With gold prices hitting new highs, countless investors are turning to online dealers like JM Bullion, but not all that glitters is gold. Some firms are trusted giants; others have left buyers empty-handed.

Let’s find out which side JM Bullion stands on

Welcome to this JM Bullion review, freshly updated for November 2025.

Whether you’re diving into the wonderful world of precious metals for the first time or are a seasoned pro, unless you’ve been living under a rock, the name “JM Bullion” probably rings a bell.

(Hopefully they’re “silver bells” – this is Christmas season, after all.)

Unfortunately, it’s no simple matter for even the most seasoned individuals to discern whether a gold dealer is legit or not until you’ve cut the check, and by then, it’s usually far, far too late to change your mind.

So, today, we’ll be taking a gander at JM Bullion to see how they “stack up” for you silver stackers out there. Is JM Bullion legit? Or are they just thieving scammers in disguise?

Asking questions like this is extremely important. After all, getting into physical gold and silver is no cake walk. It’s important that you do your own due diligence before you risk handing over your hard-earned greenbacks to a dodgy back-alley dealer.

Hopefully, this review of JM Bullion will help you get a better feel for their business practices. Do you want to have regrets? Well, that’s precisely why we’ve put together the following JM Bullion review for you. Now grab a cup of joe, have a read, and let’s get down to brass tacks…

- JM Bullion Review Quick Summary

- Key Takeaways/Executive Summary

- What is JM Bullion?

- Does JM Bullion Offer Custodial Services??

- JM Bullion Fees & Costs (2025)

- Frequently Asked Questions About JM Bullion

- Who Should Consider JM Bullion??

- JM Bullion Pros & Cons

- JM Bullion Vs. Other Leading Gold IRA Firms/Dealers

- Is JM Bullion legit? The Good, The Bad, and the Ugly

- Final JM Bullion Review

JM Bullion Review Quick Summary

- Company name:?JM Bullion

- Website: www.jmbullion.com

- Founders:?Mike Whittmeyer, Jonathan Wanchalk

- Price: Varies depending on your purchases

- Trustpilot Star Rating: 4.1 out of 5

Key Takeaways/Executive Summary

- Fees vary depending on your chosen custodian and depository, but most investors can expect roughly $150?$300 per year in storage and administration costs, plus dealer premiums of 1%?5% above spot price.

- JM Bullion offers free shipping on orders over $199, accepts Bitcoin and traditional payment methods, and provides transparent, real-time spot pricing on its website.

- The company maintains an A+ rating with the Better Business Bureau (BBB) and strong reviews on Trustpilot (41.6/5), though some clients report delayed shipments and communication issues during high-demand periods.

- JM Bullion?s recommended IRA custodian, New Direction Trust Company, is currently facing class-action litigation alleging negligence related to missing metals at an affiliated depository (First State Depository). Investors should perform independent due diligence before selecting any custodian or vault.

- Best for: Experienced investors who prefer a self-directed, low-cost, transparent buying experience and are comfortable managing their own custodian relationship.

Not ideal for: First-time investors seeking white-glove IRA setup assistance, bundled service, or personalized portfolio guidance, firms like Augusta Precious Metals or Goldco may be better suited.

What is JM Bullion?

Founded in 2011 in Lancaster, Pennsylvania, JM Bullion quickly grew from a small e-commerce startup in a basement into one of the nation?s leading online precious-metals dealers.

In 2021, the company was acquired by?A-Mark Precious Metals, a leading wholesale bullion distributor to large retailers and customers around the globe.

Since its founding, JM Bullion has shipped billions of dollars? worth of gold, silver, platinum, and palladium to investors across the United States.

Today, the company ships over 60,000 orders every month.?

They also handle precious metals storage and vault service, insurance, and for those of you who intend to own precious metals in your personal accounts as opposed to your retirement accounts, they also handle delivery of the physical metal.

In this 2025 review, we?ll take a fresh, detailed look at JM Bullion?s history, fees, IRA services, reputation, and customer experience, and compare it to other major players in the Gold IRA market.

If you?re thinking about adding physical metals to your retirement portfolio, this guide will help you decide whether JM Bullion is the right partner for your investment goals.

The company was ranked #96 on the Internet Retailer Top 500 Guide to Online Retailers.

They were also named as the #1 fastest-growing precious metals company in the nation in 2017 by Inc. 5000, as well as ranking #5 in the top 500 list of the 2019 Primary Merchandise category.

Today, JM Bullion ranks as one of the largest precious metals retailers in the world, with what they claim to be over 60,000 orders per month.

Where is JM Bullion Located?

JM Bullion does not maintain a brick-and-mortar retail location. All business is done with clients online and over the telephone.?

While they were originally based in Lancaster, Pennsylvania, they moved their headquarters to? Dallas, Texas, in 2014 to take advantage of a deeper talent pool and a more favorable business environment.

How Does JM Bullion Work?

You can buy Gold, Silver, Platinum, Palladium, Copper, and other precious metals from JM Bullion in the form of coins and bars. They have a great variety of products – primarily bullion coins, bars, and rounds.?

As for shipping, unfortunately, JM Bullion doesn?t guarantee the number of days needed to ship your order. The company says that it will ultimately depend on the carrier. They do, however, state that the majority of orders are shipped within one business day after a customer?s payment has cleared.

JM Bullion Products

JM Bullion has quite a vast array of precious metals products. Silver eagles, Austrian philharmonics, and almost everything in between.

As for the prices and fees, they are fairly transparent.

Here is a summary of their products and services:

- Gold Products: JM Bullion has one of the broadest selections of gold bullion bars and coins on the market. They?ve got American Gold Eagles, Canadian Maple Leafs, British Gold Coins, Australian Gold Coins, and Austrian Gold Philharmonics, among others.

- Silver Products: The company also has an extensive selection of Silver products. These include American Silver Eagles, Canadian Silver Maple Leafs, British Silver Coins, St. Helena Silver Coins, and Austrian Silver Philharmonics.

- Platinum and Palladium: For those interested in Platinum and Palladium, JM Bullion offers American Platinum Coins, British Platinum Coins, Canadian Platinum Coins, Austrian Platinum Philharmonics, and Palladium Bars and Coins, among others.

- Copper Products: JM Bullion offers a variety of copper bullion products, including bars, rounds, and pennies. and more. These are available in different sizes and weights.

- Numismatic and Collectible Coins: JM Bullion has quite a range of collectible coins. They have limited-edition coins(for example no-date Sacagawea Dollar coins), proof coins, colorized coins, gilded coins, error coins, minted sets, and even commemorative issues.

NOTE: Numismatics and collectibles are not generally eligible for IRAs and other self-directed retirement accounts. If you are buying for your IRA, you should limit your purchase to approved bullion.

Precious Metals Accessories: JM Bullion also sells a variety of accessories for storing and protecting your precious metals. They have coin capsules, coin tubes, coin boxes, coin safes, and even gift certificates.

JM Bullion Services

One reason why JM Bullion continues to be a leading precious metals dealer in the market is that they?ve got a wide range of services for their customers.

- Storage and insurance: They offer both physical and online storage. JM Bullion has their own secure vaults and third-party storage facilities. They also have a variety of insurance plans for them.

- Education and research: They have a blog, an educational center, and a research team that provides up-to-date information on the precious metals market. These resources include articles, videos, and webinars.

However, JM Bullion?s research and educational library is not as extensive as some other gold IRA firms that market themselves more to beginners.

This is not a factor for more experienced investors. But novices who need a bit more handholding may find more support with other firms.? - IRAs: Although JM Bullion does not have a direct IRA service, they can help you open and fund a physical precious metals IRA.

- They partner and work with New Direction IRA (more about them in a minute), which offers a variety of IRA products, including self-directed IRAs and trustee IRAs.?

- Loans: Through a partnership with Collateral Finance Corporation (CFC), JM Bullion now offers loans. Customers can use their existing bullion as collateral to borrow against their precious metals.

Important: If you own precious metals within an IRA or other tax-advantaged account, you may not personally borrow against your assets within that account for use outside your IRA. Doing so would violate rules against self-dealing and cause your IRA to be disqualified, triggering immediate tax liability and significant penalties.

JM Bullion also offers 24/7 customer service. Their customer service team is knowledgeable and helpful, and they are always willing to answer any questions that customers may have.

JM Bullion Payment Options

JM Bullion accepts the following payment methods:

- Visa

- American Express

- Discover

- MasterCard

- PayPal

- PayPal Credit

- Bank wires

- ACH

- Paper checks

- Bitcoin (if you are into that sort of thing.)

There are no order minimums for orders paid through credit/debit cards, PayPal, Bitcoin, Paper checks, or ACH. For bank wires, however, a minimum order amount of $2,500 is required.

Does JM Bullion Offer Custodial Services??

No. If you open an account with JM Bullion, the actual custodian is New Direction IRA (AKA the New Direction Trust Company).?

This means while JM Bullion handles your bullion purchase, the actual IRA account, title-holding, and regulatory reporting are handled by New Direction, not JM Bullion.

However, New Direction has had a number of legal issues in recent years: In late 2023, a class-action lawsuit was filed against New Direction alleging that it steered precious-metals IRA clients into a depository (First State Depository, LLC) that subsequently lost or misappropriated tens of millions of dollars in client metals.)

In Theriault et al. v. New Direction IRA, Inc., et al., Case No. 2:23-cv-02477 (D. Kan., filed Oct 30 2023), plaintiffs allege that:

- New Direction steered self-directed IRA clients toward First State Depository LLC (FSD) for storage of precious-metals IRAs.

- FSD was later accused by the Commodity Futures Trading Commission (CFTC) of misappropriating more than $110 million in customer metals.

- Roughly 90 % of the missing metals were held in self-directed IRAs, and over half of those accounts were reportedly administered by New Direction.

- The complaint claims New Direction failed to disclose the closeness of its business relationship with FSD, misrepresented insurance coverage, and did not adequately monitor or safeguard clients? assets.

(Sources: CFTC v. First State Depository, LLC, No. 1:23-cv-00997 (D. Del..), ClassAction.org coverage, Dockets.Justia listing)

As of November 2025, litigation is ongoing; no final judgment has been reached. New Direction denies any wrongdoing, but the case highlights why investors must vet custodians and depositories as carefully as they vet dealers.

Before investing your money with JM Bullion or any other precious metals dealer or custodian, you should conduct thorough due diligence.?

For example, you should get answers to questions like these:

- Which depository will hold my metals?

- Are my holdings held in segregated or pooled storage?

- What insurance is in place, and is it independently verified?

- What are my ongoing monthly and annual fees for storage, insurance, and custodial services?

JM Bullion Fees & Costs (2025)

| Fee Type | Who Charges It | Typical Amount / Range | Notes & Details |

| Account Setup Fee | IRA Custodian (e.g., New Direction Trust Co.) | $50 ? $100 (one-time) | Charged when establishing a new self-directed precious-metals IRA. JM Bullion itself does not charge this fee. |

| Annual Maintenance Fee | IRA Custodian | $75 ? $250 per year | Covers account administration, IRS reporting, and recordkeeping. Varies by custodian and account size. |

| Storage Fee | Depository (via custodian) | 0.5 % ? 1.0 % of asset value per year (? $100 ? $300 typical) | Paid to the approved depository, such as Brink?s Global Services or IDS of Texas. Segregated storage may cost slightly more than pooled. |

| Purchase Premiums / Markups | JM Bullion | ~1 % ? 5 % above spot price (varies by product) | JM Bullion lists live spot pricing and transparent premiums on each product page. Larger orders may qualify for volume discounts. |

| Shipping & Insurance | JM Bullion | Free on orders ? $199; ~$7 ? $15 otherwise | Applies to non-IRA (direct-delivery) orders only. IRA purchases ship directly to depositories under JM Bullion?s insurance. |

| Buy-Back / Liquidation | JM Bullion | Based on the current market bid, typically within 1 % ? 3 % of spot | JM Bullion offers a buy-back program for metals originally purchased through them. Contact support for quotes before selling. |

| Wire / Transaction Fees | Custodian or Bank | ~$25 per outgoing wire | May apply when transferring funds or liquidating IRA metals. |

| Crypto Payment Fee (Optional) | JM Bullion / BitPay | ~1 % processing | Only applies if you choose to pay via Bitcoin or other accepted cryptocurrency. |

Fees and costs are based on the best information available as of November 2025. However, all fees are subject to change. You should verify all fees and charges with JM Bullion before sending money or opening an account.

Frequently Asked Questions About JM Bullion

Does JM Bullion Have Buybacks?

Yes, JM Bullion offers buybacks. You can sell your gold and silver bullion to JM Bullion for cash. As for the price, it will be determined by the current market price of the precious metal itself as these fluctuate over time.

You can easily do this by calling JM Bullion?s customer service.

While JM Bullion is generally competitive, it’s a good idea to shop around to see who is offering the best price for your gold and precious metals. If you aren?t in a rush to make a deal, you may be able to get a better price from a retail buyer like yourself rather than from a dealer.?

Are JM Bullion Deliveries Insured?

Yes, JM Bullion deliveries are insured. The company ships all orders with full insurance coverage. You won?t need to worry if your order is lost or damaged in transit because you will be reimbursed for the full value of your purchase.

They ship via UPS, FedEx, USPS, and many others. The specific shipping method used will depend on the size and weight of your order, as well as your shipping destination.

All JM Bullion orders are shipped with a signature required.?

This means that the package will not be delivered without a signature from the recipient. This helps to prevent theft after shipping. No more ?porch pirates? with sticky fingers trying to make off like bandits with your stack

Is JM Bullion A Scam?

No, this company is legit. They have come a long way since their start in 2011. They have built a strong reputation in the precious metals industry with their continuous excellent services, which is certainly a reason why they have garnered multiple awards.

Whether they are best for you and your personal needs, however, is a completely different story. Read some of the reviews below to get a feel for how they really do business.

JM Bullion Ratings (Updated November 2025)

BBB Rating

JM Bullion has been accredited with the BBB since 2014. As of November 2025, they have an A+ rating, sporting 4.61 stars out of five, across 411 customer reviews.?

They get their share of complaints – largely over shipping delays and fulfillment issues. The BBB lists 35 resolved complaints in the last 12 months, as of November 2025.?

Consumer Affairs Rating

As of November 2025, JM Bullion Consumer posts a strong 4.3 stars out of 5, according to reviewers on ConsumerAffairs.com.

The vast majority of the reviews are 5 stars, with another 45 currently weighing in at four stars.

135 customers have responded with 1-star reviews. However, the company generally responds quickly to customer complaints on this site.

Trustpilot Rating

JM Bullion?s Trustpilot rating has unfortunately dropped as of the time of this writing, falling from 4.5 out of 5 in October 2022, to 4.3 stars as of November 2023, to 4.1? out of 5 stars?the latest based on 1700 total reviews as of November 2025.

JM Bullion Reviews and Complaints

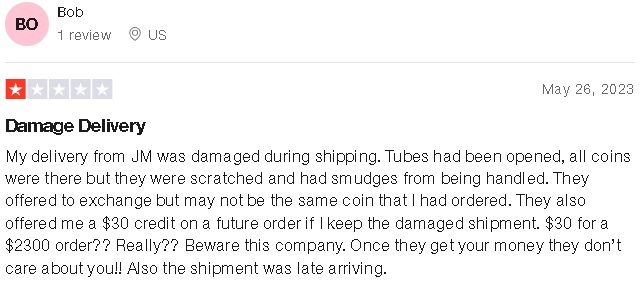

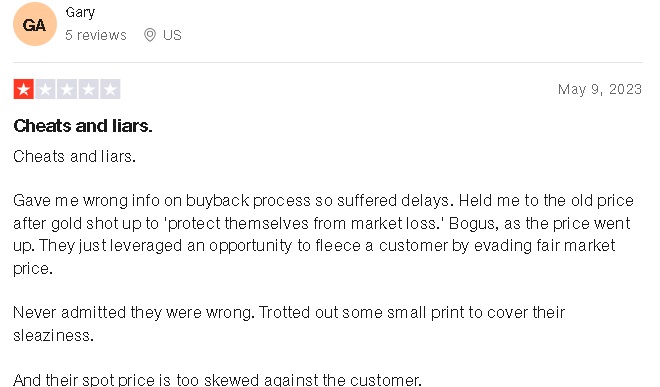

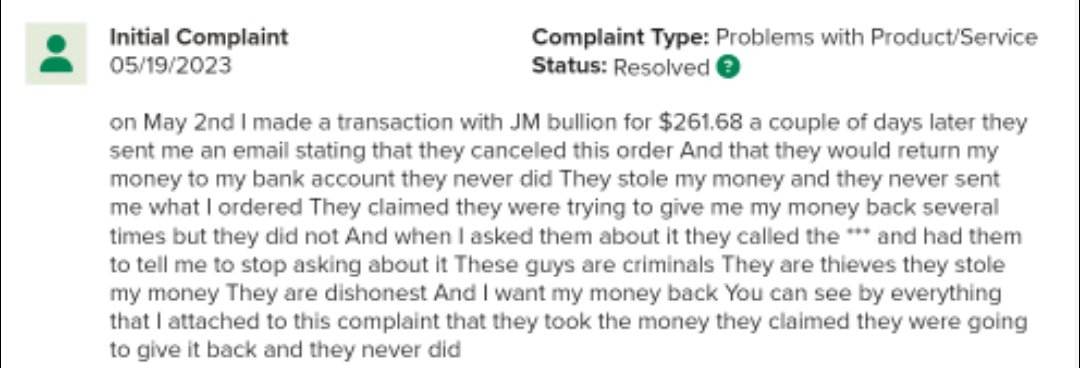

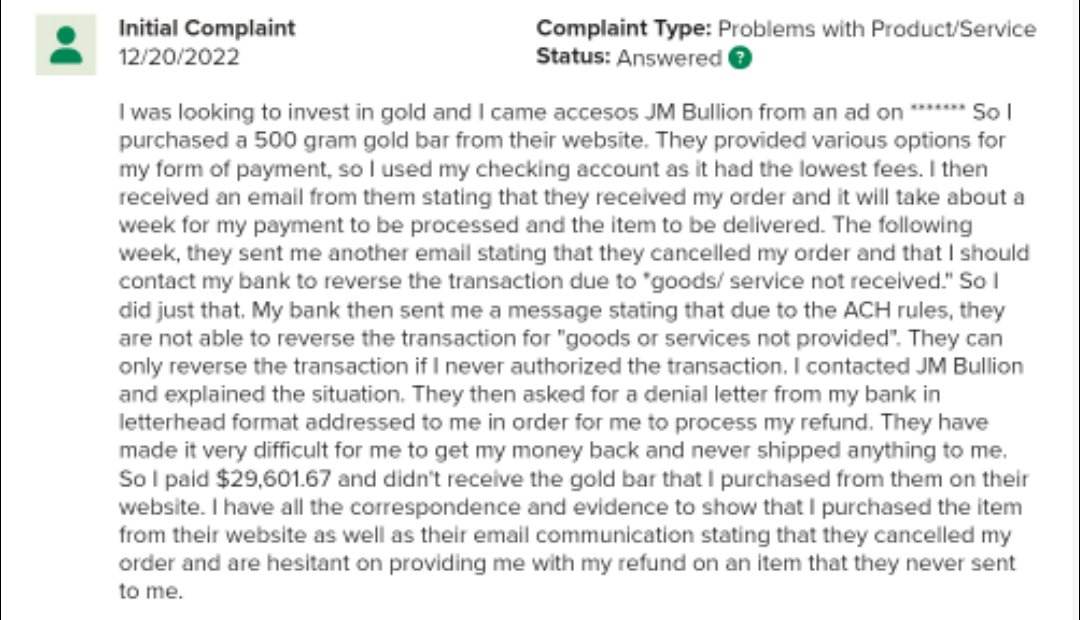

Although JM Bullion seems to have relatively decent ratings (with the exception of Consumer Affairs), there does appear to be more than a couple of complaints. Some of them are quite disturbing, to the point that you actually might want to reconsider buying from JM Bullion. Don’t take my word for it, just have a look at the following complaints from different customers below:

As you can see, the reviews and complaints have been about the products and services. It seems to be a pretty common happening that the packaging is compromised and that JM Bullion takes too long to respond to the concerns of the customer. As they say in the deep South, “Ain’t nobody got time for that!”

Does JM Bullion Sell Fake Gold?

JM Bullion is definitely not a scam. It is a legit precious metal dealer that has been operating since 2011. However, the complaints filed against the company with the BBB can leave one feeling a bit on edge, to say the least.

The company was investigated by the Better Business Bureau (BBB) after several customers complained that

A) They had not received their orders

or

B) that the orders they received were not as advertised, or worse, counterfeit!

In 2016, a customer even sued JM Bullion for selling him… Wait for it…?counterfeit silver bars (!!). That same customer was a regular buyer of the company for several years and had never had any problems before. He said that he was “shocked” to discover that the bars he had bought were counterfeit. Was it on purpose? Only you can answer that, go with your gut…

Large sums of money are being spent on their products, and when customers don’t receive the exact items they ordered by the promised date, it can definitely make prospective clients feel more than uneasy.

Sure, it seems like they’ve tried to resolve each issue posted on BBB and other review sites, but if you don’t want any surprises or problems, it’s probably best to aim for a company with no serious complaints to begin with.

How is JM Bullion?s Customer Support?

A company’s customer service can speak volumes about the professionalism of its management. No business is perfect, but oftentimes, customer support says a great deal about how the company operates. As for JM Bullion, numerous users have complained about the lack of professionalism and accountability from the company. They do have an email address and a phone number for clients to contact, but apparently, that isn’t always enough to guarantee great customer service in the eyes of some customers. This contrasts greatly with top gold IRA companies, which get positive customer service reviews time and again. Nevertheless, JM Bullion seems to be trying to resolve some complaints shown on the BBB website.

However, there were multiple clients suggesting that JM Bullion reps only give them “the runaround” when they complain about their orders. This probably isn’t exactly what you would call “good” customer service.

Who Should Consider JM Bullion??

JM Bullion is best suited for experienced, self-directed investors who want to buy precious metals with minimal markup and handle most of the IRA setup process themselves.

If you already understand how self-directed IRAs work?or if you?re comfortable coordinating with your own custodian, JM Bullion offers an efficient, transparent way to purchase IRA-approved gold, silver, platinum, and palladium at competitive prices.

Because JM Bullion operates primarily as a dealer rather than a full-service IRA company, it?s an ideal choice for investors who:

- Prefer to choose their own custodian or depository rather than rely on a single bundled provider.

- Want direct access to live spot pricing and a wide selection of coins and bars.

- Value low premiums, fast shipping, and a user-friendly e-commerce experience.

- Are comfortable doing basic due diligence on custodians and storage partners.

However, new investors who want a white-glove, concierge experience, rollover assistance, or educational guidance on building a diversified precious-metals portfolio may find a more supportive fit with providers such as Augusta Precious Metals or Goldco.

Choose JM Bullion if you?re a confident, price-focused investor who values flexibility and control over your IRA metals purchases.

JM Bullion Management

The company JM Bullion was founded by Michael Wittmeyer and Jonathan Wanchalk. These two friends shared a passion for precious metals and ultimately brought their interests to open this business.

The following is a list of “who’s who” on the executive team that is behind JM Bullion’s success:

- Michael Wittmeyer – CEO

- Jonathan Wanchalk – President

- Aloysius “Al” Lee – VP, Digital & Technology

- Tom Fougerousse – Operations Executive

- Rob Milstead – Chief Financial Officer

- Kevin R. Mitchell – InfoSec Manager

The team comprises traders, precious metals analysts, software engineers, and financial analysts, all working together to maintain the quality of JM Bullion’s business.

JM Bullion Pros & Cons

| Pros | Cons |

| ? BBB Accredited ? Holds an A+ rating and has been accredited since 2014, signaling strong consumer-protection standards. | ?? Client Complaints ? Some customers report delayed shipments, refund issues, or slow responses during high-volume periods. |

| ? Wide Array of Products ? Offers hundreds of gold, silver, platinum, and palladium coins and bars, including IRA-eligible options. | ?? No Direct IRA Service ? JM Bullion is a dealer only; IRA setup and administration must go through a third-party custodian. |

| ? Free Shipping Offer ? Orders over $199 ship free and are fully insured. | ?? Not a U.S. Mint-Authorized Dealer ? Although reputable, JM Bullion is not officially listed as an authorized purchaser of U.S. Mint bullion coins. |

| ? Accepts Bitcoin Payments ? Among the few major bullion dealers to accept cryptocurrency for purchases. | ?? Past Fraud Allegations ? Has faced isolated incidents of fraudulent orders and identity-theft attempts (primarily by external bad actors), though JM Bullion itself was not criminally charged. |

| ? Secure Shopping Experience ? Uses advanced encryption, two-factor authentication for accounts, and insured shipping. | |

| ? Competitive Prices ? Real-time spot-price tracking and narrow dealer premiums make it appealing for cost-sensitive buyers. |

JM Bullion Vs. Other Leading Gold IRA Firms/Dealers

| Feature / Company | JM Bullion | Augusta Precious Metals | Goldco | Birch Gold Group |

| BBB Rating (2025) | A+ | A+ | A+ | A+ |

| Minimum IRA Investment | Varies (by custodian) $0 dealer minimum | $50,000? | $25,000? | $10,000? |

| IRA Custodian | New Direction Trust Co. (recommended) | Equity Trust Co. | Equity Trust Co. or Self-Directed | Equity Trust Co. or STRATA Trust |

| Storage Options | Brink?s, IDS of Texas (3rd-party) | Delaware Depository or Brink?s | Delaware Depository or Brink?s | Delaware Depository or Brink?s |

| Fees | Varies by custodian (~$100?$250 annual) | Flat $250 annual (approx.) | ~$175 annual avg. | ~$180?$200 annual |

| Buy-Back Program | Yes | Yes ? guaranteed | Yes ? guaranteed | Yes ? guaranteed |

| Education Resources | Basic guides + spot charts | Strong videos + Harvard Economist materials | Free wealth protection kit | Free IRA investor guide |

| Best For | DIY investors who want low premiums | Hands-on learners seeking white-glove service | Rollover clients seeking simplicity | Value-oriented beginners or small investors |

JM Bullion Against Other Platforms

It is highly recommended that you do your own due diligence before trusting your hard-earned cash to any precious metals company.

While perfect companies rarely exist, doing thorough research can lead you to a company that is reputable and will best suit your needs. Take the time to search for reviews and complaints, especially from 3rd party review sites.

Compare the offerings of each company and their ratings to make a smart decision. The following is how JM Bullion fares against major competitors like Money Metals Exchange, Acre Gold, and SD Bullion.

|

|

4.3/5 |

|

Products Gold, platinum, silver, copper, ?palladium |

|

Services Buying, selling, storage, and loans |

|

Shipping Free shipping on orders over $199. Shipping is $7.99 for orders under $199. |

|

|

4.4/5 |

|

Products Gold, Palladium, silver, platinum, and rhodium |

|

Services Buying, selling, storage, and loans |

|

Shipping Free shipping for orders over $500. $7.97 shipping for orders under $500. |

|

|

4.0/5 |

|

Products Gold monthly subscriptions range from $250 |

|

Services Selling and storage |

|

Shipping Free shipping for orders over $299. $9.95 shipping for orders under $299. |

|

|

4.2/5 |

|

Products Gold, platinum, silver, copper, and palladium |

|

Services Buying, selling, and storage |

|

Shipping Free shipping for orders over $199. $9.95 shipping for orders under $199. |

Is JM Bullion legit? The Good, The Bad, and the Ugly

The bottom line: JM Bullion is definitely a legitimate gold, silver, and precious metals dealer.

They have a long track record, and they can definitely help you successfully execute a gold IRA rollover.

That said, the company has had some fulfillment and customer service challenges in recent months. They?ve experienced a slight deterioration in their online reputation on multiple review sites. And a few customers have left no doubt about their displeasure.?

?It?s important that you do your own due diligence before you hand over your money.

Final JM Bullion Review

No precious metals company is perfect. Each one of them offers a different way of doing things. The goal is to find one that adheres to your standards and offers the exact services that you?re looking for.

Or you can do yourself a favor by checking out the best gold dealers that can actually be recommended after reviewing over 200 gold companies?