(Honest first hand experience, fully updated for December 2025)

I spent several days researching Swiss America, reading through hundreds of reviews, calling the company myself, speaking with past customers, and comparing everything I found to other gold ira companies I have reviewed.

What I discovered honestly surprised me more than I expected.

Some parts of Swiss America are excellent, some are outdated, and some are very different from what their polished marketing suggests.

If you are thinking about buying gold, silver, or opening a precious metals IRA, this Swiss America Review will show you exactly what to expect.

My goal is simple, I want you to walk away with clarity, not confusion.

Let’s begin.

- Swiss America Review: Quick Summary

- What Is Swiss America & Why People Still Talk About Them

- Swiss America Products: What They Really Offer

- What Real Customers Say About Swiss America’s Gold, Silver, and Platinum Products

- Swiss America Gold IRA Services, First Hand Insight

- Swiss America Fractional Ownership Program

- Swiss America Prices & Fees

- Storage Options With Swiss America, My First Hand Experience

- Shipping and Delivery, What to Expect

- Educational Resources and Research

- Payment Options

- Buyback Program, Returns, and Cancellations

- Website Experience, Old School by Design

- Customer Service, My Direct Experience

- Swiss America Ratings from Trusted Sources

- Swiss America Compared to Competitors

- Pros and Cons of Swiss America

- Is Swiss America a Scam?

- Final Thoughts, Should You Choose Swiss America

Swiss America Review: Quick Summary

- Name: Swiss America Trading Corporation

- Founded: 1982

- Founder: Craig R Smith

- Headquarters: Phoenix, Arizona

- Products: Gold, silver, platinum, palladium, numismatics

- IRA Services: Yes

- Storage: Domestic and Switzerland

- Customer Rating: 4 out of 5

- BBB Rating: A plus

Swiss America is one of the oldest precious metals firms in the country.

But longevity alone does not equal excellence. What shocked me was how different they operate today compared to their reputation from ten or twenty years ago.

Important Disclosures

This Swiss America review is provided for educational and informational purposes only and should not be considered financial, legal, or tax advice.

Investing in precious metals involves risk, including potential loss of principal.

Always consult a licensed financial advisor, CPA, or tax professional before making investment decisions.

This website may receive compensation if you choose to work with companies mentioned on this page.

This compensation does not influence how companies are reviewed, rated, or discussed.

All opinions expressed are independent.

Last Updated: December 2025

This review is reviewed and updated periodically to reflect changes in company practices, ratings, and regulatory guidance.

How This Swiss America Review Was Researched

This Swiss America Review was created using a structured research and verification process designed to reduce bias and improve accuracy.

Research included:

-

Direct phone communication with Swiss America representatives during U.S. business hours (December 2025)

-

Review of Swiss America’s products, IRA services, storage options, and educational materials

-

Analysis of independent ratings and complaint records from the Better Business Bureau (BBB) and Business Consumer Alliance (BCA)

-

Comparison with other major precious metals dealers and Gold IRA providers

-

Cross-referencing IRS rules related to IRA-eligible metals and approved storage requirements

What was evaluated:

- Customer service

- Pricing explanations

- IRA process

- Storage options

- Buyback policies

What was not evaluated:

- Live purchase execution

- Delivery timelines

- Long-term storage redemption

What Is Swiss America & Why People Still Talk About Them

Swiss America began in 1982, before most of the well known online dealers existed.

Back then, people bought precious metals by phone using brochures and mail order.

Swiss America still uses that same business model today.

When I personally called them, the experience felt like going back in time but in a good way.

No fast talking commission based rookie.

No aggressive upsells.

Just a calm representative who actually knew the metals market.

They encourage diversification into precious metals for safety, liquidity, privacy, and long term wealth protection.

These principles are at the core of their brand.

The company positions gold and silver as a real store of value, especially during inflation or political instability.

Anyone reading a gold ira guide already knows the appeal.

What struck me most was their emphasis on education.

Before talking about products or prices, they asked questions about my goals.

This is rare in today’s market.

Where Swiss America Is Located

Swiss America is headquartered in Phoenix, Arizona.

They also have mailing addresses in Scottsdale and Las Vegas.

Despite the name, the company is not based in Switzerland.

I noticed this confuses a lot of people since the company name has “Swiss” in it.

While Swiss America does offer storage options in Zurich, they don’t operate an office there.

Swiss America Products: What They Really Offer

Swiss America sells a large variety of metals:

Gold

- American Gold Eagle

- Canadian Maple Leaf

- South African Krugerrand

- Austrian Philharmonic

- Swiss 20 Francs

- Gold bars in multiple sizes

Silver

- American Silver Eagle

- Canadian Silver Maple Leaf

- Silver rounds and bars

- Austrian Silver Philharmonic

- Mexican Silver Peso

Swiss America silver rounds have been in circulation among collectors for decades. It’s not uncommon to see investors discussing Swiss America rounds purchased in the 1980s that are still being held or passed down today, which speaks to their long-term recognition as legitimate bullion.

Platinum

- American Eagle

- Canadian Maple Leaf

- Platinum bars

- Smaller fractional options

Numismatic and Rare Coins

Swiss America is known for handling a lot of numismatics.

Some investors like these, but if your goal is retirement diversification, bullion is safer and has tighter spreads.

Among experienced coin collectors, Swiss America silver rounds are generally treated as bullion rather than collectible numismatic items. Discussions in collector communities consistently note that their value closely tracks silver spot prices, with limited premiums based on branding alone.

IRA Eligible Metals

Swiss America offers all standard IRA-eligible bullion.

Everything meets IRS purity rules.

If your goal is retirement protection, avoid collectibles and stick with approved bullion, especially if you are comparing options to Goldco or reading an Augusta Precious Metals review.

Multiple experienced Swiss America collectors clearly state

Swiss America rounds trade as bullion

They are not treated as rare numismatics

Premiums over spot are usually minimal

Condition (BU vs circulated) matters far less than silver content

How Swiss America Rounds Are Viewed by the Collector Community

In independent collector discussions, Swiss America silver rounds are typically grouped with other privately minted bullion products. Collectors focus on silver content and spot price rather than brand-driven premiums, which is common for most privately minted rounds.

What Real Customers Say About Swiss America’s Gold, Silver, and Platinum Products

After going through hundreds of verified reviews from BBB and Google, a clear pattern emerges around how investors experience Swiss America’s precious metals products in real life, not just on paper.

Most customers don’t talk about flashy pricing tools or online dashboards. Instead, they focus on the quality of the metals they receive, the guidance they get when choosing between gold, silver, or platinum, and the confidence they feel after the purchase.

Consistent Feedback on Product Quality

Across long term clients and first time buyers alike, customers repeatedly describe Swiss America’s gold and silver coins as high quality, legitimate investment grade products.

Many reviews come from repeat buyers who have been working with the company for years, even over a decade, which strongly suggests satisfaction with what they received, not just the sales process.

Several investors mention that the products “stand on their own,” meaning they felt comfortable with the purity, authenticity, and long term holding value of the metals they purchased, whether physical delivery or storage based.

While gold and silver are the most commonly discussed, platinum buyers also note that the company clearly explains when platinum makes sense and when it doesn’t, instead of pushing it aggressively.

Guidance Matters More Than the Metal Itself

One thing that stands out when reading these Swiss America reviews is that customers often credit their positive experience not just to the metal, but to how the product was selected.

Many novice investors say they came in unsure whether to buy gold, silver, or a mix, and were walked through:

-

The role of each metal in a diversified portfolio

-

Timing considerations during volatile markets

-

The difference between bullion and collectible coins

This guidance is repeatedly described as patient, educational, and pressure free, which matters a lot when you’re committing retirement money.

Long Term Confidence After the Purchase

Another important theme is what happens after the transaction.

Customers often mention:

-

Feeling informed rather than confused

-

Receiving follow ups and market updates

-

Being comfortable holding their metals long term

Several reviewers specifically say they became repeat customers, which usually only happens when investors remain confident in both the products they bought and the advice they received.

From an investor’s perspective, that tells me the metals themselves met expectations once emotions cooled and the decision had time to settle.

My Take After Reviewing These Experiences

Based on these real world reviews, Swiss America’s strength isn’t flashy technology or instant online checkout.

It’s the combination of solid precious metals products and high touch, old school guidance.

If you value:

-

Legitimate, investment grade gold and silver

-

Clear explanations before buying

-

Confidence that lasts beyond the first purchase

Then the product experience described by real customers aligns well with a conservative, long term precious metals strategy.

Swiss America Gold IRA Services, First Hand Insight

Based on direct research into Swiss America’s IRA process, customer documentation, and how precious metals IRAs actually operate under IRS rules, their Gold IRA service follows a traditional, custodian-driven structure rather than a fully automated online model.

Swiss America helps clients open Traditional, Roth, and self-directed IRAs that hold IRS-approved physical precious metals.

The company does not act as the IRA custodian itself.

Instead, it works alongside third-party custodians and approved depositories, which is standard across the industry.

Below is how the process works in practice.

Step One: Account Setup and Human Review

The process begins with paperwork and direct communication with Swiss America’s IRA support team.

Clients typically speak with a representative who explains eligibility rules, contribution limits, and rollover requirements.

This step is manual by design.

Because precious metals IRAs fall under strict IRS regulations, documentation must be reviewed and coordinated with the custodian before any funds move.

Step Two: Funding Through Transfer or Rollover

Once the account is established, funding is completed through a direct transfer or rollover from an existing retirement account, such as a traditional IRA or 401(k).

At this stage, timing is dictated by the releasing institution and the custodian, not Swiss America alone.

This is why Gold IRA setups often take longer than standard brokerage transfers.

Step Three: Selecting IRA-Eligible Metals

After funds clear, clients choose from IRA-eligible gold, silver, platinum, or palladium products that meet IRS purity standards.

Unlike online bullion dealers that rely on live carts and instant checkout, Swiss America handles this step through direct confirmation. Pricing, product availability, and eligibility are reviewed before the purchase is finalized to ensure compliance.

Step Four: Depository Shipment and Custodial Storage

Purchased metals are shipped directly to an IRS-approved depository in the name of the IRA, not to the client.

Home storage is not permitted for IRA metals under current IRS rules.

Once received, the metals are recorded by the custodian and held in secure storage for the duration of the IRA.

How Swiss America’s Role Fits In

Swiss America functions primarily as:

-

The precious metals dealer

-

An IRA facilitator coordinating between the client, custodian, and depository

They also place heavy emphasis on education, particularly around retirement diversification, inflation risk, and long-term currency exposure.

This educational focus appears frequently in both their materials and customer feedback.

A Realistic View of the Experience

This is not a modern, app-based experience.

Compared to newer platforms that advertise instant dashboards or online checkout, Swiss America’s process involves:

-

More phone conversations

-

More paperwork

-

Fewer digital shortcuts

That trade-off is intentional.

For investors who prefer a traditional, guided approach, especially those rolling over large retirement balances, this slower and more deliberate process can feel reassuring rather than inconvenient.

How to Evaluate This Against Other Options

If you’re comparing retirement strategies, it’s worth researching broader industry terms such as:

-

gold IRA rules

-

gold IRA fees

Understanding how custodians, dealers, and depositories interact will help you evaluate whether a hands-on provider like Swiss America fits your expectations.

Swiss America Fractional Ownership Program

This is an interesting feature that many competitors do not offer.

Swiss America allows customers to buy fractional ownership of gold or silver bars.

Instead of buying a full bar, you can buy a portion as small as 0 point zero one ounce.

They issue a certificate showing your percentage ownership.

You can track your holdings online and sell them through Swiss America at market rates.

This is helpful for small investors who want access to premium metals without buying full bars.

It also gives investors an easy way to scale up over time.

Swiss America Prices & Fees

Swiss America does not publish live pricing on its website.

Prices change daily based on spot rates, premiums, and availability.

What shocked me during my call was how complex the pricing can be.

They walk you through everything slowly, but it is not as transparent as newer online dealers.

Markups vary depending on the product. Bullion premiums are normal. Numismatic premiums can be much higher.

If you want the most accurate pricing, always call them directly and ask for the out the door total including shipping and insurance.

Pricing Context

Precious metals pricing generally includes the spot price plus a dealer premium. Premiums vary based on product type, demand, fabrication costs, and order size.

Swiss America’s bullion premiums generally fall within industry norms for phone-based dealers. Collectible and numismatic coins typically carry higher premiums due to rarity and grading factors.

Investors focused on the lowest possible premiums may prefer large online retailers, while those seeking education and guided service may prefer a traditional firm like Swiss America.

Storage Options With Swiss America, My First Hand Experience

When I personally called Swiss America to understand how storage works, the first thing that stood out was how straightforward they were.

There was no attempt to oversell anything or dress it up.

They explained the options clearly, including what is allowed, what is not, and where people often get confused.

Home Storage, What Is Actually Allowed

Swiss America does allow customers to take delivery of metals and store them at home, but only for non IRA purchases.

When I asked directly about home storage inside an IRA, they were clear that this is not permitted.

Home storage IRAs often violate IRS rules and can create serious tax problems.

They did not promote any workarounds or questionable structures, which is what you want to hear if you care about compliance.

If you are buying metals outside of a retirement account, home storage is an option. Inside an IRA, it is not.

IRA Storage Through Approved Vaults

For Gold IRA accounts, Swiss America uses IRS approved third party depositories.

When this came up on the call, they explained that IRA metals are shipped directly to a secure vault, never to the client.

Storage locations include facilities in the United States and Switzerland, depending on availability and client preference.

Metals stored in these vaults are fully insured, commonly through Lloyds of London or equivalent coverage, monitored around the clock, and audited on a regular basis.

This setup is standard across reputable Gold IRA companies and is required to keep the account compliant.

Fractional and Pooled Storage Explained Simply

I also asked about fractional storage, since this is something that confuses a lot of people.

For fractional bars or pooled programs, metals are stored in large shared vaults.

You own a defined portion of the metal, but the bars are not individually assigned to you.

Physical delivery usually requires meeting minimum redemption levels.

This type of storage lowers costs but reduces flexibility, which is why it is typically used by investors who are focused on long term holding rather than access.

Vault Security and Oversight

Swiss America’s storage partners operate the way you would expect established vaults to operate.

Facilities are monitored 24/7, insured, and regularly audited.

Nothing about this stood out as unusual compared to other large precious metals firms I have worked with or reviewed.

Shipping and Delivery, What to Expect

For physical delivery orders, Swiss America ships using established carriers such as UPS, FedEx, and USPS.

Smaller orders are often sent using USPS First Class.

Larger orders usually ship via FedEx or UPS and require a signature on delivery.

Shipping is not free.

You pay the actual carrier cost based on order size and delivery method. I prefer this approach, since it avoids hidden markups that get baked into so called free shipping offers.

Educational Resources and Research

Swiss America puts a lot of emphasis on education.

On their website you will find free newsletters, economic updates, inflation research, historical charts, blog articles, and videos featuring Craig Smith. There are also guides specifically written for retirement investors.

The site feels more like an educational resource than a sales funnel, which is intentional.

Payment Options

Swiss America accepts multiple payment methods, including cash at their office, credit cards, debit cards, ACH transfers, and bank wires.

Each option has conditions. Larger orders almost always require a wire transfer for security reasons, which is standard practice in this industry. International buyers may have fewer options depending on location.

Buyback Program, Returns, and Cancellations

Swiss America offers a standard buyback program and will repurchase metals at competitive market based prices.

Returns require authorization and return shipping is the responsibility of the client.

Cancellations must be made before shipment.

If market prices move after the order is placed, you may be charged or refunded the difference.

This mirrors how most reputable precious metals dealers operate.

Website Experience, Old School by Design

Swiss America’s website is simple and easy to navigate.

You will not find live pricing or an online shopping cart.

Everything is handled by phone or email. The site is more educational than transactional.

Personally, I like this style. It is organized, clear, and makes it easy to find what you are looking for without distractions.

That said, it will appeal more to older investors than to people who expect app based tools.

Customer Service, My Direct Experience

When I personally called Swiss America, the customer service surprised me in a good way.

They were patient, knowledgeable, and took time to answer questions without pushing expensive products.

They asked thoughtful questions and focused on explaining options rather than steering me toward higher priced items.

Support is available Monday through Friday during business hours, with no weekend coverage.

The overall experience felt very similar to what I have seen with firms like Augusta Precious Metals and Goldco when I worked with them in the past. Education first, pressure second.

Swiss America Ratings from Trusted Sources

Independent Verification

To ensure accuracy, information in this review was verified using independent third-party sources wherever possible, including:

Better Business Bureau (BBB) company profile and complaint history

Business Consumer Alliance (BCA) ratings

IRS publications related to precious metals IRAs

Industry-standard vaulting and insurance practices used by reputable metals dealers

Claims related to storage, insurance, and IRA eligibility were reviewed against publicly available regulatory and industry standards, not solely company marketing materials.

If you are a constant reader of our website, you will know that we really are keen on showing how these precious metals companies are rated by trusted experts in the industry.

We’re going to see how Swiss America is rated and reviewed from two reputable websites.

You can see the following below (UPDATED December 2025).

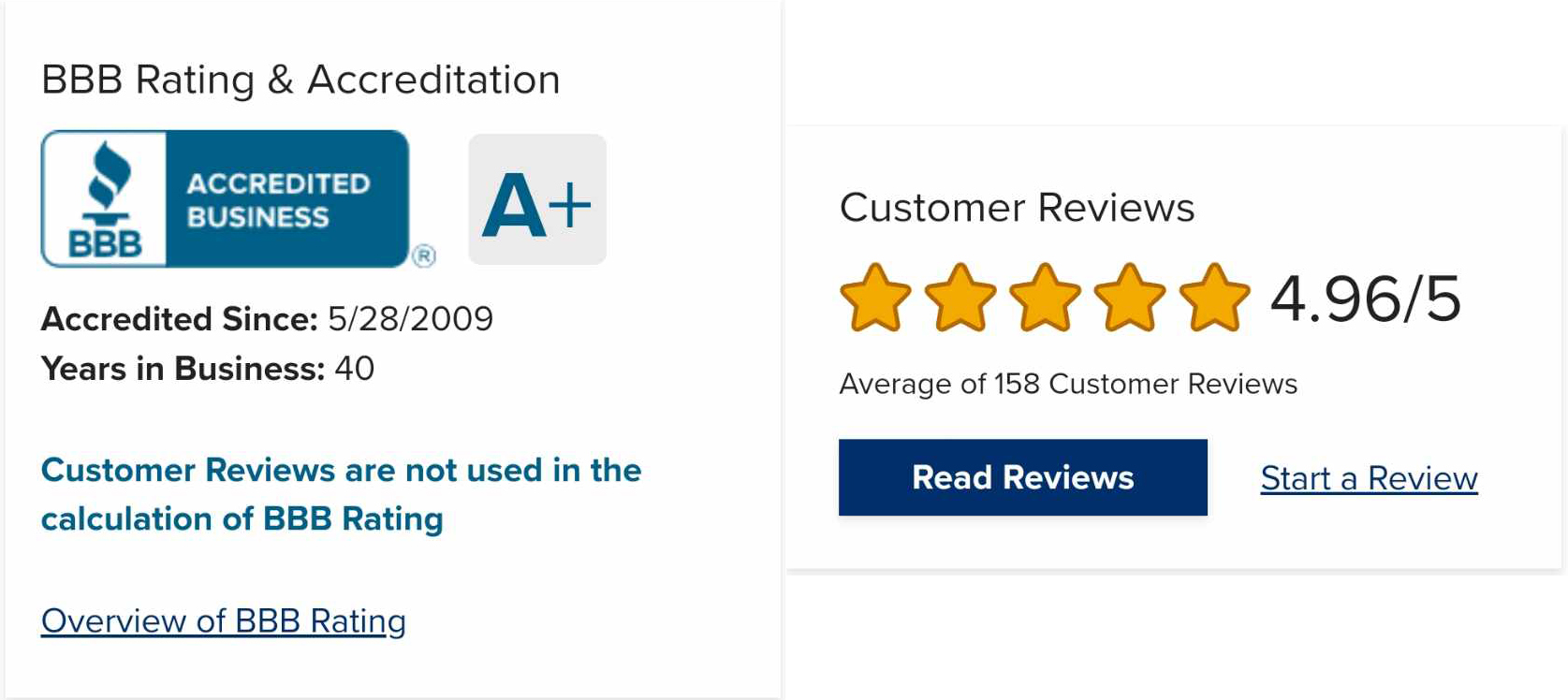

Swiss America BBB Rating

Swiss America has an A+ grading in their BBB profile and has been accredited long ago since 2009.

Out of 158 customer reviews, they have received a 4.96/5 star rating.

(Swiss America Review Updated 2025. I just checked again their BBB profile as of 17th December 2025, see the screenshot below)

Looks like their total user reviews went down to just 96 in total, as you can see above Swiss America Trading’s official BBB profile used to have 158 reviews when I last checked back in September 2023.

After all, there are services online that will help you remove negative BBB reviews.

This will make you take online reviews with a grain of salt next time especially when making an important financial decision..

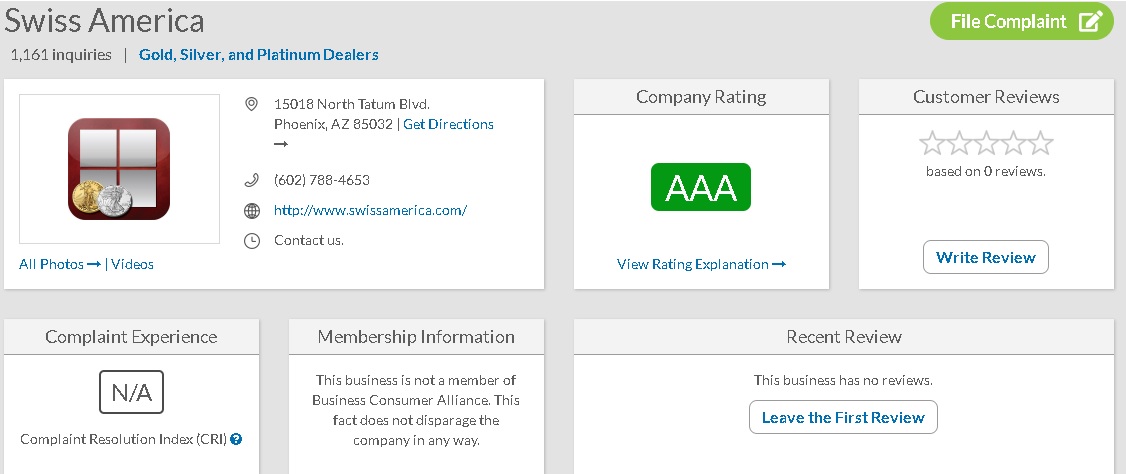

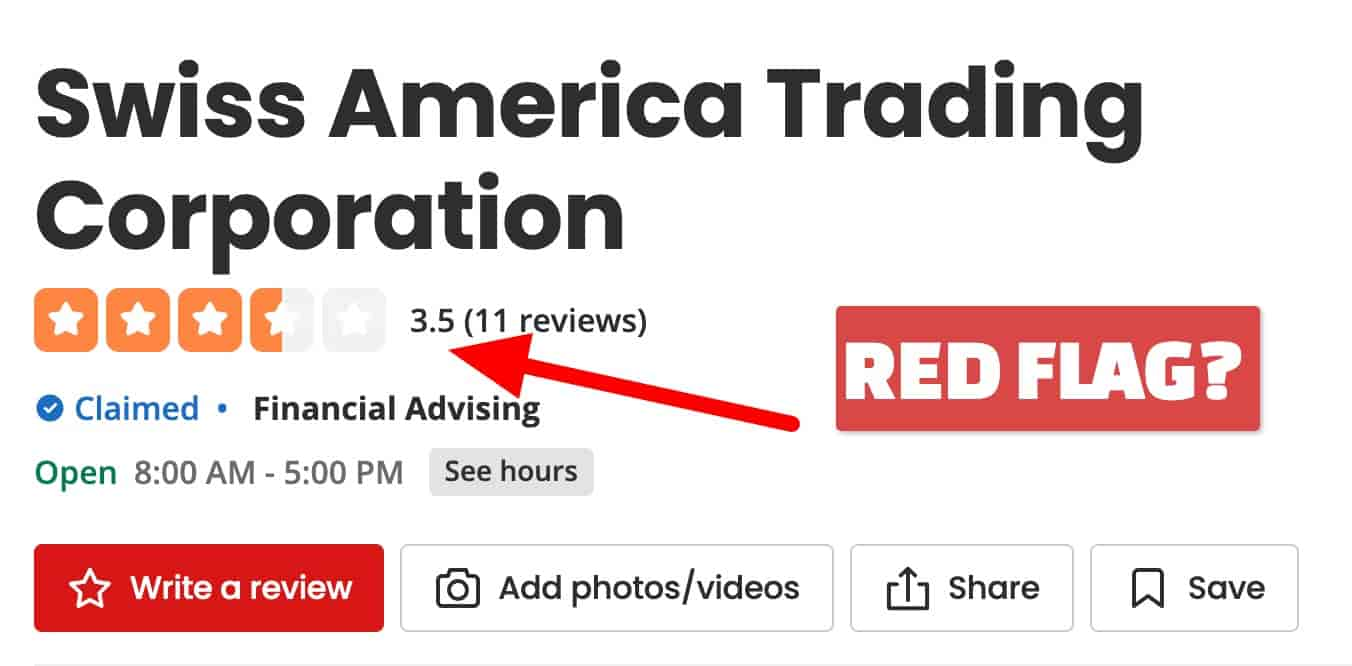

Swiss America BCA, Yelp & TrustPilot Rating

Interestingly, Swiss America has an AAA company rating from BCA but doesn’t have customer reviews even in 2025-2026.

In the other hand, they also do not have a Trustpilot rating as of this time of writing (I confirm also as of December 2025 Swiss America got no trustpilot reviews)

When it comes to Yelp, Swiss America does have 11 reviews with a 3.5 rating.

I can see only one review on Yelp that is recent and posted in 2025, the rest of reviews are from 2023 and 2019.

Swiss America Complaints

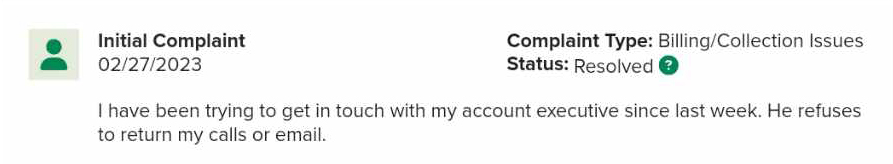

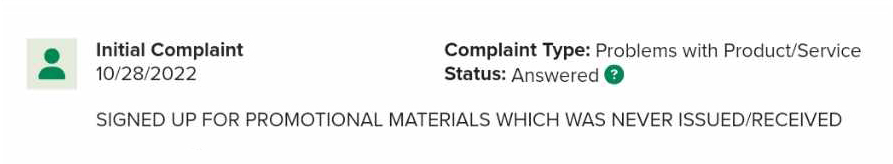

As you have read above, I have only seen 2 complaints in my research regarding Swiss America.

This is a big green flag if you ask me.

You can see the following below:

The complaints were due to unresponsive customer service and issues with promotional materials.

The positive news about this was that both complaints were answered and resolved quickly by Swiss America.

This says a lot about how the company is professional about concerns.

I did a quick check of the complaints, the 2022 one disappeared while the 2023 one stayed, but there is another complaint from 2024.

The 2024 complaint was about a client who wanted his $200,000 investment back which was refunded by the Swiss America’s team.

Swiss America Compared to Competitors

Here I will compare the products, services and the shipping times of Swiss America versus some of the companies I have personally worked with in the past.

| Company | Products | Services | Shipping |

|---|---|---|---|

| Swiss America | Gold, silver, platinum, palladium | Buying, selling, IRA, storage | No free shipping |

| JM Bullion | Gold, silver, platinum | Buying, selling, storage | Free shipping over $199 |

| APMEX | Gold, silver, platinum | Buying, selling, storage | Free shipping over $500 |

| Money Metals | Gold, silver, platinum | Buying, selling, storage, loans | Free shipping over $199 |

| Goldco | Gold IRA specialists | IRA rollovers, education | Varies |

|

|

4.0/5 |

|

Products Gold, platinum, silver, and copper |

|

Services Buying, selling, storage |

|

Shipping No Free shipping on all orders regardless of the price. Shipping fee dependent on courier |

|

|

4.4/5 |

|

Products Gold, Palladium, silver, platinum, and rhodium |

|

Services Buying, selling, storage, loans |

|

Shipping Free shipping for orders over $500. $7.97 shipping for orders under $500. |

|

|

4.6/5 |

|

Products Gold, platinum, silver, rare coins, and palladium |

|

Services Buying, selling, storage |

|

Shipping Free shipping for orders over $25k. Shipping fee depends on orders under $25k. |

|

|

4.3/5 |

|

Products Gold, platinum, silver, copper, palladium |

|

Services Buying, selling, storage, loans |

|

Shipping Free shipping on orders over $199. Shipping is $7.99 for orders under $199. |

Swiss America is strongest in personal service and education. Weakest in online convenience and transparent pricing.

If you want a guided IRA experience, you may compare this with a Goldco review or Augusta Precious Metals.

Pros and Cons of Swiss America

Pros

- Strong educational content

- Forty plus years in business

- A plus BBB rating

- Knowledgeable staff

- Fractional ownership program

- Wide selection of metals

Cons

- Outdated website I noticed there are a lot of broken links and outdated articles.

- No live pricing

- Shipping not free

- Customer service not available 24/7

- Some products have higher markups

- A noticable chunk of BBB reviews were deleted.

Is Swiss America a Scam?

No, in my opinion and based on my experience contacting and testing them on November, 14. 2025 I believe Swiss America is a legitimate company

They have decades of experience, excellent BBB ratings, and a clean reputation. (Even though the fact they deleted reviews on BBB still bothers me a bit.)

They are not the fastest nor the most modern company, but they are trustworthy.

They are a good fit if you prefer personal service, traditional phone based ordering, and educational guidance.

They are not ideal if you want instant online checkout or live pricing, for that you can check out the following trustworthy companies:

Investment Risks & Suitability

Precious metals are not suitable for every investor.

Potential risks include:

Market price volatility

Opportunity cost versus income-producing assets

Higher premiums on certain products, especially collectibles

Liquidity differences between bullion and numismatic coins

Ongoing storage and insurance costs

Tax and IRA considerations:

Precious metals IRAs must follow strict IRS rules

Early withdrawals may result in taxes and penalties

Improper storage arrangements can disqualify an IRA

Swiss America may be suitable for long-term investors seeking diversification and education. It may not be appropriate for short-term traders or investors seeking instant online transactions.

Final Thoughts, Should You Choose Swiss America

If you prefer old fashioned service, strong education, and thoughtful advisors rather than automated websites, Swiss America is worth considering. They are steady, experienced, and respected.

But compare them with other gold ira companies if you want:

- Faster IRA setup

- Live pricing

- More online convenience

- Modern interfaces

Swiss America is honest and reliable but traditional in every sense.

Thank you for reading my Swiss America Review. If you have questions, feel free to leave a comment.

Review Update Policy

This Swiss America review is updated periodically to reflect changes in Swiss America’s services, pricing practices, ratings, or regulatory requirements. Updates are made when new information materially affects the accuracy or usefulness of this content.