Bitcoin surged over 150% in 2024, but most retirement savers are missing out as they remain invested in stocks even as crypto gains momentum. What if you could protect your Bitcoin gains tax free for retirement?

We compare top providers such as BitIRA and iTrustCapital against volatile gold IRAs, highlighting their main advantages, associated risks, and a simple step-by-step guide to set one up. Get the edge you need before the next bull run.

Key Takeaways:

- Bitcoin IRA leaders like BitcoinIRA excel in security, while Directed IRA offers low fees; they enable tax advantaged crypto retirement investing unlike Traditional IRAs.

- Bitcoin IRAs outperform Gold IRAs in growth potential but face higher volatility; gold provides stability as a hedge against inflation.

- Choose Bitcoin IRA companies by prioritizing security, fees, and crypto options; weigh risks like market swings against gold’s lower volatility for diversified retirement.

- What Is a Bitcoin IRA?

- What Are the Best Bitcoin IRA Companies in 2026?

- How Do Bitcoin IRAs Compare to Gold IRAs?

- Bitcoin vs Gold Ownership in America (2026)

- What Are the Benefits of a Bitcoin IRA for Retirement?

- What Are the Risks of Investing in a Bitcoin IRA?

- How to Choose the Best Bitcoin IRA Company?

- How to Set Up a Bitcoin IRA?

- Frequently Asked Questions

What Is a Bitcoin IRA?

A Bitcoin IRA is a self-directed IRA that enables investors to hold Bitcoin and other cryptocurrencies as retirement assets within a tax advantaged structure, differing from Traditional IRA and Roth IRA by allowing alternative investments like crypto instead of just stocks and bonds.

This specialized account offers tax-deferred or tax-free growth on crypto gains, with options for institutional custody or self-custody setups using cold storage solutions.

Approved by the IRS, a Bitcoin IRA provides a pathway for retirement savers to diversify into digital assets like Bitcoin, potentially maximizing long-term wealth while adhering to IRA contribution limits and withdrawal rules, such as penalties before age 59½.

In a Bitcoin IRA, a custodian handles compliance and secure storage, often partnering with providers like Coinbase Custody or Fireblocks for institutional custody.

Self-custody options, such as those from Unchained IRA, allow holders to manage private keys via cold storage and multisig wallets, reducing counterparty risk. This setup integrates seamlessly with retirement planning, enabling rollovers from 401k or 403b plans into crypto holdings.

Tax advantages shine through tax-deferred growth in Traditional Bitcoin IRAs, where gains compound without annual reporting, or tax free withdrawals in Roth versions after 59½.

Investors must track basis for crypto trades within the account, using tools like CoinLedger for internal records, though distributions trigger standard IRA tax rules. Custodians ensure IRS compliance for crypto as qualified assets, blending digital innovation with proven retirement strategies.

Practical examples include funding via direct contribution limits or rollovers from TSP accounts, then allocating to Bitcoin staking rewards for yield.

Providers like iTrustCapital or Swan IRA offer trading interfaces, but always review fee schedules and minimums to align with long-term goals. This structure enables savers to hedge against inflation with crypto alongside equities.

How Does a Bitcoin IRA Differ from a Traditional IRA?

A Bitcoin IRA differs from a Traditional IRA primarily in asset allocation, allowing direct investment in Bitcoin and crypto within a self-directed framework, while Traditional IRAs focus on stocks, bonds, and mutual funds with tax deferred contributions based on your tax bracket and AGI limits. Bitcoin IRAs expand options to digital assets, precious metals like gold and silver, and private equity, fostering broader diversification.

Both share contribution limits influenced by AGI, but crypto introduces unique custody needs.

Tax implications vary subtly: Traditional IRAs deduct contributions upfront, deferring taxes until withdrawal penalty applies before 59½, while Bitcoin IRAs mirror this but require meticulous internal tax reporting for crypto trades and staking rewards.

Roth Bitcoin IRAs, like their counterparts, fund with after-tax dollars for potential tax-free growth and withdrawals. Rollovers from 401k, 403b, or TSP work identically, converting existing savings into crypto without immediate taxes.

Custodian roles highlight key contrasts, with Bitcoin IRAs relying on specialized firms like Equity Trust for secure institutional custody or self-custody via multisig and cold storage.

Traditional IRAs use standard brokers with simpler holdings, avoiding crypto’s volatility and hacking risks. Investors in Bitcoin IRAs often integrate software like TurboTax or TaxAct for distribution planning, ensuring IRS compliance amid complex crypto transactions.

For retirement planning, Bitcoin IRAs suit those seeking high-growth potential from crypto, while Traditional IRAs prioritize stability. Experts recommend assessing risk tolerance before rolling over funds, starting small with Bitcoin allocations.

This comparison underscores how self-directed accounts unlock crypto IRA benefits without sacrificing core IRA protections.

What Are the Best Bitcoin IRA Companies in 2026?

The best Bitcoin IRA companies in 2026 include iTrustCapital, Swan IRA, Unchained IRA, Equity Trust, and Fidelity, each offering specialized self-directed IRA platforms for crypto IRA investments with competitive fees, robust custodian services, and institutional custody options tailored for Bitcoin IRA and crypto IRA accounts.

These providers stand out for their fee schedule transparency and low minimum investment requirements, making tax-advantaged retirement investing accessible. For instance, users can roll over a 401k or 403b into a self-directed IRA to hold Bitcoin alongside traditional assets, avoiding tax penalties before age 59½.

Institutional custody features like cold storage and multisig wallets ensure security, while platforms support Roth or traditional IRA structures for tax-deferred or tax-free growth.

Swan IRA excels in Bitcoin-focused strategies, Unchained IRA emphasizes self-custody options, and Fidelity integrates crypto with broader retirement tools.

Comparing custodians reveals strengths in trading efficiency and support for staking rewards. Experts recommend evaluating minimum investments and fee schedules before a rollover to align with long-term crypto IRA goals, preparing portfolios for diversification beyond precious metals like gold or silver in Gold IRAs.

1. BitcoinIRA (Best Overall for Security)

BitIRA stands out as the best overall for security in a Bitcoin IRA, leveraging Coinbase Custody and Fireblocks with multisig wallets and cold storage to protect crypto assets in a self-directed retirement account.

This provider prioritizes institutional custody, using advanced protocols to safeguard holdings against hacks. Investors benefit from seamless 401k rollovers into tax-advantaged Bitcoin IRA accounts, maintaining compliance with IRS rules on contribution limits and AGI thresholds.

Cold storage solutions keep most assets offline, while multisig requires multiple approvals for transactions. For retirement savers, this setup supports tax-deferred growth, with tools for tax reporting via platforms like CoinLedger or TurboTax.

BitIRA suits those prioritizing security over variety, offering reliable custody for Bitcoin and select altcoins in Roth or traditional IRA formats. Its focus on Fireblocks technology provides peace of mind compared to less secure Gold IRA custodians handling physical silver or gold.

2. Directed IRA (Best for Low Fees)

Directed IRA excels for low fees in Bitcoin IRA setups, featuring a transparent fee schedule with minimal charges on trading and account management for cost-effective crypto IRA retirement investmenting.

Users appreciate the low-fee structure, which reduces costs on frequent trades within self-directed IRAs. This allows efficient allocation of funds from TSP or 403b rollovers into Bitcoin, maximizing tax-free compounding without high overhead.

The platform’s minimum investment requirements remain accessible, paired with straightforward account setup. It supports diverse strategies, including staking rewards, while keeping withdrawal penalties in check until age 59½.

For cost-conscious investors, Directed IRA offers clarity on fee schedules absent in some competitors. This edge proves valuable for crypto IRA portfolios seeking growth akin to, yet distinct from, tax-deferred precious metals investments in Gold IRAs.

3. Equity Trust (Best for Customization)

Equity Trust is ideal for customization in Bitcoin IRAs, offering flexible self-directed account options for tailored crypto and alternative investments like precious metals in retirement portfolios.

Clients enjoy personalized trading strategies, blending Bitcoin with other assets like gold and silver in Roth IRA or Traditional IRAs. Rollovers from existing 401k plans integrate smoothly, respecting IRS tax bracket considerations and contribution limits.

The custodian’s strengths lie in diverse investment options, from multisig setups to self-custody elements. This flexibility aids in crafting portfolios that balance crypto volatility with stable holdings, supported by efficient tax reporting.

Equity Trust appeals to advanced users customizing beyond basic Bitcoin IRA holdings. Its approach contrasts with rigid Gold IRA structures, enabling retirement savers with self-directed IRA control over digital and precious metals alike.

4. Alto IRA (Best for Crypto Variety)

Alto IRA leads in crypto variety for Bitcoin IRAs, providing access to a wide range of cryptocurrencies beyond Bitcoin for diversified retirement trading and investments, unlike Unchained IRA’s Bitcoin-focused approach.

Investors gain exposure to altcoins and staking opportunities within tax-advantaged accounts like Roth IRA or Traditional IRA, enhancing portfolio diversification. Seamless rollovers from 403b or TSP plans preserve tax-deferred status, with low minimums for entry.

The platform’s trading interface simplifies managing multiple assets, complete with custodian oversight for security similar to Swan IRA. Users avoid common pitfalls like early withdrawal penalties by adhering to 59½ rules.

Alto IRA excels for those expanding crypto IRA holdings, offering more options than Bitcoin-only providers. This variety supports sophisticated strategies, setting it apart from Gold IRAs focused solely on physical gold or silver custody.

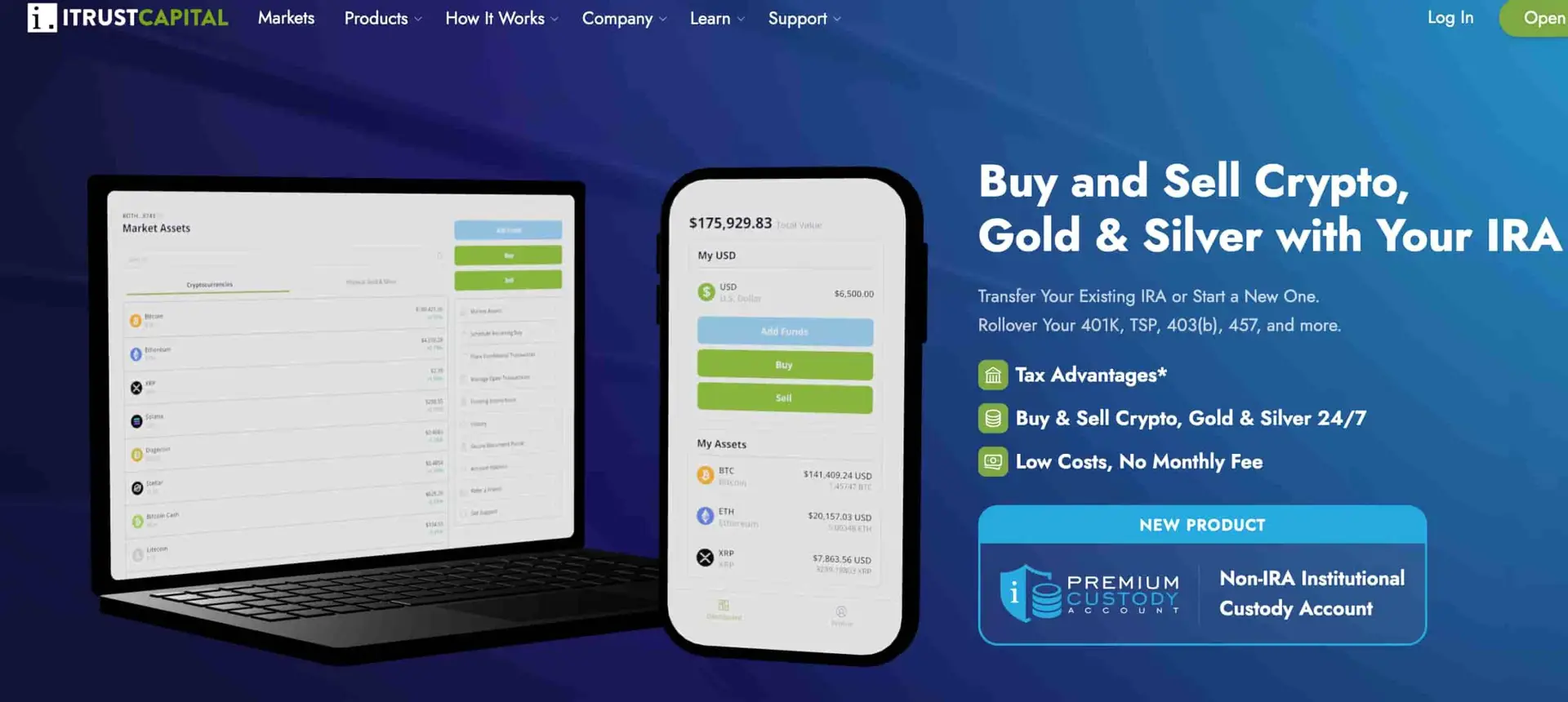

5. iTrustCapital (Best for Beginners)

iTrustCapital is the top choice for beginners in Bitcoin IRAs, with user-friendly platforms, low fees, seamless trading, and reliable custodian services for easy crypto IRA entry.

New users benefit from intuitive interfaces that guide 401k rollovers into self-directed accounts, unlike more complex platforms like Fidelity. The fee schedule remains competitive, minimizing costs while enabling tax-free growth in Roth IRAs.

Custodian support includes educational resources on cold storage and multisig, easing entry into crypto retirement investing. Integration with tax tools like TaxAct, CoinLedger, or TurboTax simplifies reporting for staking rewards or gains.

iTrustCapital demystifies Bitcoin IRA setups for novices, contrasting with complex Gold IRA processes involving physical storage or providers like BitIRA. Its beginner focus ensures confident navigation of self-custody options and IRS compliance.

How Do Bitcoin IRAs Compare to Gold IRAs?

Bitcoin IRAs and Gold IRAs both utilize self-directed IRA structures for alternative assets, but Bitcoin IRA focuses on crypto like Bitcoin with high growth potential and volatility unlike Bitcoin ETF products while Gold IRAs invest in precious metals such as gold and silver for stability and inflation hedging in retirement accounts.

Both options allow tax-advantaged growth within traditional or Roth frameworks, supporting rollovers from 401k or 403b plans. A qualified custodian handles compliance, ensuring tax-deferred or tax-free benefits until age 59½. Self-directed accounts enable diversification beyond stocks and bonds.

Bitcoin IRAs emphasize crypto custody solutions like multisig wallets or institutional custody from providers such as Coinbase Custody, Fireblocks, BitGo Trust, or Ledger Enterprise.

Gold IRAs rely on secure vaults for physical precious metals, with trading facilitated through approved dealers. Fees and minimums vary, so compare fee schedules carefully.

Investors often blend these in a portfolio for balance, using cold storage for Bitcoin or allocated gold bars for tangibility, as reported by sources like CryptoSlate. This comparison highlights how each fits retirement goals amid market shifts, with options like Swan Bitcoin.

Bitcoin vs Gold Ownership in America (2026)

Bitcoin vs Gold Ownership in America (2026)

Americans Holding Bitcoin Assets: Number of Holders (millions)

The Bitcoin vs Gold Ownership in America (2026) dataset reveals a striking shift in asset preferences among Americans. In 2026, 50 million Americans hold Bitcoin, surpassing the 37 million who own gold. This marks a pivotal moment where a digital asset has overtaken a traditional store of value.

Americans Holding Assets data underscores Bitcoin’s rapid adoption. With 50 million holders, Bitcoin reflects its appeal as a digital alternative to gold, driven by younger demographics favoring cryptocurrencies for their accessibility and potential returns. Gold, held by 37 million, remains a trusted hedge against inflation and uncertainty, yet its growth has been outpaced by Bitcoin’s explosive rise.

- Bitcoin’s lead highlights its mainstream acceptance, fueled by institutional investments, user-friendly exchanges, and a narrative of scarcity with a fixed supply of 21 million coins.

- Gold’s position as a physical asset appeals to conservative investors seeking stability, though its storage and transaction costs limit broader adoption.

This crossover signals a generational divide: younger Americans embrace Bitcoin’s innovation, while older generations prefer gold’s history. The data suggests a maturing crypto market challenging gold’s dominance, potentially reshaping investment portfolios.

In summary, with 50 million Bitcoin holders versus 37 million gold owners, the Bitcoin vs Gold Ownership in America (2026) illustrates evolving financial trends toward digital assets.

What Are the Key Differences in Performance and Volatility?

Key differences in performance and volatility show Bitcoin IRA assets like Bitcoin experiencing explosive growth but high volatility, contrasting with the steadier, lower-volatility returns of gold and silver in precious metals IRAs.

Bitcoin’s price swings demand tolerance for rapid ups and downs, ideal for those eyeing long-term appreciation in a self-directed Roth IRA or Traditional IRA. Gold and silver act as safe havens during economic uncertainty, preserving value through inflation. Experts recommend assessing personal risk before allocating funds via rollover or contribution limits tied to AGI.

Historical patterns reveal Bitcoin’s potential for outsized gains over short periods, while precious metals offer consistent hedging. Volatility in crypto requires vigilant monitoring, often with staking rewards or trading tools from custodians like Unchained IRA, iTrustCapital, or Swan IRA. Gold’s stability suits conservative retirement strategies.

For practical planning, track performance against benchmarks in your account dashboard. Consider tax reporting with tools like CoinLedger, TurboTax, or TaxAct to handle crypto transactions versus simpler precious metals forms. This informs balanced IRA decisions.

What Are the Pros and Cons of Each?

Bitcoin IRAs offer high return potential but face volatility risks, while Gold IRAs provide stability through precious metals with lower growth prospects.

- Bitcoin IRA Pros: Access to crypto growth, staking rewards, potential for equity-like returns or Bitcoin ETF exposure in a tax-advantaged wrapper.

- Self-custody options with multisig for security using Fireblocks or Ledger Enterprise, liquidity for trading on platforms like Swan IRA or Swan Bitcoin.

- Pros of Gold IRA: Tangible assets hedge inflation, lower volatility suits retirement preservation.

- Physical custody in vaults, simpler tax reporting without complex transaction logs.

Bitcoin IRA cons include high fees from custody like Fidelity, BitIRA, Equity Trust, or Coinbase Custody and trading, plus exposure to IRS regulatory shifts and withdrawal penalties before 59½. Gold IRAs face storage costs and less liquidity, with minimum purchase requirements limiting small accounts. Both share custodian dependencies.

Choose based on timeline: aggressive growth favors Bitcoin, steady protection suits gold or silver. Review providers like Equity Trust, BitGo Trust, or others (CryptoSlate) for self-directed flexibility, ensuring alignment with TSP rollover rules and tax bracket implications.

What Are the Benefits of a Bitcoin IRA for Retirement?

The benefits of a Bitcoin IRA for retirement include tax-free or tax-deferred growth on Bitcoin appreciation, potential staking rewards, and portfolio diversification beyond traditional assets. Investors can hold Bitcoin within a self-directed IRA, shielding gains from immediate taxation. This structure mirrors Roth or traditional IRA rules, allowing contributions up to annual limits based on adjusted gross income.

Tax-advantaged growth stands out as a primary draw. In a Roth IRA like a Roth Bitcoin IRA, qualified withdrawals after age 59½ escape taxes entirely, ideal for long-term holders. Traditional IRA versions defer taxes until distribution, potentially aligning with a lower tax bracket in retirement and avoiding early withdrawal penalties.

Staking rewards add passive income potential not found in standard IRAs. Certain custodians like iTrustCapital or Unchained IRA enable staking rewards on eligible cryptocurrencies, compounding returns within the tax-sheltered account. This enhances retirement planning by blending crypto yields with Equity Trust oversight.

Diversification via a Bitcoin IRA reduces reliance on stocks or bonds. Pairing it with a Gold IRA holding precious metals like gold or silver creates balanced exposure to digital and physical assets. Self-directed accounts from providers like Swan IRA using cold storage and multisig wallets ensure secure custody during market volatility.

What Are the Risks of Investing in a Bitcoin IRA?

Risks of a Bitcoin IRA include high volatility of Bitcoin prices, custody vulnerabilities despite cold storage, and evolving IRS regulatory changes impacting tax reporting. Bitcoin’s price can swing dramatically, testing the resolve of retirement investors seeking stability. This volatility often exceeds that of precious metals like gold in traditional IRAs.

Custody risks persist even with reputable custodians using cold storage or multisig setups from providers like Coinbase Custody or Fireblocks. Self-custody options, such as those from Unchained IRA, shift responsibility to the account holder, raising chances of loss from private key mismanagement. Institutional custody helps, but hacks or insider threats remain possible in the crypto space.

Regulatory uncertainties from the IRS create additional hurdles for tax reporting in self-directed Bitcoin IRAs. Changes to rules on crypto transactions, staking rewards, or like-kind exchanges could alter tax-deferred or tax-free benefits in Roth or traditional accounts. Investors must track basis meticulously using tools like CoinLedger alongside TurboTax or TaxAct.

- Monitor daily price fluctuations to avoid panic selling near age 59½ when withdrawal penalties lift.

- Choose custodians with proven fee schedules and insurance for holdings.

- Consult tax professionals yearly for IRS compliance on contributions, rollovers from 401k or 403b, and AGI impacts.

Mitigation starts with diversification, blending Bitcoin IRA allocations with gold or silver for balance. Experts recommend limiting crypto to a portion of total retirement assets to weather market storms.

How to Choose the Best Bitcoin IRA Company?

To choose the best Bitcoin IRA company, evaluate factors like fees, custodian reliability with security features from providers like Unchained IRA and Swan IRA, alongside trading options and customer support. Self-directed IRA providers specializing in crypto IRA accounts offer tax-advantaged ways to hold bitcoin in retirement portfolios, distinct from traditional or Roth IRAs focused on stocks and bonds.

Prioritize custodians with self-custody options or institutional-grade security, such as multisig wallets and cold storage, to protect against hacks common in crypto spaces.

Companies like Unchained IRA emphasize collaborative custody models, while Swan IRA integrates seamless bitcoin accumulation strategies. Compare these against broader self-directed IRA firms like iTrustCapital or Equity Trust for overall suitability.

Assess trading flexibility, including direct bitcoin purchases, staking rewards, and rollover processes from 401k or 403b plans. Strong customer support ensures smooth handling of tax reporting via tools like CoinLedger or TurboTax integrations. Ultimately, select providers aligning with your risk tolerance for volatile assets in a tax-deferred retirement account.

Gold IRAs, by contrast, involve precious metals like gold and silver stored in depositories, often with higher physical custody fees. Bitcoin IRAs provide digital liquidity but demand rigorous security scrutiny to match the stability of traditional metals-backed accounts.

What Fees Should You Watch For?

Watch for fees in Bitcoin IRAs including setup fees, trading fees, custody fees, and minimum balances outlined in the fee schedule to ensure cost-effective retirement investing.

These costs can erode returns in a tax-advantaged account, especially with Bitcoin’s price swings. Review the full fee schedule upfront to avoid surprises.

Setup fees cover account opening and initial rollover from existing 401k or TSP plans, often ranging as one-time charges. Custody fees protect assets via services like Coinbase Custody or Fireblocks, charged annually based on holdings. Trading fees apply per bitcoin transaction, so frequent trades amplify expenses.

Minimum balance requirements lock in commitments, suitable for larger retirement rollovers but restrictive for smaller contributions under annual limits.

Hidden costs might include wire transfer fees or insurance premiums for cold storage. Providers like Unchained IRA and Swan IRA often disclose transparent schedules, aiding comparisons with gold IRA custodians charging storage and assay fees.

- Scrutinize annual custody fees tied to average daily balances.

- Compare trading commissions across platforms for bitcoin buys.

- Check for inactivity fees on self-directed crypto IRA accounts.

- Evaluate waiver options for minimums after initial funding.

How to Set Up a Bitcoin IRA?

To set up a Bitcoin IRA, open a self-directed account with a custodian, fund via rollover or contributions, and handle tax reporting using tools like CoinLedger, TurboTax, or TaxAct. This process mirrors traditional IRA setups but incorporates crypto custody solutions for secure storage. Custodians like Equity Trust or iTrustCapital streamline the transition to tax-advantaged crypto investments.

Begin by selecting a provider offering self-directed IRA options for bitcoin and other cryptos. These accounts support Roth or traditional structures, enabling tax-deferred or tax-free growth. Compare fee schedules and minimums to match your retirement goals.

Funding occurs through rollover from a 401k, 403b, or TSP, or direct contributions within annual limits. Providers like Swan IRA or Unchained IRA facilitate seamless transfers without triggering withdrawal penalties before age 59½. Institutional custody from BitGo Trust or Coinbase Custody ensures compliance and security.

Once funded, execute trades via integrated platforms with cold storage and multisig wallets from Fireblocks or Ledger Enterprise. Track staking rewards and capital gains for tax reporting. Tools like CoinLedger connect with TurboTax or TaxAct to simplify IRS Form 1099 filings based on your AGI and tax bracket.

Step 1: Choose a Custodian and Open Your Account

Select a custodian specializing in crypto IRA accounts, such as Equity Trust or iTrustCapital. These firms provide self-directed options beyond precious metals like gold or silver. Review their custody models for Bitcoin ETF access and trading capabilities.

Complete the account application online, specifying Roth or traditional IRA preferences. Expect identity verification and a modest minimum investment threshold. This establishes your tax-advantaged retirement vehicle for crypto holdings.

Opt for providers with institutional custody like BitGo Trust or Coinbase Custody to safeguard assets. Multisig protocols from Fireblocks add layers of security against single-point failures. Swan Bitcoin integrates seamlessly for ongoing purchases.

Step 2: Fund Your Bitcoin IRA via Rollover or Contribution

Initiate a rollover from your 401k, 403b, or TSP to avoid early withdrawal penalties. Direct transfers maintain tax-deferred status, preserving retirement savings. Custodians like Ledger Enterprise handle paperwork to ensure compliance.

Make annual contributions within IRS limits, directing funds to bitcoin or diversified cryptos. Platforms like Unchained IRA or Swan IRA support recurring buys into cold storage. This builds your portfolio without self-custody risks.

Monitor fee schedules during funding to minimize costs on trades and storage. Equity Trust offers flexible options for bitcoin ETF rollovers. Confirm all assets settle in secure wallets before proceeding to investments.

Step 3: Select Investments and Manage Your Portfolio

Allocate funds to Bitcoin via spot purchases, ETFs, or staking for rewards. Use provider dashboards for trading, backed by Ledger Enterprise or Fireblocks multisig. Diversify into other cryptos if the platform allows.

Compare to gold IRAs, where precious metals require physical storage, unlike digital crypto custody. Bitcoin IRAs offer higher liquidity and potential growth. Regularly rebalance to align with retirement timelines.

Enable features like Swan Bitcoin for automated dollar-cost averaging. Track performance against traditional investments. Custodians provide statements for ongoing oversight.

Step 4: Handle Tax Reporting and Compliance

Use CoinLedger to aggregate transactions from your Bitcoin IRA for accurate tax reporting. It exports data compatible with TurboTax or TaxAct, simplifying capital gains calculations. This ensures compliance with IRS rules on crypto IRAs, as reported by sources like CryptoSlate.

Report distributions or conversions, watching for impacts on your tax bracket and AGI. Roth IRAs offer tax-free withdrawals after 59½, while Traditional IRAs defer taxes. Avoid penalties by adhering to contribution limits.

Leverage CryptoSlate resources for updates on IRS regulations. Institutional tools from BitGo Trust aid in audit-ready records. Professional integration keeps your retirement strategy optimized.

Use tools like CoinLedger, TurboTax, or TaxAct for tax reporting, with hardware security from Ledger Enterprise and services from Swan Bitcoin or Fidelity.

Frequently Asked Questions

What are the best Bitcoin IRA companies for retirement?

The best Bitcoin IRA companies for retirement include leaders like BitcoinIRA, Directed IRA, Unchained IRA, and Alto IRA, which specialize in self-directed IRAs allowing cryptocurrency investments such as Bitcoin. These platforms offer secure storage with Coinbase Custody, tax-advantaged retirement accounts, and integration with trusted custodians, making them top choices when comparing Bitcoin IRA companies for retirement (and how they compare to Gold IRAs) for diversification and growth potential.

How do Bitcoin IRAs compare to Gold IRAs for retirement planning?

Bitcoin IRAs provide exposure to high-growth digital assets with potential for substantial returns but higher volatility, while Gold IRAs offer stability and inflation hedging through physical precious metals. When evaluating the best Bitcoin IRA companies for retirement (and how they compare to Gold IRAs), iTrustCapital options like iTrustCapital excel in accessibility and fees, whereas Gold IRAs from providers like Augusta Precious Metals emphasize tangible asset security, suiting different risk tolerances.

What are the key features of the top Bitcoin IRA companies?

Top Bitcoin IRA companies feature low fees, insured crypto storage via institutional custodians like Fireblocks, easy rollovers from traditional IRAs, and 24/7 trading platforms. Companies such as Equity Trust and Kingdom Trust stand out in lists of the best Bitcoin IRA companies for retirement (and how they compare to Gold IRAs) due to their robust compliance, diverse altcoin options, and user-friendly apps that outperform many Gold IRA counterparts in digital efficiency.

Are Bitcoin IRAs a better retirement investment than Gold IRAs?

Whether Bitcoin IRAs are better than Gold IRAs depends on your goals: Bitcoin offers asymmetric upside for long-term growth, while Gold provides downside protection. The best Bitcoin IRA companies for retirement (and how they compare to Gold IRAs) highlight Bitcoin’s historical 200%+ annual returns versus Gold’s 5-10%, but with greater risk—providers like BitIRA enable hybrid portfolios blending both for balanced retirement strategies.

What fees should I expect from the best Bitcoin IRA companies?

Fees for the best Bitcoin IRA companies typically include setup ($50-200), annual custody (0.08-1% of assets), and trading spreads (0.5-2%), often lower than Gold IRAs’ storage and shipping costs. When reviewing the best Bitcoin IRA companies for retirement (and how they compare to Gold IRAs), low-cost options like Swan IRA minimize expenses, allowing more capital for Bitcoin exposure compared to Gold’s premium storage fees.

How do I choose between a Bitcoin IRA and a Gold IRA for retirement?

Choose based on risk appetite, market outlook, and diversification needs: opt for Bitcoin IRAs for growth potential or Gold IRAs for preservation, or consider a Bitcoin ETF alternative. The best Bitcoin IRA companies for retirement (and how they compare to Gold IRAs) like BitIRA facilitate seamless transitions, with Bitcoin suiting younger investors chasing yields and Gold fitting conservatives—consult a fiduciary advisor to align with your retirement timeline.