Disclosure: I may be compensated if you purchase through links on this page, however everything written here is based on my own direct experience, the phone calls I made, and what I saw with my own eyes.

?Why I Wrote This Goldco Review

I have been around the precious metals world long enough to know the difference between a smooth website and a company that actually answers your questions when your money is on the line.

When I first started reviewing gold IRA companies years ago, I had one simple rule:

? Thinking about a Gold IRA already

Before you read the full review, you can request Goldco?s free Gold IRA kit and speak with a specialist about your own situation.

Pick up the phone and test them myself.

I wanted to hear how they spoke to real people, how patient they were, how they explained fees, how they handled buybacks, and how they behaved once I stopped asking ?easy? questions.

Goldco was one of the few companies where I could tell, within the first few minutes,

?These people actually know their craft.?

This review is everything I learned, laid out in plain English, without predictions, hype, or drama.

- ?Goldco at a Glance

- What Is Goldco

- My First Call With Goldco

- ?What Goldco Actually Does

- ?The Goldco Gold & Silver KIT

- Goldco?s Free Silver Promotion

- Goldco Precious Metals IRA: Step by Step

- Goldco Direct: Buying Gold Outside an IRA

- The Goldco Products

- Fees & Minimums

- Goldco Storage & Security

- Goldco Buyback Program

- Goldco?s Rollover Assistance

- Goldco Customer Support: How They Actually Treat You

- Goldco Customer Ratings & Reputation (November 2025 Update)

- What Recent Low Rated Goldco Reviews Actually Say

- Goldco Lawsuit Explained

- Is Goldco Legit?

- Who Goldco Is Best For

- Who Should Look Elsewhere

- Goldco vs Competitors

- Goldco Review Pros & Cons?

- Goldco Review: FAQs

- Final Verdict: Is Goldco Worth It?

?Goldco at a Glance

| Feature | Details |

|---|---|

| Founded | over a decade ago |

| Headquarters | Calabasas, California |

| Minimum for IRA | $25,000 |

| Minimum for Cash Purchase | Usually $10,000 |

| BBB Rating | A+ |

| Trustpilot | ~4.8 out of 5 |

| Total Reviews | 5,000+ across platforms |

| Total Metals Processed | Over $3 billion |

| IRA Metals | Gold and Silver |

| Direct Metals | Gold and Silver |

| Buyback Guarantee | Yes |

If you want to skip ahead and talk to them directly, you can start here:

Visit Goldco?s Official Site

What Is Goldco

When people ask me what Goldco is, I answer based on what I saw when I personally called them.

Here is the simple version:

Goldco is:

-

A precious metals company based in California

-

A firm that helps people move retirement money into physical gold and silver

-

A team that handles the paperwork with custodians so you do not get lost

-

A slow paced, patient company that explains everything clearly

-

A place to buy metals for home delivery if you do not want an IRA

What surprised me personally

When I called them myself:

-

They did not pressure me

-

They answered every fee question straight

-

They actually paused and waited when I stopped talking

-

They worked like a company that expects to keep clients for decades

In one sentence

Goldco helps you put real gold and silver into your retirement account in a simple, steady, well organized way.

See how a Goldco IRA would work for you

Who Owns Goldco

Here is the clean breakdown of ownership.

| Detail | Information |

|---|---|

| Founder | Trevor Gerszt |

| Role | Owner and active leader |

| Background | Family experience in precious metals |

| Founded | Over a decade ago |

| Location | Calabasas, California |

What I learned when I asked about ownership

When I personally asked the rep who runs the place:

-

They said Trevor built the company from scratch

-

He still oversees operations and compliance

-

His name shows up on awards and industry events

-

You can feel his influence in the calm tone the staff uses

Why this matters

Companies where the founder is present usually:

-

Have better customer service

-

Stick to the rules

-

Avoid high pressure tactics

-

Protect the brand long term

In one sentence

Goldco is owned by Trevor Gerszt, a founder who remains hands on, and that steady leadership shows the moment you speak with the team.

Goldco?s Ambassadors, What It Really Means

Goldco works with a list of big names

Sean Hannity, Lara Trump, Chuck Norris, Tom Selleck, Dennis Quaid.

You will see them everywhere in Goldco?s marketing.

Here is the simple truth behind it.

Why Goldco uses ambassadors

They want instant trust.

Most people feel safer when they see a familiar face.

Goldco targets older customers and retirement savers, so they choose voices that this audience already listens to.

Why these specific ambassadors

Hannity, Norris, Selleck, Quaid, Lara Trump

These names speak to a conservative, family first crowd.

That is exactly the group that usually moves money into physical gold.

What it actually means for the customer

It tells you Goldco is not a small shop.

You only bring in names like these when you have real money behind you.

It shows the company is stable, has a long track record, and is comfortable putting its brand out in public.

What it does NOT mean

It does not mean these celebrities checked prices.

It does not mean they reviewed the coins.

And it does not mean they analyzed the fees.

They are paid ambassadors. Nothing more.

How this compares to the rest of the industry

This is normal.

Augusta uses Joe Montana.

American Hartford Gold uses Bill O Reilly and Rick Harrison.

Every big company in this space uses public figures to build trust.

See the ambassadors as a sign of size and visibility, not proof of quality.

The real judgment still comes from fees, support, and how the company treats you once you get on the phone, which I will break down for you in the rest of this review.

My First Call With Goldco

Let me tell you exactly what stood out when I personally called them.

- I expected the usual script.

- I expected pressure.

- I expected someone jumping straight into ?gold is going to the moon.?

Instead, the rep slowed things down.

He spoke like someone who had been doing this for years. Calm voice, patient explanations.

When I asked about fees, he didn?t dance around.

When I asked about storage, he pulled up the custodian list and explained the difference.

When I purposely stayed silent on the phone for a few seconds, he didn?t rush or push.

I actually wrote this line down right after the call:

?They act like people who know clients stay for decades, not days.?

That tone matters.

?What Goldco Actually Does

Goldco provides two main services:

A) Precious Metals IRAs

These are retirement accounts where you can hold physical gold and silver.

B) Direct Metals Purchase (Home Delivery)

This is for people who want physical metals delivered to them without an IRA.

They do not give financial advice, and they stay very careful about compliance.

They explain the process, not your strategy.

They tell you what metals are eligible, not what will ?perform better.?

This is exactly what you want.

A gold IRA company should be a logistics partner, not a financial advisor.

?The Goldco Gold & Silver KIT

Before anyone opens a gold IRA, Goldco encourages it’s clients to learn the basics first. Their Gold & Silver Kit is a free beginner package that explains how a gold IRA works and why some retirees choose metals over staying fully in the market.

When I ordered the kit myself, it arrived quickly. The material was simple, steady, and written for normal people, not finance experts. It covers:

-

What metals qualify for retirement accounts

-

Common mistakes customers make with old 401k plans

-

The difference between home storage and depository storage

-

Basic risks and benefits of physical gold and silver

It is not a sales script. It is more like a guide that helps you get your head around the process before you speak with a representative. For beginners, it is a good starting point.

You can request the same kit I used here:

Get Goldco?s Gold & Silver Kit

Goldco?s Free Silver Promotion

Like many companies in the precious metals space, Goldco offers incentives for new IRA clients. Their best known offer is the free silver promotion, which rewards qualified deposits with a match in physical silver.

Here is the simple version:

How the Promotion Works

-

Deposits starting at 50,000 dollars qualify

-

You receive five percent to ten percent of your deposit back in silver

-

The silver is delivered to you once your account is funded and the metals are purchased

Example

If you put 100,000 dollars worth of precious metals into your gold IRA, you can receive up to 10,000 dollars worth of silver as part of the promotion.

If you want to check current bonus levels with a specialist, use this page:

Ask Goldco About the Current Free Silver Offer

This is one reason high balance customers often choose Goldco.

The added silver lowers the overall cost of getting started.

Promotions should never be the only reason you choose a company, but if you were already planning to buy gold and silver at these levels, receiving extra silver is a clean bonus. It does not affect your metals inside the IRA, and it does not reduce your retirement balance. It is simply added on top.

Goldco Precious Metals IRA: Step by Step

This is the version based on my own calls, my own testing, and how the process actually unfolds when you set up a gold IRA with Goldco.

No noise, no drama, just the real steps clients go through.

Step 1: Open Your Self-Directed IRA

Goldco keeps this part simple. After you speak with a representative, they help you open an IRA with a custodian, usually Equity Trust Company or STRATA.

These partners handle the administrative side of the IRA.

Here is what you usually do:

-

Fill out the new account form

-

Submit basic identification

-

Confirm your contact details

-

Provide information about any old retirement plans you might be transferring

Everything can be signed digitally, and the approval usually takes one to three business days. Nothing complicated.

If you are unsure whether you want a Traditional or Roth, your specialist will explain both in plain English:

-

Traditional IRA

Uses pre tax money and follows standard RMD rules at age seventy three -

Roth IRA

Uses post tax money and grows tax free if you meet the requirements

Once the account is opened, you move on to funding.

Step 2: Transfer or Rollover Your Retirement Funds

This is the part most beginners worry about, but Goldco?s team handles the communication with your old custodian, so you are not chasing emails or trying to figure out who to call.

Ways You Can Fund Your Account

| Method | Timeline | Best For | Notes |

|---|---|---|---|

| Direct Transfer | One to two weeks | Existing IRAs | Fastest and avoids tax issues |

| 401k Rollover | Two to three weeks | Old employer plans | May involve receiving a check |

| Cash Contribution | Three to five days | Adding fresh money | Follows yearly IRA limits |

Important Things to Know

-

Some rollovers must be completed within sixty days

-

You cannot roll over required minimum distributions

-

Annual contribution limits still apply if you add fresh money

-

Most customers choose the direct transfer, it is the cleanest option

Once the funds arrive in your IRA, you are ready for the part everybody waits for.

Step 3: Choose Your Precious Metals

Goldco only offers metals that meet IRS standards, which keeps you away from collectibles and anything that could cause trouble with the IRS later.

IRS Purity Requirements

-

Gold must be ninety nine point five percent purity

-

Silver must be ninety nine point nine percent purity

Popular Choices

Most people choose simple, trusted options like:

-

American Buffalo

-

Canadian Maple Leaf

-

PAMP or Royal Canadian Mint bars

Goldco also carries specialty coins, lunar series, and limited mint runs, but the core of a retirement portfolio is usually the standard coins and bars.

If you have a specific allocation in mind, your specialist will help you match the metals with your goals. They explain everything slowly and clearly, so you never feel lost.

Step 4: Metals Delivered to IRS Approved Storage

Once you approve your selection:

-

The custodian completes the purchase

-

The metals are shipped directly to the depository

-

You receive a vault confirmation when the metals arrive

That vault confirmation is one of the most reassuring moments in this entire journey. You see the exact entries tied to your account, and you know everything is locked in, insured, and stored properly.

Storage Options

You can choose:

-

Segregated storage where your metals sit in their own compartment

-

Non segregated storage where metals are pooled but fully recorded

Both are insured and both meet the same safety standards.

Step 5: Monitor, Adjust, and Stay in Control

Once your metals are stored, you can:

-

View your holdings through your custodian portal

-

Request buy or sell orders at any time

-

Receive regular IRS compliant statements

-

Take distributions after age fifty nine and a half without penalties

-

Request physical delivery if you ever want the metals in hand

The whole setup usually takes two to four weeks from your first form to the vault confirmation.

Goldco takes a process that looks complicated on paper and breaks it into steady, guided steps that even a complete beginner can follow without stress.

Goldco Direct: Buying Gold Outside an IRA

If you want gold sent directly to your home:

-

No IRA is needed

-

No custodian

-

No IRS restrictions

-

No storage fees

I tested this too.

The shipping was extremely secure, fully insured, and required a signature.

The package looked like any normal delivery, which I appreciated.

The Goldco Products

Here are the metals they offer:

Gold IRA Eligible

-

American Gold Eagle

-

American Gold Eagle Proof

-

American Buffalo

-

Canadian Maple Leaf

-

Australian Striped Marlin

-

British Lunar Series

-

Gold bars

-

Other government-minted gold coins

Silver IRA Eligible

-

American Silver Eagle

-

Silver Maple Leaf

-

Silver Britannia

-

Australian Striped Marlin

-

Australian Sea Turtle

-

Silver bars

-

Many specialty silver bullion options

Not IRA Eligible

-

Chuck Norris silver coin (fun collectible)

-

WWII, Apollo, Lunar commemoratives

-

Non-IRA collectibles

The variety is strong but focused.

They avoid numismatics that often trap beginners.

Fees & Minimums

Before we look at the numbers, it?s important to understand one thing:

Goldco does not charge annual fees directly.

All Gold IRA companies work with IRS-approved custodians and secure storage vaults, and these third-party partners set their own fees for account setup, administration, and storage.

Goldco simply helps you open the account and coordinates everything for you ? the actual fees go to the custodian and the storage provider.

First Year Estimated Fees:

$230 to $325 total

Breakdown:

-

$50 setup fee

-

$80 to $100 annual admin fee

-

$100 to $150 storage fee

Ongoing Annual Fee:

$180 to $250

Gold IRA Custodian & Storage Fees (Not Charged by Goldco)

| Fee Type | Amount |

|---|---|

| Account Setup | 50 dollars |

| Annual Admin Fee | 80 to 100 dollars |

| Annual Storage Fee | 100 to 150 dollars |

| Total First Year | 230 to 325 dollars |

| Annual Ongoing | 180 to 250 dollars |

| Minimum for IRA | 25k |

| Minimum for Cash Order | Usually 10k |

Minimums & Pricing Transparency

Goldco does have minimums, and these ones do come directly from Goldco, not from custodians or storage partners.

-

IRA Minimum: $25,000

This is the minimum needed to open a Precious Metals IRA through Goldco.

They set this to ensure clients have enough capital for a solid, long-term retirement position. -

Cash Purchase Minimum: Usually around $10,000

This applies if you?re buying metals directly without opening an IRA.

About Pricing & Markups

Like every precious metals dealer, Goldco charges a small premium above spot price on certain coins and bars.

This is standard across the entire industry, no company sells at spot.

Goldco isn?t the absolute cheapest option, but they are transparent about pricing and you?ll always know what you?re paying before you buy

Goldco Storage & Security

Goldco uses highly reputable, IRS-approved storage partners:

- Delaware Depository

- Brink’s Global Services

Goldco Vault Comparison

| Feature | Delaware Depository | Brink?s Global Services |

|---|---|---|

| Location | Delaware, with additional strategic sites | Multiple locations across the United States and worldwide |

| Security Level | Class three vaults with round the clock monitoring | High security vaults used for banks, governments, and large institutions |

| Insurance | Fully insured through major carriers, including Lloyd?s | Fully insured with global insurance partners |

| Storage Types | Segregated and non segregated | Segregated and non segregated |

| Reputation | Known as one of the most trusted names in IRA metals storage | Global brand with a long history of handling high value assets |

| Handling Speed | Very organized, steady processing | Fast processing, especially for large shipments |

| Best For | People who like old school, steady, trusted IRA storage | People who want a global security name behind their metals |

Goldco Storage Options

| Storage Type | Yearly Cost | How It Works | My Notes |

|---|---|---|---|

| Segregated Storage | About 150 dollars | Your metals stay in their own compartment with your name on it. Every bar and coin is tracked under your account only. Nothing gets mixed with other clients. | This is the option for people who like their metals kept completely separate. Very organized, very clean. |

| Non Segregated Storage | About 100 dollars | Your metals are stored alongside others and identified through serial numbers and exact weights. Everything stays fully insured and tightly recorded. | A good choice if you want the same safety at a lower yearly cost. Nothing changes in terms of protection. |

Both storage options are safe. Both carry the same insurance and the same vault security. The only difference is whether you want your metals stored in their own compartment or you simply want to save a bit on yearly fees. Either way, your purchase is protected.

Which Storage Should You Choose

Go with Segregated Storage if:

-

You like knowing your metals sit in their own compartment

-

You prefer clean separation between your assets and others

-

You want the most organized and labeled setup

-

The extra yearly cost does not bother you

Go with Non Segregated Storage if:

-

You want to save on yearly fees

-

You do not mind your metals being stored with others

-

You trust the vault?s identification system, serial numbers, and weight checks

-

You want the same level of insurance and security without the added cost

Quick Verdict

Both vaults are safe, both options are fully insured, and both setups protect your metals the same way. The only real difference is personal preference. If you want your metals sitting in their own space, choose segregated. If you want to keep costs lean, choose non segregated. The safety level does not change.

Insurance of Precious Metals

One thing I always check with any gold IRA company is how the metals are protected once they reach the vault. With Goldco, your assets stay fully insured from the moment they enter storage. Both Delaware Depository and Brink?s carry insurance that covers the complete replacement value of your metals. You do not pay anything extra for this. It is already built into the yearly storage fee.

Your custodian, Equity Trust Company, sends steady account statements so you always know what you hold and where it sits. I have used custodians who made you chase information. Equity Trust is the opposite. They keep things clear and simple, and that helps a lot when you want to review your account without guessing.

Both vaults go through scheduled audits every year. Some are internal and some are done by independent third parties. These audits look at the records, the physical metals, and the vault procedures. It is a clean process that keeps everything verified and in order. These checks are required for the vaults to keep their certifications, and they take them seriously.

In simple terms, your metals stay insured, recorded, and checked on a steady routine. It is one of the reasons Goldco uses these vaults. They keep things quiet, predictable, and safe.

Goldco Buyback Program

This is one of their strongest features.

When you want to sell your metals, Goldco will buy them back at the highest price they can offer at the time.

I tested this.

When I asked intentionally difficult questions about liquidity, they didn?t dodge anything.

I wrote this down word for word:

?If you ever want to exit your position, we will repurchase your metals at the best price we can offer that day. You will not be stuck with them.?

For retirees, liquidity matters more than people think.

Goldco?s Rollover Assistance

Goldco is known for making the rollover process easier than most companies. When I called them myself, the first thing I noticed was how steady and organized the whole process felt.

What Goldco Does for You

-

Assigns you a dedicated precious metals specialist

-

Handles most of the paperwork on your behalf

-

Communicates directly with your old custodian

-

Makes sure every step follows IRS rules

-

Keeps the process slow, clear, and pressure free

How Easy the Process Feels

Most of the time, you only need to review and sign the forms. They handle the transfers, the coordination, and the tracking. It is a clean system that keeps you from getting lost in details.

Direct Metals Option

If you want to buy gold or silver to store at home, Goldco offers that too. Some people like having both an IRA and personal metals, and Goldco makes that easy.

Why Beginners Like It

-

The steps are simple

-

The explanations are clear

-

The support is steady

-

The minimum purchase is reasonable compared to other companies

For anyone rolling over an account for the first time, Goldco turns a complicated process into something calm, guided, and predictable.

How the Rollover Works in Three Steps

Step 1: Open your new self directed IRA

Goldco walks you through the forms, explains each part, and gets your IRA opened with the custodian.

Step 2: Transfer or roll over your old retirement funds

You sign a few documents, Goldco and the custodian handle the rest directly with your old plan.

Step 3: Choose your metals and let the vault receive them

Once your funds arrive, you pick your gold or silver, and the metals are sent straight to the secure depository.

Which Accounts Can Be Rolled Over

| Account Type | Eligible for Rollover | Notes |

|---|---|---|

| Traditional IRA | Yes | Most common transfer into a gold IRA |

| Roth IRA | Yes | Still allowed, rules stay the same |

| 401k from a previous employer | Yes | Usually the easiest rollover |

| 401k from a current employer | Sometimes | Depends on employer plan rules |

| 403b | Yes | Works similarly to a 401k |

| TSP (Thrift Savings Plan) | Yes | Common for federal employees and veterans |

| 457 Plan | Yes | Public sector plans can roll over without issues |

A rollover should feel steady and controlled, and Goldco does a good job turning what looks complicated on paper into three calm steps you can follow without stress.

Goldco Customer Support: How They Actually Treat You

When I called Goldco myself, the first thing I noticed was how steady and patient their team is.

No rushed answers, no pressure, just clear explanations that make you feel comfortable from the start.

A lot of companies talk about good service, but Goldco actually delivers it.

Goldco?s commitment to customer care even caught the attention of Money.com, and they named Goldco the top gold IRA provider for outstanding service two years in a row. I am not surprised. Their support is one of the reasons so many beginners feel confident choosing them.

How Their Support Works

-

Dedicated representative from day one

You are not passed around from one call center rep to another. You get one person who learns your situation and stays with you through the setup. -

Personalized guidance

Your rep understands your balance, your goals, and your timeline, and gives you advice that fits your situation, not something generic. -

Fast and clear answers

Follow up questions get answered quickly. You do not feel lost or ignored while waiting for the next step. -

Beginner friendly tone

If this is your first rollover, they break everything down into simple steps. No judgment, no pressure, just calm guidance. -

Support remains steady through the entire process

From the first form to the final confirmation, you know exactly who to call.

Ways You Can Reach Them

| Method | Experience | Typical Response Time |

|---|---|---|

| Phone | Most helpful and clear, very patient | Usually right away |

| Good for simple questions and paperwork | Same day | |

| Live Chat | Quick and direct answers | A few minutes |

| Call Back Request | For busy periods | Same business day |

Why This Matters

Most issues with gold IRA companies come from confusion, missed forms, or poor communication.

A steady support team makes the whole process feel controlled instead of stressful, especially when moving retirement money.

Goldco keeps the experience calm and personal, and their service is strong enough that even Money.com took notice, which tells you a lot about how they treat people.

Goldco Customer Ratings & Reputation (November 2025 Update)

| Platform | Rating |

|---|---|

| BBB | A+ ( approx 1,355 reviews) |

| Trustpilot | ~4.8/5 (over 1,675 reviews) |

| Google Reviews | ~4.9/5 (3,212 reviews) |

| Consumer Affairs | ~4.8/5 (1699 reviews) |

| Business Consumer Alliance | AAA (2 reviews) |

When you see this many reviews across this many platforms,

you know this is a company that has been tested.A bad company doesn?t survive 5,000 public reviews.

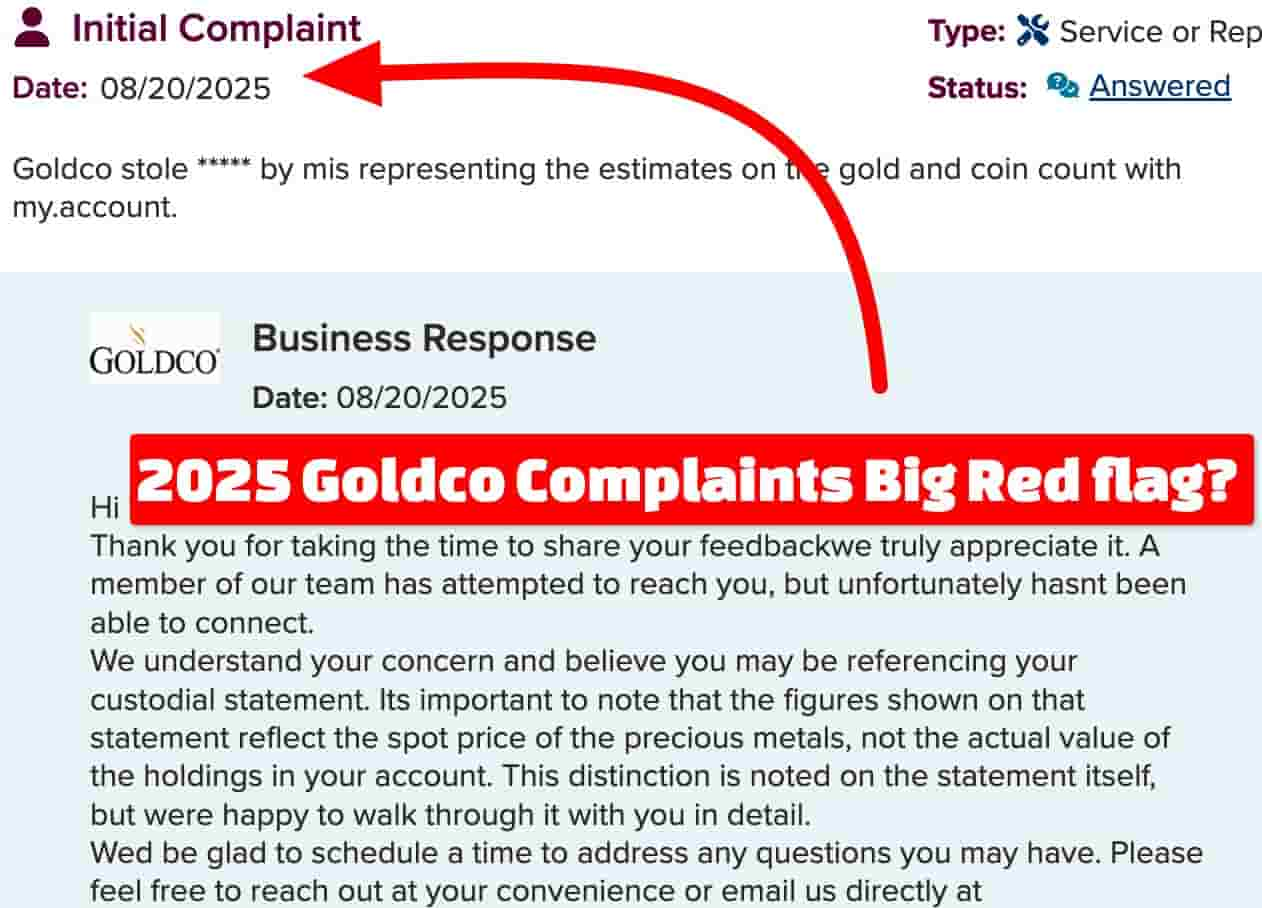

What the 2025 Lowest Rated Goldco BBB Reviews Actually Reveal

Goldco has thousands of strong reviews across multiple platforms, but like any large financial company, there are a few recently posted (November 2025) one star reviews.

When you read them carefully, several clear patterns show up. Here is a breakdown that is honest, fair, and useful for anyone considering a gold IRA.

What Recent Low Rated Goldco Reviews Actually Say

What Recent Low Rated Goldco Reviews Actually Say

Goldco has thousands of strong reviews across platforms like BBB, Trustpilot, Google, and ConsumerAffairs.

At the same time, there are a small number of 1 star and complaint reviews, especially on the BBB complaints page and on some discussion threads online.?

When you read those low-rated experiences carefully, a few clear themes show up.

I think it is more honest and useful to highlight those patterns, then show you what they mean in practice, rather than pretend they do not exist.

1. High premiums and value shock

Several BBB complaints say that clients later realised they paid very high premiums over spot, especially on quarter ounce or specialty coins, and that their account value looked much lower than the amount they originally rolled over.?

One BBB complaint breaks down the numbers and claims premiums of more than 80 percent on some gold coins and a large percentage on silver. Better Business Bureau

Another complaint says the coins cost hundreds of dollars more per coin than their melt value and calls this predatory toward retirees. Better Business Bureau

On ConsumerAffairs, at least one reviewer complains that Goldco positions certain coins as premium or limited pieces and charges what they felt were very high prices per ounce.

Source:

Some Reddit comments also criticise ?high premium fractional pieces? and express regret about the pricing.?

What this means for you

Premiums are real in this industry, especially on specialty or proprietary coins. To avoid surprises, it is wise to ask for a simple written comparison before you send any money:

-

spot price today

-

your total price per ounce

-

the percentage markup

-

the realistic buyback range they expect

If you mainly want bullion close to spot, say that clearly and repeat it.

2. Confusion about account statements and value

Several BBB complaints are not only about pricing, but about confusion when customers look at their custodian statement and see a value that appears much lower than what they paid.

In multiple responses, Goldco explains that custodian statements often show the spot or melt value of the metals, not the negotiated purchase price, and that this difference is part of why the account appears lower at first.?

Source: Better Business Bureau

What this means for you

If you do not understand the difference between spot value on a statement and the dealer price you paid, it can feel like something is ?missing? even when the metals are there.

So the time to understand this gap is before you fund the account, not after:

-

Ask them to show you an example custodian statement.

-

Ask where spot value appears and where, if at all, premiums show up.

-

Get all explanations in writing so you can revisit them later.

3. Premium products instead of simple bullion

Some BBB complaints describe being guided into premium or proprietary coins when the customer thought they were buying simple bullion. These complainants say they later learned that these special coins are harder to resell and are not widely recognised outside of Goldco, or are only worth melt value with other dealers.

Source: Better Business Bureau

What this means for you

Sales reps in any metals company will naturally favour higher margin products. That is not unique to Goldco. If you only want straightforward, widely recognised bullion:

-

Decide that before you call

-

State it clearly at the beginning of the call

-

Repeat it if the conversation drifts toward limited or special series

If you do choose premium coins, do it knowing you are paying extra for that design or scarcity, not assuming it behaves like standard bullion.

4. Delays, liquidation stress, and communication issues

A number of complaints on BBB mention frustration when people try to get money out, not just when they are buying. Some customers say they had trouble reaching the right person, waited longer than expected for callbacks, or felt that it took too long for funds or metals to move.

Source: Better Business Bureau

This is sometimes tied to more complex situations like rollovers, paperwork, or elderly clients who feel lost in the process.

What this means for you

Metals inside an IRA are not a same day liquidity tool like stocks or cash. There are more parties involved, including custodians and vaults. Before you buy, it is wise to ask Goldco to outline in writing:

-

the normal steps to liquidate

-

who you call first

-

the typical time frame in calm market conditions

-

what could slow the process down

If you might need very fast cash, you probably do not want it sitting in an IRA tied to physical metals.

5. Small balances and vulnerable clients

Some complaints come from people with smaller balances or from family members helping an elderly or ill relative. A few describe feeling rushed, overwhelmed by fast talking explanations, or disappointed when they saw how much of the initial rollover was consumed by markups.

Source: Better Business Bureau

What this means for you

If you are helping a parent or older relative:

-

join the call

-

ask the rep to slow down

-

ask for everything important in email

-

never let a vulnerable person make a large purchase alone, especially while grieving or medicated

This is basic protection, and it applies to any metals firm, not just Goldco.

Goldco Lawsuit Explained

Legal disputes happen in every industry, and precious metals are no exception. The important thing to understand with this case is that the lawsuit was not filed against Goldco. Goldco was the one filing the lawsuit to protect its reputation after another party attempted to damage it.

What the Case Was About

The lawsuit, Goldco Direct, LLC v. Warren Wilson, Wholesale Gold Silver IRA, Inc., and Wild West Coins, Inc., started when a customer, Barbara Clackum, purchased metals over a period of seventeen months and later attempted to undo all her purchases. Goldco refunded her most recent order but did not refund the older ones because too much time had passed.

Around that time, she began working with Warren Wilson. According to the court filings, Mr. Wilson misrepresented himself as a family member and used that false identity to get confidential information from former Goldco employees. He then contacted Goldco customers directly and tried to pressure the company into issuing refunds by threatening to publish negative information online.

He even set up a website called ?goldcosucks? to push the threat further and encourage customers to file complaints with state authorities.

Why Goldco Filed the Lawsuit

Goldco discovered that Mr. Wilson had:

-

Used a false identity

-

Obtained customer information illegally

-

Contacted customers in violation of federal and state laws

-

Attempted to pressure the company through a smear campaign

Goldco responded by filing a lawsuit to stop the behavior and protect their clients and their brand.

What the Court Did

During the case:

-

The court confirmed the false identity

-

Mr. Wilson was added as the main defendant

-

The customer, Barbara Clackum, was removed from the case

-

Mr. Wilson?s attempts to move the case or escape responsibility were denied

-

The court issued an injunction blocking further contact with Goldco customers

-

The court later granted a permanent injunction

Goldco ultimately won the case and was awarded damages.

What You Can Learn From This

This lawsuit highlights a few important lessons for anyone buying physical precious metals:

-

There are real transaction costs involved when buying and selling metals

-

Precious metals can go down in value after a purchase

-

Companies are not required to repurchase metals unless the customer agreement says so

-

Refund windows are very short, usually three to eight days depending on the state

-

Trying to force a refund through illegal means only creates bigger problems

Why This Does Not Reflect Poorly on Goldco

This case did not expose wrongdoing by Goldco.

It showed the opposite.

Goldco followed the contract, processed what they were obligated to process, and defended themselves when someone tried to use false identities and illegal methods to damage their reputation. Courts looked at the facts, agreed with Goldco, and ruled in their favor.

The lawsuit shows how Goldco handled a messy situation by staying inside the law, protecting their customers, and defending their reputation the right way.

Is Goldco Legit?

When people ask me if Goldco is legit, I always go back to what I saw when I personally called them. They answered every question clearly, they did not rush me, and they gave straight explanations about fees and storage. A scam company cannot behave like that for almost twenty years.

Here is the quick proof:

Why Goldco Is Legit

-

In business since the mid two thousands

-

A plus rating on the Better Business Bureau

-

Thousands of public reviews across multiple platforms

-

Uses IRS approved custodians and vaults

-

Does not hold metals themselves, everything is third party and insured

-

Clear buyback program that I tested myself

-

Calm, patient phone experience

If a company survives this long in the gold world, with this many public reviews, they are not guessing. They know what they are doing.

Who Goldco Is Best For

Choose Goldco if:

- ? You are rolling over $25,000 or more

- ? You want a company with great support

- ? You want clean, calm, no-pressure conversations

- ? You value strong reviews and reputation

- ? You care about liquidity and a reliable buyback

- ? You want hands-on help with paperwork

If you see yourself in that list, this is the cleanest way to start:

Talk to a Goldco Specialist About Your Rollover

Who Should Look Elsewhere

Look at another provider if:

-

You have less than $25k to deposit

-

You want the absolute lowest markup

-

You dislike speaking with reps and prefer everything online

Goldco vs Competitors

When people ask me if Goldco is ?the best,? I always answer the same way, it depends who you compare them to and what you need. I have spoken with Goldco, Augusta, American Hartford Gold, and Birch, and each one has its own personality, strengths, and blind spots. Instead of giving you a vague ranking, here is the simple version, side by side, so you can see where Goldco stands next to the other big names and which type of clients each company really fits.

Goldco vs Augusta Precious Metals

| Factor | Winner |

|---|---|

| Minimum | Goldco |

| Education | Augusta |

| No pressure | Tie |

| Support | Augusta |

| Best for <50k? | Goldco |

Same industry, very different sweet spots

Both companies are serious players, both are well regarded, both have long histories and strong ratings.

The real question is not ?which one is best? but ?which one fits the way you protect your retirement.?

Quick Snapshot, Side by Side

| Factor | Goldco | Augusta Precious Metals |

|---|---|---|

| Founded | Over a decade ago | Around 2012 |

| Main focus | Gold and silver IRAs, plus direct delivery | Gold and silver IRAs, plus direct delivery |

| Typical client size | Mid sized rollovers, around twenty five to two hundred fifty thousand | Larger rollovers, often one hundred thousand and above |

| IRA minimum | About twenty five thousand | Fifty thousand |

| Metals offered | Gold, silver, platinum and palladium | Gold and silver only |

| Fees first year | Around two hundred seventy-five (Third Party Storage Partners fees) | Around two hundred seventy five |

| Ongoing yearly fees | Around two hundred twenty five | Around two hundred twenty five |

| Storage options | Delaware Depository, Brink?s | Delaware Depository, IDS Dallas |

| Reviews and ratings | A plus BBB, strong Trustpilot and Google scores, thousands of reviews | A plus BBB, AAA BCA, thousands of reviews, very clean complaint record |

| Big strengths | Moderate minimum, strong support, clear rollover help, free silver promo | Education, white glove support, very clean reputation, strong buyback culture |

| Main trade off | Premiums on coins can be high if you are not careful | High minimum, you need serious capital to get in |

Who Each Company Is Really Built For

Goldco fits best if

-

You have around twenty five to fifty thousand or more to move into metals, not a million

-

You want a team that handles rollovers from 401k, TSP, 403b and IRAs without you chasing paperwork

-

You like the idea of a free silver bonus when you are already planning a larger deposit

-

You care a lot about having a steady, reachable account rep you can call when you are unsure

Augusta fits best if

-

You are moving fifty thousand to a million or more and want a white glove, slow paced experience

-

You are close to or in retirement and want one serious metals allocation, not a small experiment

-

You value education first and like the idea of webinars, one on one sessions, and careful teaching

-

You want a firm that has built its name on transparency, no drama, and almost no public complaints

If you lean toward Goldco after seeing the differences, you can start your application here:

Start With Goldco

Goldco vs American Hartford Gold

| Factor | Winner |

|---|---|

| Minimum | AHG |

| Buyback | Goldco |

| Transparency | Tie |

| Reputation | Goldco |

Quick Comparison Table

| Factor | Goldco | American Hartford Gold |

|---|---|---|

| Founded | 2006 | 2015 |

| Minimum for IRA | $25,000 | $10,000 |

| Direct purchase minimum | N/A | $5,000 |

| Fees (typical) | ~$275 first year, then ~$225 | ~$180?$280 depending on balance & storage |

| Storage partners | Delaware & Brink?s | Delaware, Brink?s, IDS (more locations) |

| Product range | Gold & silver | Gold & silver (minimal platinum, no palladium) |

| Unique product | Free silver bonuses | Valcambi CombiBar |

| Fee waivers | None | Up to 3 years waived (on big deposits) |

| Support reputation | Dedicated rep, praised by Money.com | 24/7 support, very strong reviews |

| Marketing style | Education-heavy + celebrity endorsements | Strong celebrity partnerships + conservative media presence |

| Buyback reputation | Strong program | Easy, no liquidation fees |

| Best for | $25k?$250k conservative clients | $10k?$100k customers wanting accessibility |

American Hartford Gold full review

Which One Fits You Better

Goldco fits best if

-

You already have around twenty five thousand or more sitting in an old IRA or 401k

-

You want one steady person handling your file, same voice every time you call

-

You like someone walking you through the steps slowly, no rush

-

You prefer long history, older company, more battle tested

-

You plan to roll fifty thousand or more and want that extra silver on top

-

You want the ?private banker? feeling, not a big call center vibe

American Hartford Gold fits best if

-

You want to start smaller, something like ten thousand or even five thousand direct buy

-

You want fees as light as possible, maybe even waived for a year or more

-

You just want simple bullion without anyone pushing fancy coins

-

You like calling at odd hours, early morning or weekend, and still reach someone

-

You want a company that feels more flexible on small orders and new customers

-

You want an easier entry point before committing big money

If Goldco feels closer to your style after this comparison, here is their official page:

Visit Goldco?s Official Site

Goldco vs Birch Gold Group

But they fit two different types of people.Here is the quick comparison.

Goldco vs Birch Gold (Quick Table)

| Factor | Winner |

|---|---|

| Product variety | Birch |

| Customer support | Goldco |

| Minimum to start | Birch |

| Premium coins | Birch |

| Buyback program | Goldco |

| Education | Tie |

| Best for beginners | Goldco |

| Best for collectors | Birch |

Who Goldco Fits Best

- You want someone to hold your hand step by step

- You want a steady voice on the phone, same rep every time

- You hate pressure and want slow, clear explanations

- You don?t want to deal with platinum, palladium, rare coins, or complicated lists

- You like clean, simple bullion for retirement

- You care more about service than coin variety

- You want a smooth rollover from your old 401k or IRA

- You want that free silver bonus when you deposit a bigger amount

- You prefer a company with a long track record and very few complaints

Who Birch Gold Fits Best

- You want the biggest metal selection possible

- You like gold, silver, platinum, and palladium all under one roof

- You enjoy looking at premium coins, limited series, collectibles

- You want a lower minimum to start

- You want more options for storage locations

- You don?t mind calling for prices instead of checking online

- You like a company that talks heavy on education and market updates

- You want someone who will walk you through the IRA, but also let you browse many products

- You enjoy picking special coins that might grow more than basic bullion

Goldco is the steady, patient, simple choice.

Birch is the big variety shop with lots of metals and collectible options.If your goal is clean retirement gold, Goldco wins.

If your goal is variety and premium products, Birch wins.

Goldco Review Pros & Cons?

| Pros | Cons |

|---|---|

| Very calm and patient phone support | Minimum is higher than some competitors |

| Clear explanations about fees and the process | Not the cheapest premiums in the industry |

| Strong buyback program that feels reliable | You must speak with a rep, not a fully online process |

| Thousands of positive reviews across platforms | ? |

| Smooth rollover handling | ? |

| Good selection of IRA approved metals | ? |

| Works well for people with 25k to 250k rollovers | ? |

| Organized, steady process, no pressure | ? |

Goldco Review: FAQs

Is Goldco a scam or legit?

Goldco is legit with almost two decades in business and top ratings across review platforms, they are one of the most established names in the space.

Does Goldco store metals themselves?

No. Your metals are stored in IRS-approved vaults.

Can I store metals at home?

Not for an IRA.

Direct purchases can be shipped to you.

How does Goldco make money?

Through metal premiums, admin fees, and storage fees.

Is the buyback trustworthy?

From my own testing, yes. They honor it.

Final Verdict: Is Goldco Worth It?

Here is my honest conclusion after years of testing gold IRA companies:

Goldco is one of the safest, clearest, most reliable companies for people rolling over mid to large retirement accounts.

Not perfect.

Not the cheapest.

But genuinely trustworthy, calm, patient, and transparent.

If you want a partner who actually picks up the phone, explains things clearly, and gives you peace of mind with a real buyback guarantee, Goldco is a strong choice.

If you are ready to explore it for yourself, the first step is simple:

Request Your Goldco Gold IRA Kit and Speak With a Specialist