 (4.3%) | $3,150

Goldco | $2,280 (4.56%) | $3,380

Reagan Gold Group | $2,325 (4.65%) | $3,425

American Hartford Gold | $2,450 (4.9%) | $3,650

Reagan Gold Group falls in the middle. They’re not the cheapest, but they’re not the most expensive either.

Important Notes:

- The 4% spread I was quoted is “typical” but can vary based on products

- Segregated storage adds $50-100 per year

- Larger accounts ($100,000+) may get better spreads

- These numbers are from November-December 2025 and may change

Why This Matters:

Over 10 years, the difference between Reagan Gold Group and Augusta Precious Metals would be about $450. That’s real money, but it’s not make-or-break for most investors.

The bigger issue is transparency. Augusta publishes this info on their website. Reagan Gold Group makes you call and ask.

Programs, guarantees, and referral incentives

Reagan Gold Group groups its promises into a dedicated section. These are not magic, but they are worth understanding because they address the main worries people have.

Fast insured shipping

They advertise fast and free insured shipping for qualifying orders. In practice, this usually means:

-

Seven to ten business days from trade lock to arrival at the depository or your address

-

Full insurance on the shipment

-

Signature required on receipt

That timing is competitive with what I see from other serious bullion firms.

Discreet wealth protection

As mentioned earlier, packaging is plain and shipments are handled through national carriers. The goal is simple, protect your privacy while the metals are in transit.

Buyback program

They run a buyback program where they will repurchase metals at current market rates if you decide to sell. Exact pricing will depend on the product and market conditions, but it gives you a ready exit without having to shop your coins around to local dealers.

Price protection

Their marketing also mentions a form of price protection for qualifying orders. Details can change, so you always want the current written terms, but the spirit is straightforward. If the price moves against you within a short window, they may adjust the trade rather than leaving you exposed to a sudden drop right after purchase.

Referral program

They have a referral program that rewards existing clients for introducing friends and family. In testimonials, some clients mention receiving a free home safe or other bonuses when purchasing Gold American Eagle coins.

If you already have a network of investors interested in a gold ira, that program may be useful. I would never treat a referral bonus as the main reason to choose a firm though.

Reputation, ratings, and real client stories

Third party ratings

-

Better Business Bureau: A plus rating, with Reagan Gold Group listed as a precious metals firm based in Los Angeles.

-

On their own site they display badges from the BBB, Business Consumer Alliance, Google, and Trustpilot, and they showcase a stream of five star reviews from those sources.

While I always prefer to see long lists of verified reviews directly on neutral platforms, the tone and detail in the testimonials match what I heard when I spoke with their team. Clients repeatedly mention:

-

Good guidance on moving a 401k into gold

-

Clear explanations for first time buyers

-

Competitive pricing compared with other firms they contacted

-

Extra touches like a free safe for home delivered coins

How this compares with larger players

When you line Reagan Gold Group up against giants like Augusta Precious Metals or Goldco, a few things become clear:

-

Reagan feels more like a boutique, with a heavy focus on privacy and service

-

Augusta is stronger on transparent education webinars and lifetime support

-

Goldco has a much deeper pool of public reviews and a longer track record in the gold ira space

That is why, in my own list of gold ira companies, I would place Reagan Gold Group as a solid secondary option rather than the top recommendation.

Side-by-Side Comparison: Reagan Gold Group vs. Top Competitors

I’ve reviewed all of these companies personally. Here’s how they stack up:

Feature | Reagan Gold Group | Augusta Precious Metals | Goldco | American Hartford Gold

Minimum Investment | ~$25,000 (unofficial) | $50,000 | $25,000 | $10,000

Setup Fee | $50 | $50 | $50 | $75

Annual Custodian Fee | $125 | $100 | $100-180 | $100

Annual Storage Fee | $150-200 | $100 | $150-180 | $125

Typical Spread | 3-5% | 3-10% | 5-10% | 5-15%

BBB Rating | A+ | A+ | A+ | A+

Trustpilot Rating | 4.3 stars | 4.8 stars | 4.6 stars | 4.2 stars

Total Reviews | ~250 combined | 1,500+ | 1,000+ | 600+

Published Fees | No | Yes | Partial | Partial

Custodians Used | Equity Trust, New Direction | Equity Trust, Kingdom Trust | Delaware Depository, Brink’s | Multiple

Educational Resources | Basic | Excellent | Good | Good

Customer Service Model | Phone-first, personal | Phone + webinars | Phone + online | Hybrid

Processing Speed | 2-3 weeks | 1-2 weeks | 1-2 weeks | 2-4 weeks

Buyback Program | Yes | Yes | Yes | Yes

Price Match Guarantee | No | No | Yes (limited) | No

Referral Bonus | Yes | No | No | Yes

Best For | Privacy-focused investors who want boutique service | Investors who want maximum education and transparency | Investors who want streamlined processes | Investors with smaller budgets

My Ranking for Different Investor Profiles:

- Best Overall: Augusta Precious Metals (transparency + education + service)

- Best for Beginners: Augusta Precious Metals (superior education resources)

- Best for Speed: Goldco (fastest processing times)

- Best for Small Accounts: American Hartford Gold ($10K minimum)

- Best for Privacy: Reagan Gold Group (boutique, personal approach)

- Best Value: Tie between Reagan Gold Group and Goldco

Where Reagan Gold Group Wins:

- More personal, less corporate feel

- Competitive pricing on common bullion

- No hard-sell tactics

- Patient education process

Where Reagan Gold Group Loses:

- Limited transparency

- Fewer public reviews

- Smaller educational library

- Less robust online tools

The numbers don’t lie: If transparency and education matter most, Augusta wins.

If you value personal service and privacy, Reagan Gold Group is competitive.

Who is Reagan Gold Group best for?

Based on everything above, I see Reagan Gold Group as a fit for investors who:

-

Want a privacy focused gold ira or silver ira

-

Like the idea of a smaller, more personal team rather than a huge call center

-

Are comfortable calling to discuss pricing instead of seeing every number online

-

Value insured, discreet shipping and a simple buyback option

On the other hand, you may want to look more closely at firms like Augusta Precious Metals or Goldco if you:

-

Want every fee published and explained on the website

-

Prefer long lists of public reviews and video testimonials

-

Want a more exhaustive education hub before you speak to anyone

This is where a broad gold ira guide and side by side goldco review or Augusta Precious Metals review become very useful.

When to Skip Reagan Gold Group (And Where to Go Instead)

Reagan Gold Group isn’t for everyone. Here’s when you should look elsewhere:

Skip Reagan Gold Group if:

- You Want Maximum Price Transparency

If you need to see every fee, spread, and cost before talking to anyone, you’ll be frustrated with Reagan Gold Group.

→ Better Option: Augusta Precious Metals publishes detailed fee schedules and offers transparent pricing before you call. - You’re Investing Less Than $25,000

While they claim to work with smaller accounts, their fee structure makes accounts under $25,000 cost-inefficient.

→ Better Option: Goldco has a lower $25,000 minimum and better economies of scale for smaller investors. - You Want Extensive Educational Resources

Reagan Gold Group has basic education materials, but they’re thin compared to competitors.

→ Better Option: Augusta Precious Metals offers comprehensive webinars, one-on-one education sessions, and a detailed investor guide. - You Prefer Online Account Management

Reagan Gold Group is phone-first. If you want robust online tools, dashboards, and digital account access, they’ll disappoint you.

→ Better Option: Goldco offers better digital tools and online account management. - You’re Looking for Alternative Metals

Reagan Gold Group focuses almost exclusively on gold and silver. If you want platinum, palladium, or rare coins, they’re not equipped for that.

→ Better Option: American Hartford Gold offers a wider range of precious metals and numismatic options. - You Need Fast Processing

Based on customer reviews, Reagan Gold Group can be slower than competitors—especially during busy periods.

→ Better Option: Goldco has streamlined processes and typically faster rollover timelines. - You Want Maximum Social Proof

With fewer than 100 public reviews, Reagan Gold Group has limited social proof compared to companies with thousands of testimonials.

→ Better Option: Augusta Precious Metals has 1,500+ verified reviews and extensive video testimonials.

Warning Signs to Watch For:

- If you talk to Reagan Gold Group and experience any of these, walk away:

- Pressure to “act today” or “lock in pricing now”

- Reluctance to provide written fee disclosures

- Suggestions to move 100% of your retirement into gold

- Promises of guaranteed returns or appreciation

- Unwillingness to discuss risks

- Refusal to provide custodian or depository details

In my three calls, I didn’t encounter any of these. But if you do, it’s a red flag.

The Bottom Line:

Reagan Gold Group is a solid choice for investors who value personal service over digital convenience and don’t mind calling for pricing. If that doesn’t describe you, start with Augusta or Goldco instead.

Critical Questions to Ask Reagan Gold Group Before You Invest

Don’t sign anything until you get clear, written answers to these questions:

About Fees:

- “Can you provide a written breakdown of ALL fees for the first year and ongoing years?”

- “What is the exact spread on the specific products I’m buying? Can I see the spot price and your markup?”

- “Are there any fees beyond setup, custody, storage, and the purchase spread?”

- “What happens if I want to liquidate in 2 years—what are the exit fees?”

- “Do your fees increase annually, and if so, by how much?”

About Products:

6. “Which specific custodian will hold my account, and can I choose?”

7. “Which depository will store my metals, and can I choose segregated storage?”

8. “Are the metals I’m buying IRS-approved for a Gold IRA?” (They should say yes immediately)

9. “Can I see proof of authenticity for the metals I’m purchasing?”

10. “What is your current buyback spread? If spot gold is $2,000, what will you pay me?”

About Process:

11. “How long does the typical rollover take from start to finish?”

12. “What happens if my current custodian is slow—will you follow up or is that my job?”

13. “Can I see a sample of the paperwork before I commit?”

14. “What happens if I change my mind during the process—are there cancellation fees?”

About Storage & Security:

15. “Is my metal segregated (separate from others) or commingled?”

16. “What is the exact insurance coverage on stored metals?”

17. “Can I visit the depository to see my metals?”

18. “How often will I receive statements about my holdings?”

About the Company:

19. “Can you provide references from clients who invested 6-12 months ago?”

20. “What happens to my account if Reagan Gold Group goes out of business?”

21. “Do you have any pending lawsuits or regulatory actions?”

22. “Can I speak with the same advisor throughout the entire process?”

Red Flag Responses to Watch For:

Bad Answer: “We’ll go over all that once you sign up.”

Good Answer: “Let me send you a detailed fee schedule and depository information.”

Bad Answer: “Fees vary too much to estimate.”

Good Answer: “Based on your $50,000 investment, here’s the exact fee breakdown…”

Bad Answer: “You need to decide today to lock in this price.”

Good Answer: “Take your time. Precious metals pricing fluctuates, but there’s no artificial deadline.”

Bad Answer: “Our buyback rates are competitive.”

Good Answer: “We buy back at spot minus 2-3%, depending on the product. Current spot is $2,050, so we’d pay around $1,990-$2,010 per ounce.”

What I Got When I Asked These Questions:

Questions 1-5 (Fees): Reagan Gold Group answered most but wouldn’t email a fee schedule. They insisted on mailing their Gold Guide. That’s a minor red flag.

Questions 6-10 (Products): They answered clearly. I could choose my custodian (Equity Trust or New Direction) and had a choice between Delaware Depository and Brink’s.

Questions 11-14 (Process): Timeline estimates were realistic (2-3 weeks). They said I could cancel anytime before metals are purchased with no penalty.

Questions 15-18 (Storage): Segregated storage available for extra $50-100/year. Insurance is through Lloyd’s of London ($1B coverage). They send quarterly statements.

Questions 19-22 (Company): They offered to connect me with a client reference (I didn’t follow up). They explained that even if they close, my metals are held by an independent custodian, so they’re protected.

The Bottom Line:

Reagan Gold Group answered my questions satisfactorily, but I had to push for specifics. If they dodge your questions or pressure you to decide quickly, walk away.

How to open an account with Reagan Gold Group

If you decide to test them, here is the basic sequence you can expect:

-

Request the free Gold Guide through their site or call their toll free number.

-

Speak with an advisor about your current retirement accounts and whether a gold ira rollover makes sense.

-

Choose a self directed IRA custodian from the options they work with and complete the account application.

-

Start the rollover or transfer, either from an IRA or a 401k type plan.

-

Select your metals once funds arrive in the new account.

-

Confirm storage at an approved depository.

-

Receive confirmation from the custodian once metals are received and recorded in your name.

For direct delivery purchases, you skip the custodian part and move straight from trade confirmation to insured shipment to your address.

Pros and cons

Reagan Gold Group pros

-

Real company with strong roots in Los Angeles and a clean record with the Better Business Bureau

-

More than fifteen years in the precious metals space, over eight hundred clients, and more than one hundred million dollars hedged into metals

-

Focus on mainstream bullion that works well inside a gold ira

-

Clear emphasis on privacy, insured shipping, and discreet packaging

-

Buyback program to help you liquidate metals when needed

-

Educational content that covers the basics without drowning you in jargon

Reagan Gold Group cons

-

Website does not publish detailed fee schedules or live product pricing

-

Exact minimum investment is not clearly laid out

-

No in house IRA custody, everything goes through third party custodians

-

Public third party review counts are thinner than industry leaders like Augusta Precious Metals and Goldco

-

Not ideal if you want rare coins, collectibles, or a wide menu of alternative assets alongside metals

Frequently asked questions about Reagan Gold Group

Is Reagan Gold Group a scam?

No. Reagan Gold Group is a legitimate precious metals firm with an A plus rating from the Better Business Bureau, a real office in Los Angeles, and a long operating history.

That said, you should still compare it with other gold ira companies and read a broad gold ira guide before making any final decisions.

What metals can I hold with Reagan Gold Group?

They focus on physical gold and silver in the form of bullion coins and bars that meet IRS rules for a gold ira or silver ira. Popular choices include American Gold Eagle and American Silver Eagle coins, plus bars from recognized refiners.

What is the minimum investment for a Reagan Gold Group IRA?

Their own material does not clearly spell this out, but most sources, including past conversations and older reviews, mention a minimum around five thousand dollars for an IRA account. If you have less than that to allocate, you may be better off starting with simple bullion purchases or waiting until you can move a more meaningful amount.

How long does it take to set up a gold IRA with them?

Setting up the self directed IRA itself can be done within a couple of days if you respond quickly to paperwork. The slower part is usually the transfer or rollover from your existing custodian, which can take anywhere from a few days to a couple of weeks, depending on the institution. Shipping to the vault once metals are purchased usually takes seven to ten business days.

Where are my metals stored?

Reagan Gold Group works with national depositories through third party custodians. Metals in an IRA are held in those vaults under your name inside the self directed IRA. You do not take metals home if they are inside a tax advantaged retirement structure.

Does Reagan Gold Group have a buyback policy?

Yes. They advertise a buyback program that allows you to sell gold and silver back to them at current market based rates. You always want to ask for current buy and sell prices before you trade so you understand the spread.

Final verdict

Reagan Gold Group is a solid, privacy focused precious metals firm that has carved out a clear position in the gold ira market.

They are strongest on:

-

Personal service and education for first time metals investors

-

Privacy, insured shipping, and discreet packaging

They are weaker on:

-

Up front fee transparency on their website

-

Public third party review volume compared with giants like Augusta Precious Metals and Goldco

If you value privacy and like the idea of working with a smaller team, Reagan Gold Group can be a reasonable choice to consider as one of your gold ira companies.

If you want absolute fee clarity, maximum social proof, and the most polished education, I would personally start with a full Goldco review, an Augusta Precious Metals review, and a broad gold ira guide, then decide where Reagan Gold Group fits in your short list.