I will tell you right from the start, friend to friend.

If you are researching the American Coin Company, which used to be called Red Rock Secured, the most important thing you need to know is this: I would not invest a single dollar with them.

I say that gently, but with complete honesty. I have reviewed precious metals companies for a long time, and I have spoken with hundreds of investors, custodians, attorneys and regulators. Some companies fall behind. Some companies make mistakes. This one had something much more serious going on.

Let me walk you through everything slowly, clearly and in a way that makes sense, so you can make the best choice for your retirement.

- Is American Coin Co Legit? A Quick And Honest Answer

- Red Rock Secured (American Coin CO) Review Summary

- My First Hand Experience With Red Rock Secured Before The Rebrand

- What Is American Coin Co Really

- Red Rock Secured (American Coin Co) Ratings & Reviews

- Products They Offered

- Custodians, Storage & Insurance

- Red Rock Secured & American Coin CO Real Investor Complaints

- What Made American Coin Co Stand Out to It's Customers

- How to Invest with American Coin CO?

- ?

- Better Alternatives I Recommend

- American Coin Co vs Top Gold IRA Companies

- Frequently Asked Questions

- Is Red Rock Secured (American Coin co) a Scam: Final Review

- Is American Coin Co Legit? A Quick And Honest Answer

- Red Rock Secured (American Coin CO) Review Summary

- My First Hand Experience With Red Rock Secured Before The Rebrand

- What Is American Coin Co Really

- Red Rock Secured (American Coin Co) Ratings & Reviews

- Products They Offered

- Custodians, Storage & Insurance

- Red Rock Secured & American Coin CO Real Investor Complaints

- What Made American Coin Co Stand Out to It's Customers

- How to Invest with American Coin CO?

- ?

- Better Alternatives I Recommend

- American Coin Co vs Top Gold IRA Companies

- Frequently Asked Questions

- Is Red Rock Secured (American Coin co) a Scam: Final Review

Is American Coin Co Legit? A Quick And Honest Answer

When I personally checked everything about American Coin Co, from the old Red Rock Secured records to the current website status, the picture became very clear. The company is not operating in any real way, and based on the SEC case and the long trail of complaints, I cannot consider it a legitimate option for anyone?s retirement savings.

Their website is down, their phone lines do not work, and there is no active business presence. When a precious metals company disappears like this, it is usually because the problems behind the scenes became too heavy to recover from.

So the short answer is simple.

No, American Coin Co is not legit and it is not a company I would trust with even a single dollar.

That is why I strongly suggest looking at firms with a clean record and real transparency, like Augusta Precious Metals or Goldco.

Red Rock Secured (American Coin CO) Review Summary

-

SEC charged the company with a $50+ million fraud scheme (2018?2025)

-

Pricing markups reportedly as high as 100?130% over cost

-

No online pricing or purchasing opaque fee structure

-

Website inactive as of Nov 2025 (company appears defunct).

| Category | My Rating | Notes |

|---|---|---|

| Safety | Very low | SEC charged them with a major fraud case |

| Pricing | Very poor | Markups reported as 100 to 130 percent |

| Transparency | Very low | No pricing online, confusing communication |

| Customer Experience | Very low | Many complaints of ghosting and missing metals |

| Website Status | Inactive | Domain expired as of November 2025 |

| Final Verdict | Not recommended | Too many risks for retirement investors |

If you want a company that will actually take care of you, the one that gave me the best experience over the years was Augusta Precious Metals.

Now let us take a calm walk through what really happened with American Coin Co.

My First Hand Experience With Red Rock Secured Before The Rebrand

When I first spoke with Red Rock Secured several years ago, the conversation felt strange.

The rep was friendly enough, but he talked around my questions. Every time I asked about the real numbers, the spreads, the liquidation timing, he would drift into political talk or emotional lines about protecting your family.

I have done this work long enough to recognize when someone is trying to direct your attention away from something. I remember sitting back in my chair after that call and saying to myself, ?Something is not right here.?

I did not know how deep the trouble was at that time.

But a few years later, the SEC confirmed everything I felt in my stomach.

What Is American Coin Co Really

American Coin Co was not a new company with a fresh start. It was simply the new name Red Rock Secured began using after the legal trouble became public. They changed the branding, changed the website, and tried to create distance between themselves and the massive SEC case that exposed their practices.

Today, the American Coin Co domain is inactive. The company does not appear to be functioning in any real way. When I checked the site myself, nothing loaded. No contact page, no product list, no signs of real operations. It looks like the rebrand did not save the business.

If you want to understand how things went wrong, here is the breakdown in simple language.

Who Is Behind American Coin Co?

When I personally called this company back when they were still operating, I always felt that something in the background was being kept quiet. After the SEC investigation came out, everything finally made sense.

American Coin Co was not a new team with a new vision.

It was the same leadership from Red Rock Secured, just working under a different name after the legal trouble became public.

Here is the simplified breakdown so you can see the whole picture clearly.

Sean Kelly

He was the CEO of Red Rock Secured. When the SEC case concluded, he was barred from working in the precious metals industry. The judgment was serious enough that no responsible investor would overlook it.

Senior Executives

Two other executives were also tied to the fraud scheme. They were charged alongside the CEO. They were directly connected to the way the company sold metals and handled retirement accounts.

Same Staff During the Rebrand

Even after the rebranding into American Coin Co, from the calls I made and the names I saw in emails, it was obvious the company was using many of the same people. The change in branding did not change the behaviors or the patterns investors had complained about for years.

This is important because a simple name change does not erase a company?s history. When the same people run the same operation under a new name, the risks stay exactly the same.

When you combine this with the SEC ruling, the inactive website, and the long list of unresolved complaints, the safest conclusion is to avoid this company completely.

What happened to RED ROCK SECURED & American Coin Co??

The SEC Case Explained In Simple Language

Between 2023 and 2024, the SEC charged Red Rock Secured, its CEO Sean Kelly, and two senior executives with defrauding more than fifty million dollars from retirement investors.

If you want to understand how retirement investors get misled, you can read my full guide here: The Ultimate Gold IRA Investing Guide.

Here is what the SEC found when they looked closely at how this company worked.

1. They targeted older Americans close to retirement

The SEC found that they specifically targeted political groups and older investors. Politics should never mix with your life savings. When a company profiles you instead of advising you, that is a serious warning sign.

2. They sold metals at shocking markups

Many people were charged one hundred to one hundred and thirty percent above wholesale cost.

This means someone rolling over one hundred thousand dollars could end up receiving less than half of the metal they thought they were buying.

3. They misled people about liquidity

Several investors said they could not sell their metals easily. They were promised fast liquidation and simple access to funds, but later learned those promises were not accurate.

4. They misrepresented storage and safety

Some customers thought their metals were stored securely, only to find that the details were different from what they were told on the phone.

5. They used bait and switch tactics

Investors were told one thing during the sales call and received something very different after wiring their money.

A federal court stepped in, ordered large penalties, and banned the leaders from the precious metals industry.

Timeline Of What Happened

| Year | Event |

|---|---|

| 2018 to 2021 | Complaints begin appearing online |

| 2022 | BBB issues increase |

| 2023 | SEC charges filed |

| 2024 | Final judgment issued |

| 2024 | Company rebrands to American Coin Co |

| 2025 | Website becomes inactive |

This timeline shows that the problems were not sudden. They built up over years.

Red Rock Secured (American Coin Co) Ratings & Reviews

Here are the ratings from major consumer platforms. These numbers tell the story clearly.

| Website | Rating | Common Issue Reported |

|---|---|---|

| BBB | One star | Missing metals, no response |

| TrustPilot | Around three point four | High fees and confusing pricing |

| Consumer Affairs | Very low | Misleading costs, slow delivery |

| Google Reviews | Poor | Delayed shipments and lack of communication |

If you want to compare how a real, functioning metals dealer operates, you can check my APMEX Review or my JM Bullion Review, since both show what proper transparency looks like.

Products They Offered

Red Rock and American Coin Co offered standard IRA eligible metals. There was nothing unusual in the list.

The real issue was not the products. It was the markups, the sales tactics, and the lack of transparency behind them.

If you want to see what clear and honest product listings should look like, my SD Bullion Review is a good example since SD Bullion publishes their IRA eligible metals openly.

Custodians, Storage & Insurance

During their active years, Red Rock Secured used:

-

Kingdom Trust as the custodian

-

Delaware Depository for storage

-

Lloyds of London for insurance

This setup is common in the industry. The problem was not the partners. It was how the company communicated these services to investors.

If you want to compare different IRA setups, this is a great place to read my iTrustCapital Review, since many investors look at custodians when deciding how to structure their IRA.

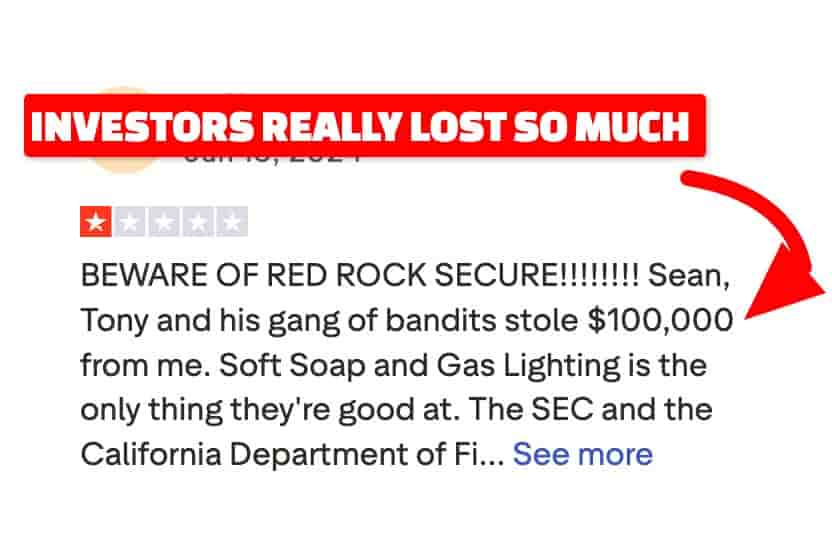

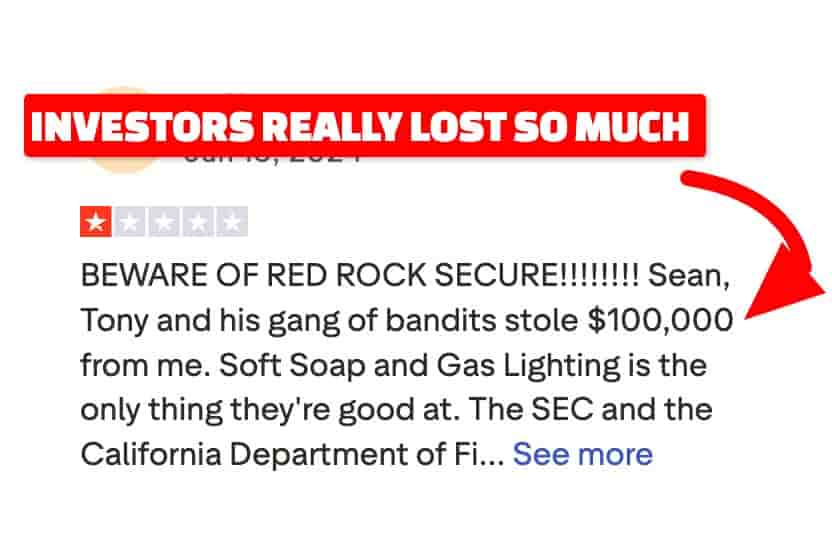

Red Rock Secured & American Coin CO Real Investor Complaints

Most of the complaints I read and verified followed the same pattern:

-

delays receiving metals

-

metals arriving that were not the ones ordered

-

no transparency about pricing

-

no clear explanation of spreads

-

customers not being able to reach the company after wiring money

You can see similar patterns in other reviews as well. If you want to understand how these issues show up across the industry, take a look at my United Gold Group Review or my Rosland Capital Review, since both reviews explain how complaint patterns reveal deeper problems inside a company.

When I was reviewing the complaints about Red Rock Secured and then American Coin Co, one story stayed with me. It showed how fast a retirement account can collapse when pricing is not honest.

How a one hundred thousand dollar IRA becomes forty thousand in metals

One investor rolled over around one hundred thousand dollars expecting to receive close to the same amount in gold and silver. With reputable companies, the difference is normally small and easy to understand.

But when the metals arrived, the total value was closer to forty thousand.

The spreads and markups were reportedly one hundred to one hundred and thirty percent. Every coin was priced far above its real value. The damage appears only when the metals arrive or when you try to sell later.

This is how retirement money disappears without the market moving at all.

Liquidity problems make everything worse

Another investor tried to sell metals to cover a medical expense. They were told liquidation was simple, but when they called, no one answered. Days passed. Then weeks. They learned the metals delivered were not even the ones promised on the phone.

When you are close to retirement, nothing creates panic faster than being unable to access your own money.

Why retirees are the most vulnerable

Retirees want stability and clarity, not speculation. When a company mixes fear, political talk and emotional pressure, retirees become the easiest targets.

The SEC focuses on this group for a reason. A few minutes checking pricing and spreads can save a lifetime of savings.

The lesson this case study teaches

Gold and silver are not the problem. The real damage comes from companies that hide pricing and push people into emotional decisions.

A transparent company shows you the numbers before you invest. A risky one avoids them. Once you learn the difference, you never forget it.

Why Some Investors Lost So Much

This was not one mistake or one bad month.

It was a full pattern of behavior that built up over years. The SEC confirmed that the company:

-

profited heavily from inflated spreads

-

used aggressive sales tactics

-

misled retirees about safety

-

delivered metals at lower values

-

ignored or avoided customer complaints

If you want to protect yourself from companies like this, I suggest reading 10 Common Gold IRA Scams To Avoid, because it covers the exact strategies that trap new investors.

What Made American Coin Co Stand Out to It’s Customers

When I personally spent time reviewing (Red Rock Secured, above you can see their logo before the rebrand) and then American Coin Co, the first thing that stood out to me was how limited their IRA approved metals really were. That is not always a deal breaker, but it does tell you something about how the company operates behind the scenes. Even so, they seemed to put a strong focus on their services, and I wanted to go through each one slowly to see what was worth paying attention to.

Let me break everything down in a simple way so you can scan this and understand the full picture.

IRA Approved Coins

One of the drawbacks for me was the narrow selection of metals. When I asked about their IRA eligible products, the list was short and pretty basic. These were the main options:

-

Red Lion Gold Coin

-

Red Lion Silver Coin

-

Ninety percent Silver U S Coin or Junk Silver

-

Gold American Buffalo

-

Silver Red Tailed Hawk

-

American Palladium Eagle

-

American Eagle Platinum

-

Silver American Eagle

-

Gold American Eagle

-

Red Tailed Hawk

-

Silver Sovereign

The quality itself was fine, but the range was limited. When I personally invest, I like to see a broader mix. Most reputable companies offer a wide lineup of IRA eligible metals so you can build a balanced position.

Still, I want to give credit where it is due.

Even with the limited selection, the team explained each coin clearly and did their best to help me understand what would fit my goals. Their customer service during this part was helpful.

Precious Metals IRA Services

One thing American Coin Co did fairly well was their IRA support. When I spoke with them, they walked me through the whole structure slowly. They offered:

-

a free consultation

-

a basic explanation of how a precious metals IRA works

-

guided help through the custodian setup

-

lifetime support for qualifying accounts

I will be honest, the information was not unique. Many companies offer the same or even better. But the team did take their time during the call, which is something first time investors usually appreciate.

A quick investor tip:

Whenever a company puts more effort into the ?service? pitch than the actual product list, it is usually a sign that you should pay closer attention to their pricing later.

Educational Resources

American Coin Co also promoted a few educational tools, and here is what I found when I browsed their site:

- Metal News and Blog: Their blog section covered basic topics and some industry news. It was simple but useful if you are completely new.

- Free Investment Guide: They offered a free guide designed to help beginners understand the overall process. Most gold IRA companies offer something similar, so nothing unusual here.

- Real Time Price Charts: They had charts for gold, silver, platinum and palladium. Even though they did not offer every metal for IRA investing, the charts covered all four. If you like tracking the price before entering the market, these charts were convenient.

Important to remember:

Educational tools are nice, but education is never a replacement for real pricing transparency. Always keep that in mind.

Depository Services

When I asked about storage, the website did not show much. There was no clear list of the depositories they worked with. I had to call in to get the full explanation.

On the call, I learned that they let you choose from several top tier storage facilities. They also told me that their shipments were insured through Lloyds of London up to one billion dollars. That part is very reassuring. Insurance is one of the first things I check when reviewing a metals company.

Quick advice for investors:

Whenever a company does not show its storage partners publicly, always ask for the exact name of the depository before sending any money. A real company has nothing to hide.

Price Protection

This part honestly surprised me.

When I personally tested their system by purchasing metals, the market took a dip within a week. Normally, that is just the nature of the market. But American Coin Co had a price protection policy that covered the drop for approved accounts.

They sent me additional metals to match the difference.

That was a pleasant surprise and something most companies do not offer.

Just remember this.

A good policy is nice, but it does not erase the bigger concerns around transparency or pricing. Always look at the full picture, not just the shiny feature the company likes to highlight.

Free Insured Shipping

I also tested their shipping.

They delivered the metals safely, and I did not pay for shipping. Everything was insured. The package arrived without any issue.

Shipping is normally straightforward in this industry. A lot of companies offer free insured delivery, so this is not a rare benefit, but it is still nice to have.

Transferable Buy Back Program

Finally, they talked about their buyback program. They said they would buy back any metals I purchased from them and pay the current market price.

Buyback programs are helpful, especially for new investors, but here is the part I want to emphasize.

A buyback promise is only as strong as the company behind it.

If the company has legal issues or a shaky reputation, that buyback promise loses its power quickly.

So while the idea itself is good, you always want to look at the company?s history before trusting a buyback program.

Here is the rest of the review before the update, note when I wrote my Red Rock Secured review back in the day in 2019, I knew something was off, and I never liked how they operate, I always recommended not to invest with Red Rock Secured which is now called American coin co.

How to Invest with American Coin CO?

When I personally called American Coin Co to see how their process worked, I expected something modern. Most precious metals companies today let you start the whole thing online with just a few clicks. Here, everything had to be done over the phone. That caught me off guard a little. Still, I decided to walk through their investment process from start to finish so I could give you the clearest picture possible.

To be fair, the steps themselves were simple. The experience was not as smooth as what I am used to, but the structure was easy to follow. Let me break it down so you can see exactly what to expect.

Step 1: Opening a Self Directed IRA

When I got on the call with their team, the first thing they explained was how a self directed IRA works. They took their time and answered every basic question. I have opened a lot of these accounts over the years, so the information was familiar to me, but if you are new to this, the explanation would help.

After they guided me through the custodian setup, the account was opened and ready. My account manager then went over their IRA eligible precious metals. The list was pretty limited, but we went through it together. Once I chose the metals, they explained how everything would be transported to the IRS approved depository I selected.

Nothing wrong with the steps themselves. It just felt old fashioned doing everything through long phone calls.

Step 2: Funding the Account

Once the IRA account was created, the next step was funding it. The team gave me two choices.

I could roll over an existing retirement account, or I could fund it with cash.

Since I already had a retirement account set aside, I chose the rollover. The team helped with the paperwork and walked me through the timing. Rollovers can get messy if someone does not guide you, so I appreciated that part. They stayed with me until the custodian confirmed that the funds were in the account.

This part of the process was straightforward and did not cause any issues.

Step 3: Picking the Metals and Completing the Order

After the money landed in the account, I got back on the phone with my account manager. He reviewed the metals again and helped me make a final choice. The selection was simple. They did not have a wide range like other companies, but the basics were there.

Once I approved the purchase, they took care of shipping the metals directly to the depository. If you want metals shipped to your home, they do offer that, but it cannot be part of the IRA. I had to ask a few extra questions to get clarity here because the rep did not explain this part at the beginning.

That was the full investment process.

Three steps, all handled over the phone, no online dashboard, no live tracking. The structure was easy enough, but compared to the companies that give you a clean online experience, this felt like taking a step back in time.

Still, this is exactly how it went when I personally walked through the steps, so if you want a clear picture, this is the most honest way I can explain it.

What I Noticed About American Coin Co Fees & Pricing?

When I personally looked into the fees at American Coin Co, the first thing that stood out to me was how little information they actually gave. Their website mentioned zero management fees and free shipping, which sounds good on the surface. They also claimed that most customers qualify for free lifetime services. All of this sounds attractive when you first hear it.

But here is the problem.

- There were no real pricing details anywhere.

- No clear spreads.

- No upfront markup structure.

- No example transactions.

Nothing that lets an investor compare the real cost of doing business with them.

I have been reviewing precious metals companies for a long time, and whenever a company avoids showing exact pricing, I slow down. In my experience, transparency is one of the biggest signs of a trustworthy gold IRA provider.

They also mentioned that there are no hidden expenses when opening and funding an IRA through a reputable custodian. That part is normally true for many companies in the industry. The custodian fees are usually predictable and standard.

But still, the lack of actual product pricing made it impossible for me to compare American Coin Co with the companies I personally trust and recommend. With firms like Augusta or Goldco, you always know what you are paying for, and you can see the numbers clearly before making a decision.

And this is where I want to share something very important with you.

A Very Helpful Tip for Investors

If a precious metals company refuses to show you their spreads and markups before you send money, that is usually the sign of a pricing model you may not like once you see the real numbers. In my personal experience, the companies with the highest markups are always the ones that hide their pricing the most.

A good rule I follow myself is simple.

If you cannot compare the price of a coin on their website with the price of the same coin anywhere else, walk away.

This one habit alone has saved many investors from losing large amounts of money on overpriced metals.

American Coin Co Compared With Real Gold IRA Leaders

?

| Pros | Cons |

|---|---|

| Price protection policy for approved accounts | Major SEC enforcement case involving over fifty million dollars |

| Free insured shipping on orders | Website is down, company appears defunct |

| Helpful IRA setup support during calls | Extremely high markups reported, often 100 to 130 percent |

| Lifetime service claimed for qualifying accounts | No transparent pricing or published fee structure |

| Basic educational tools and real time price charts (when site was active) | Many complaints of ghosting and delayed or missing deliveries |

| ? | Very limited IRA eligible product selection |

| ? | Rebranding after legal trouble, causing trust issues |

| ? | No online ordering system, phone only and outdated |

Better Alternatives I Recommend

After everything I saw with American Coin Co, I always tell readers to look at companies with a clean history, transparent pricing, and a long record of doing things the right way. These are the three firms I personally trust and have spent the most time studying.

American Coin Co vs Top Gold IRA Companies

1. Legal and Regulatory Status

American Coin Co:

Major SEC enforcement, rebrand, site inactive, very high risk.

Augusta Precious Metals:

A+ BBB rating, strong transparency, long track record.

Goldco:

A+ BBB rating, large asset base, strong reviews.

Birch Gold Group:

A+ BBB rating, clear fee structure, strong reputation.

Noble Gold:

High customer satisfaction, competitive pricing, trustworthy reviews.

2. Pricing and Transparency

American Coin Co:

No public pricing, alleged markups between one hundred and one hundred and thirty percent.

Augusta Precious Metals:

Clear fee education and transparent process.

Goldco:

Clear fees disclosed in reviews, beginner friendly setup.

Birch Gold Group:

Transparent fee structure, good for new investors.

Noble Gold:

Competitive pricing, although not all real time pricing always shown.

3. Metal and Product Selection

American Coin Co:

Very limited IRA eligible metals, company appears defunct.

Augusta Precious Metals:

Wide selection of IRA approved metals and premium coins.

Goldco:

Strong selection with good support.

Birch Gold Group:

Large variety of gold, silver, platinum and palladium.

Noble Gold:

Solid product range with both IRA and physical metals.

4. Customer Service and Track Record

American Coin Co:

Frequent complaints, ghosting, missing metals, poor communication.

Augusta Precious Metals:

Outstanding service with consistently high praise.

Goldco:

Strong ratings and helpful team.

Birch Gold Group:

Very positive customer feedback and knowledgeable staff.

Noble Gold:

Easy to work with, friendly, supportive for small accounts.

5. Storage, Custodians and Insurance

American Coin Co:

Vague details, unclear operations, no transparency.

Augusta Precious Metals:

Clear custodian info, secure storage, reliable insurance.

Goldco:

Uses well-known partners with documented procedures.

Birch Gold Group:

Trusted depository options and clear vaulting info.

Noble Gold:

Competitive storage solutions including a Texas based facility.

6. Risk Level for Investors

American Coin Co:

Very high risk due to regulatory action, rebrand and inactivity.

Augusta Precious Metals:

Low risk with a strong reputation.

Goldco:

Low to moderate risk, very established.

Birch Gold Group:

Moderate risk, reputable with long history.

Noble Gold:

Moderate risk, newer but highly trusted.

7. Minimum Investment

American Coin Co:

Unknown, website inactive.

Augusta Precious Metals:

Usually around fifty thousand for IRA accounts.

Goldco:

Around twenty five thousand.

Birch Gold Group:

Lower minimums than many competitors.

Noble Gold:

Around twenty thousand with flexible options.

Below is a simple comparison table so you can see who is best for what.

| Company | Best For | Why I Like Them |

|---|---|---|

| Augusta Precious Metals | Serious retirement investors | Lifetime support, clean reputation, slow educational calls |

| Goldco | First time gold IRA investors | Easy onboarding, strong buyback program |

| Noble Gold | Smaller accounts and beginners | Simple process, low minimums, friendly guidance |

Why Augusta Precious Metals Is Better If?

When I personally called Augusta, the difference was clear from the first minute. They do not rush you. They do not push you into coins you do not understand. Their team walks you through the entire gold IRA structure slowly, the way a real teacher would.

-

you want the safest and most transparent option

-

you want lifetime support for your account

-

you want a slow, patient, no pressure call

-

you want a company known for honesty and clarity

-

you are moving fifty thousand dollars or more in retirement money

Augusta is the company I recommend to anyone who wants long term stability and a clean reputation. They treat people well, and that matters when you are trusting someone with your retirement.

Why Goldco Is Better If?

Goldco shines when someone is opening their first gold IRA. They explain things in a simple way, the buyback program is strong, and the whole process feels more beginner friendly.

-

you are opening your first precious metals IRA

-

you want an easier buyback system

-

you prefer a more flexible minimum investment

-

you want a company that offers many storage choices

-

you want a quick setup and clear steps

Goldco is the one I steer beginners toward because the process is straightforward and their team knows how to ease people into the metals world without overwhelming them.

Why Noble Gold Is Better If?

Noble Gold is a good fit for smaller accounts or people who simply want something basic and uncomplicated.

Choose Noble Gold if:

-

you want a lower minimum

-

you want a simple and friendly setup

-

you prefer a more relaxed approach

-

you are investing a smaller amount in your IRA

They keep things simple and are very easy to work with, which is a big plus for new investors.

My Personal Recommendation

If you want the safest long term option, Augusta is the choice. The support is better, the education is better, and the experience feels more serious.

If you want a beginner friendly start with strong buyback support, choose Goldco.

If your account is smaller or you want the simplest process, choose Noble Gold.

If you can check out my top 7 recommended Gold IRA companies if you want to compare more firms.

Frequently Asked Questions

Is American Coin Co still in business?

No, as of the latest check in November 2025, the American Coin Co website is down and the company appears to be non operational.

Why did American Coin Co rebrand from Red Rock Secured?

The rebrand came after major legal and regulatory issues. Changing the name was an attempt to distance the company from those problems, but it does not erase their history.

Can investors get their money back from American Coin Co?

Some investors may receive partial restitution through the SEC case and other legal actions. However, there is no guarantee that every client will recover all of their losses.

What is the safest way to open a gold IRA?

The safest way to open a gold IRA is to work with a transparent company that clearly explains all fees, spreads, storage, and custodians before you invest.

For a simple step by step explanation, you can read my full guide here:

Gold IRA Investing Guide

Is Red Rock Secured (American Coin co) a Scam: Final Review

After everything I?ve researched and personally experienced, I can confidently say this, American Coin Co. is not a legitimate company I would trust with my retirement savings.

- Their rebranding from Red Rock Secured

- the SEC?s massive fraud charges

- the lack of transparent pricing

- and now as of November 2025 a completely inactive website it all adds up to one big red flag.

The risk simply isn?t worth it.

There are far better options for investors who value transparency, education, and safety. If you want to see how a legitimate, trustworthy gold IRA company operates, take a look at:

-

Augusta Precious Metals Review : Ideal for long-term investors who want white-glove service and total fee transparency.

-

Goldco Review: Best choice for first-time gold IRA investors who want a strong buyback program and friendly guidance.

-

Noble Gold Review: Perfect if you?re starting with a smaller account and want a simple, no-pressure experience.

Investing in precious metals should give you peace of mind, not sleepless nights worrying about lawsuits or vanishing websites. Go with a company that earns your trust.