SD Bullion is one of the largest online precious metals dealers and gold IRA rollover companies in the U.S. They?re a well-established and reputable company with a long history of successfully delivering on their promises. They are especially well known for their competitive pricing (e.g., reasonable markups over spot price) and their broad product catalog.

That said, no gold IRA company is a perfect match for every customer. They all have their advantages and disadvantages, and SD Bullion is no exception.?

This SD Bullion review covers pricing, customer experience, storage options, IRA eligibility, and how SD Bullion compares with competitors. So you can decide if it?s the right fit for you.

- Key Takeaways

- SD Bullion Review Quick Summary

- SD Bullion Lawsuit

- What Precious Metal Products Are Authorized for IRAs?

- SD Bullion Fees

- Does SD Bullion Sell Fake Gold & Silver?

- SD Bullion Recent Buyer Experience (late Oct?Nov 2025)

- Who SD Bullion Is Best For

- ?SD Bullion vs. Augusta Precious Metals: A Side-By-Side Comparison

- Is SD Bullion a Scam? The Bottom Line

- Frequently Asked Questions About SD Bullion

Key Takeaways

- SD Bullion, founded in 2012, is a large online precious-metals dealer known for low prices and a wide selection of coins and bars.

- The company was started by the founders of Silver Doctors and has served hundreds of thousands of customers.

- SD Bullion offers gold, silver, and platinum coins, bars, and rounds in bullion form, as well as some collectibles and jewelry items, as well as a selection of basic survival supplies.

- The company has recently been named as defendant in a class action lawsuit claiming the company falsely advertises ?the lowest price.? They have not admitted wrongdoing.

- No minimum order, making SD Bullion attractive for novices and small accounts.

- Free U.S. shipping on orders over $199?

- Accepts bitcoin

- ?Three months free vault storage for new clients.

- Percentage-based vaulting fee may not be suitable for large accounts.?

- Reviews praise SD Bullion?s pricing, but some customers have complained about customer service and order communication.

SD Bullion Review Quick Summary

Name: SD Bullion

Co-Founder: Tyler Wall

Price: Varies depending on your investments

Rating: 4/5

What is SD Bullion?

SD Bullion, short for Silver Doctors Bullion, is an online precious metals dealer based in Ottawa Lake, Michigan. It was founded by Tyler Wall in 2012.

SD Bullion was established by the founders of Silver Doctors Network, an online hub that provides information to investors on the current status and situation of the precious metals market.

Since then, SD Bullion has grown to be one of the country?s most popular sites to buy gold and silver bars and coins. Over the years, they?ve shipped more than two million orders to more than 450,000 customers representing more than $5,000,000,000 in trusted transactions.

And a few unsatisfied clients, too. More about that below..?

Where Is SD Bullion Located? (My First-Hand Take)

When I started digging into SD Bullion?s background, one thing I appreciated right away was how transparent they are about their locations. Unlike some online-only dealers that hide behind P.O. boxes, SD Bullion actually lists multiple physical addresses tied to different parts of their business.

Here?s the breakdown:

-

Toledo, OH ? Headquarters

This is where SD Bullion is officially based. Most of their executive and administrative operations happen here. -

Ottawa Lake, MI ? Depository Operations

Just across the Ohio border, Ottawa Lake is connected to their storage arm, SD Depository LLC. This is where clients? metals are securely stored under IRA-approved conditions. -

Fort Worth, TX ? Mailing / Administrative Address

You?ll sometimes see this address on Better Business Bureau listings or corporate documents for SD Bullion, Inc. It appears to function mainly as a registered or mailing address, not a physical storefront.

Overall, it?s reassuring to see a company in this industry openly disclose where they operate, it signals legitimacy and adds another layer of trust for investors.

SD Bullion Lawsuit

Investors should know about a recent civil suit targeting SD Bullion:?In July 2025 a class?action lawsuit, Vickery v. SD Bullion Inc., et al. (Case No. 3:25-cv-01915, U.S. District Court for the Southern District of California), was filed against SD Bullion and several affiliated companies.?

The plaintiff, Robert Vickery, alleges that SD Bullion falsely advertised that its bullion products consistently offered the ?lowest price? on the market. He claims he purchased gold coins from SD Bullion in May 2025 in reliance on this representation, only later discovering the identical coins were listed by a competitor for about $102 less each.?

The legal complaint argues that SD Bullion?s ?lowest price? claims were literally false, pointing out that fluctuations in the metals market make it impossible for any dealer to always offer the lowest price.

The suit claims violations of the federal Lanham Act and California?s Unfair Competition and False Advertising laws, and seeks to represent a nationwide and California subclass of buyers who purchased coins from SD Bullion after May 18, 2018. Remedies sought include damages, restitution, and injunctive relief.

SD Bullion has not admitted wrongdoing, and the case is still pending.

The phrase, ?Lowest prices, period? still features prominently on their website, so the company is sticking to its guns.?

Jason?s Note: I wouldn?t read too much into the lawsuit. This kind of marketspeak ?puffery? is common across many industries. Also, SD Bullion is generally well-regarded for competitive pricing.

But I?d be remiss if I didn?t mention the lawsuit, so you can decide on the validity of the accusation yourself.

At any rate, it?s always a good idea to compare pricing at multiple gold companies, especially for bullion, which is designed to be sold as a commodity based on the market price of the metal content itself, and not on subjective criteria.?

What Does SD Bullion Sell?

SD Bullion sells gold, silver, and platinum bullion rounds, bars, and coins,? including bullion suitable for IRAs. Products include:

- gold and silver American Eagles,

- American Buffaloes,

- Australian Kangaroos,

- Canadian Maple Leafs,

- Chinese Pandas,

- Britannias,?

They also sell a variety of non-IRA-qualified bullion products and some collectible/numismatic products, as well. At this time, they are not listing any palladium products.?

Apart from the items listed above, SD Bullion also sells water filters, safes/vaults and survival food.

IMPORTANT: ?If you want to purchase precious metals for your IRA, you must buy IRA qualified bullion. Numismatics and collectible coins are not suitable for IRAs. Owning a prohibited metal product in your IRA could cause your account to be disqualified, triggering taxes and penalties.

What Precious Metal Products Are Authorized for IRAs?

To qualify for IRA investment, each coin or bar must meet strict minimum fineness requirements. For gold, the metal must be at least 99.5% pure. Silver products must reach 99.9% purity, while both platinum and palladium are required to meet an even higher standard of 99.95% fineness.

Moreover, they must be manufactured in a national mint, or in especially certified facilities.

Not every popular coin meets these exacting requirements. For example, the South African Krugerrand, a widely-collected and circulated gold coin, doesn?t make the grade, as it?s only 22 karats (.9167 fine), short of the ?four nines? standard normally required of non-U.S.-minted coins.?

IRA Minimum Purity Standards

| Metal | Required Fineness |

| Gold | 0.995 or higher |

| Silver | 0.999 or higher |

| Platinum | 0.9995 or higher |

| Palladium | 0.9995 or higher |

There is one notable exception to these purity requirements:? the American Gold Eagle coin.?

Although Gold Eagles are minted as 22-karat (.9167 fine)coins meaning they contain a small amount of copper for added strength they still qualify for IRA use. That?s because the alloy is structured so that the coin contains the full troy ounce of pure gold stated on its face, with the copper added on top of that amount.

As a result, Gold Eagles weigh slightly more than comparable .9999 coins like the Gold Buffalo or the Canadian Maple Leaf, even though their pure gold content is the same.

Before buying any metals for your IRA, confirm that they meet the IRS requirements for fineness and manufacturing quality.

SD Bullion Storage Service

Unlike most gold companies, SD Bullion offers in-house storage service at its own secured vault facility. They don?t contract out to a third party.

This arrangement gives them the flexibility to offer three months of free storage to new customers.?

Your assets are segregated from other investor?s metals, and fully insured by Lloyd?s of London.

See below for the SD Bullion storage fee schedule.

How to buy from SD Bullion?

Buying from SD Bullion is designed to be a straightforward and easy process. Since SD Bullion has a website for its e-commerce, clients can access their product catalog and choose which products to buy.

After you have found the right items, you can add them to cart, and proceed to the payment. Once the payment is confirmed and cleared, SD Bullion will ship your products to your preferred location.

Information on payment methods and shipping are located below.

First-hand: SD Bullion ?new customer? promo (5 oz at/near spot)

Quick gist:

SD Bullion runs newbie promos from time to time (most famously ?5 oz at spot?). It?s not always live, and when it is, the real cost depends on shipping/tax and whatever else you add to hit the free-shipping threshold. Community posts show the deal has existed repeatedly over the years, but availability comes and goes.

What I did:

-

Signed up with a fresh email, added the ?new customer? silver bar to cart, and watched for the discount to apply at checkout.

-

If the cart was under the free-shipping minimum, the savings shrank fast; if I crossed the free-shipping line with other low-premium silver, it penciled out better. (Several stackers reported the same dynamic?great headline, but shipping/tax can change the math.)

What real buyers say (recent 2025 chatter):

-

It exists, but it?s not 24/7. People have grabbed the 5-oz ?spot? bar multiple times over the years; sometimes the offer shows up via email after account creation, sometimes on a deals page, and sometimes? not at all.?

-

Free shipping matters. Under the threshold, shipping/taxes can erase the ?spot? win; over it, the math looks better.?

Gotchas I noticed:

-

?At spot? can land a bit above spot in practice?fees, tax, or deal structure. Don?t assume miracle pricing; confirm the per-oz out-the-door. One-time/one-address limits are common on these intro deals (per assorted user reports). If you?ve ordered before, odds drop.?

How to try it (simple checklist):

-

Create a new account ? wait for any welcome email with a promo.

-

Search the site?s Deals page and Google ?SD Bullion spot deal? to surface any live landing pages.

-

Add the promo item ? add low-premium silver to get past the free-shipping threshold ? check final per-oz cost before paying.

-

Bottom line:

Nice way to test SD without overcommitting if the deal is live and you optimize the cart. Don?t chase the headline; calculate the final per-oz delivered and compare against a couple of other low-premium shops that often undercut day-to-day pricing.

Can I Sell Gold to SD Bullion?

Yes, SD Bullion happily buys gold, silver, platinum, and palladium. However, you must sell a minimum amount for them to make you an offer.?

- Silver: 20 ounces

- Gold: 1 ounce

- Platinum: 1 ounce

- Palladium: 1 ounce

To sell your metals to SD Bullion, call them and describe your holdings. They?ll make you an offer. If you accept, they?ll send you a confirmation with shipping instructions, as well as discreet shipping labels.

Follow the directions and ship the product back to the address on the label.

SD Bullion?s team will inspect your shipment for authenticity. Once verified and approved, you?ll receive your payment in 1 to 3 business days.?

SD Bullion Fees

SD Bullion Shipping Costs

SD Bullion ships small orders at a flat rate shipping and insurance of $9.95 per order within the United States.?

?If your U.S.order is more than $199.00 you will see a free shipping option at checkout.?

International orders are quoted separately per order and location

SD Bullion Storage Fees

After the initial three-month free storage period for new customers ends, SD Bullion has a hybrid fee schedule for vault/depository services:?

There?s a flat monthly fee of $9.99 per month. You?ll also pay an additional annual fee based on the amount of assets you have in storage.

Here?s the breakdown:?

| Metal Type | Annual Rate |

| Silver | .39% |

| Gold | .29% |

| Platinum | .29% |

Jason?s note:?

The percentage-based storage fees can add up quickly. With SD Bullion, your percentage-based storage costs would be $290 per year to store $100,000 in gold, and $390 per year to store the same amount of silver.

Add to that another $120.00 per year in monthly charges.?

?If you are an Investor with a larger account, you should consider other gold companies that don?t charge a percentage, but charge a flat rate, regardless of the amount you hold in storage.?

Does SD Bullion offer IRA services?

SD Bullion is not an IRA custodian directly. However, it does offer IRA-eligible precious metals.

Moreover, SD Bullion can help you set up your own IRA account. They have a preferred custodian, which is New Direction IRA. You can also select another? IRA custodian, including:

- Goldstar Trust

- Provident Trust

- The Entrust Group

- Kingdom Trust

- Equity Institutional

Take note that IRA fees may vary depending on your custodian.

SD Bullion Payment Methods

SD Bullion accepts several payment methods. Below are the following ways for you to pay for your orders.

Bank Wire

Bank wires are required for orders over $20,000 and not available for purchases under $500. Instructions are emailed after checkout. Payment must arrive within 72 hours, and funds usually clear in 24?48 hours.

Note: If you want to pay electronically using your bank account and routing number, choose e-Check, not bank wire.

Personal Check

Accepted for orders up to $20,000. Checks must be postmarked within 72 hours and reach SD Bullion within 7 business days. Funds typically clear in 3?5 days.

Cashier?s Check

Also allowed for orders up to $20,000. Follow the same timing rules as personal checks: postmark within 72 hours, arrive within 7 days, and expect 3?5 days for processing.

Postal Money Order

Available for orders up to $9,999. Must be postmarked within 72 hours and received within 7 business days. Processing typically takes 3?5 days.

Credit/Debit Card

Cards are accepted for purchases up to $5,000. Visa, Mastercard, and Discover are supported. Card payments are not eligible for the 4% cash discount. Payments usually clear within 24?48 hours.

Bitcoin

Bitcoin can be used for orders up to $250,000. This method does not qualify for the 1% cash discount. After placing your order, you must complete payment through BitPay within 15 minutes. Funds usually clear in 24 hours.

PayPal

Accepted for purchases up to $500. PayPal payments do not receive the 4% cash discount. Funds typically process within 24 hours.

e-Check (Electronic Check)

Available for orders up to $10,000 and does qualify for the 4% cash discount. Only checking accounts are accepted. New customers must verify their bank through Plaid. If your bank isn?t supported, you?ll need another payment method. e-Check payments generally clear in 3?5 business days.

International Orders

International customers can pay for orders via Credit Card, Bitpay, or Bank Wire. Please note that international bank wire transfers go through an intermediary institution, which typically adds a fee of their own. SD Bullion will tack this fee onto your invoice. Your order will not ship until you pay this additional fee by credit card.

SD Bullion Shipping

SD Bullion ships their products via FedEx, USPS, and UPS, fully insured. Upon delivery, a signature from the owner or receiver is required.

All domestic orders that are over $199 will be shipped and insured FOR FREE. Orders less than $199 will be charged a fee of $9.95 for shipping and insurance.

For international orders, SD Bullion does accept international shipping. The shipping fee will be calculated upon checking out your order.

Can I return my orders?

Yes, you can. You have within 3 business days after the receipt of your shipment to notify SD Bullion that you want to return your orders.

Moreover, the products you returned, with the exception of the SD24K product line, are subject to a 5% restocking fee or $35, whichever is higher.

Moreover, SD24K jewelry products that are returned are subject to a 10% restocking fee.

Does SD Bullion Sell Fake Gold & Silver?

I don?t see a pattern of SD Bullion pushing counterfeits, but I have seen scattered community stories (Especially on Reddit) over the years (some legit concerns, some clearly misunderstandings). Here?s how I handle it and what I tell readers:

-

Reputation vs. reality: Big dealers live on trust. If they let fakes through routinely, they?d get roasted and vanish. That said, mistakes and secondary-market quirks happen.

-

Secondary market ? mint-fresh. If you buy ?random/secondary,? expect scuffs, torn assay cards, or loose bars. That doesn?t mean ?fake??it means previously owned.

-

My open-box routine:

-

Silver: quick magnet test (shouldn?t stick), then weight + dimensions.

-

Gold: weight + calipers, and a PMV/Sigma scan if available.

-

I always video the unboxing?saves headaches if I need support.

-

-

When something looks off: Keep all packaging, take close photos, and contact support the same day. In my experience, reputable shops issue an RMA and make it right.

-

If you want perfect presentation: Pay for ?new, in assay? and avoid secondary listings. You?re buying condition and peace of mind along with the metal.

Bottom line: The ?SD Bullion fake? stories online are real enough to justify a ?trust, but verify? habit not to write off the dealer. I treat SD as reputable, test everything I receive, and choose ?new in assay? when I care about pristine packaging. That combo keeps me stacking confidently without ignoring red flags.

SD Bullion Ratings & Reviews (Updated November 2025)

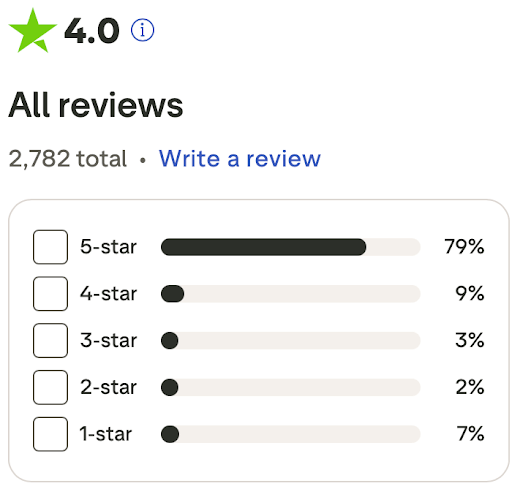

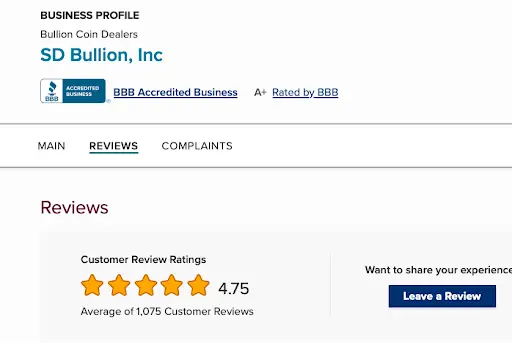

SD Bullion sports a solid 4-star rating (out of five) across 2,782 reviews, according to Trustpilot.com. They also have excellent overall ratings on the Better Business Bureau?s review site, rated ?A+?,? with a 4.75-star rating across 1,075 reviews.

The overwhelming majority of reviews on TrustPilot are five-star reviews, and 88% of reviewers gave the company either four or five stars.

SD Bullion Complaints

Seven percent gave SD Bullion a 1-star review, with complaints about their customer service being a common theme.

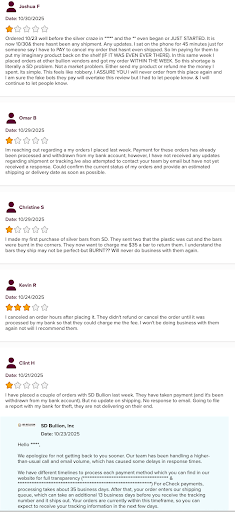

Concerningly, four of the five most recent reviews on Better Business Bureau at the time of this writing (November 6th, 2025) were 1-star reviews, and the fifth was a 3-star review.

Here?s a screenshot:

Jason?s Note: I checked the 1-star reviews on TrustPilot to see what customers were complaining about. There were some claims that they shipped metals in poorer condition than advertised, and other customers complained that the company was unreasonable in enforcing their cancellation fee.

There were multiple complaints of the company taking money and not delivering the promised metals at all, with Trustpilot reviewers saying they are reporting SD Bullion to their bank or otherwise taking legal action.

These complaints overwhelmingly were related to home delivery of gold and precious metals products, not to gold IRA accounts. Gold IRA investors have to buy bullion, so the condition of the metal doesn?t matter, as long as the weight in precious metal is there. And custodians have to verify delivery.

So SD Bullion may be a better match for gold IRA investors rather than for those purchasing precious metals for home storage, outside of IRA accounts.?

It?s a good idea to compare SD Bullion with other gold bullion dealers with outstanding ratings and reviews.

SD Bullion Recent Buyer Experience (late Oct?Nov 2025)

-

I?ve seen a run of posts about shipping delays at SD Bullion (and JM Bullion) this month. Some buyers reported labels created but no movement for ~2?3 weeks; others said their orders eventually shipped after support flagged them ?urgent.? I?m not thrilled with the wait, but the theme is delays during heavy demand?not orders vanishing.?

-

One r/Gold update flipped from ?warning? to ?label created + 2-day ship comp,? which lines up with high-volume backlogs vs. bad faith.?

-

Pricing chatter pops up every week. Some stackers feel APMEX > SD > others on premiums, and shop Monument/Bullion Exchanges/findbullionprices for deals: shop around, don?t assume one dealer is always cheapest.

Service & Communication (my take)

-

When volumes spike, hold times increase and ETAs slip. If I see ?label made, no scans,? I call, ask them to re-print and reship, or confirm the parcel?s physical status. Several posters said that nudge helped.

-

If a delay drags on, I ask for a small make-good (faster shipping, etc.). There?s precedent.

-

Branding note (minor, but worth knowing)

-

Some buyers noticed John 3:16 printed on SD?s shipping box flap. Doesn?t change the metal, but if overt faith branding bugs you (or you gift coins), you?ll want to know.

Are they overpriced?

Depends on the day and the SKU. SD can be cheaper than AP on some items and higher on others; community advice is: watch weekly deals and compare across a few reputable shops. I treat SD as one of several tabs open before I buy.?

?Fakes? & Product Condition (how I handle it)

-

Reddit has a few anecdotes over the years, ?magnet sticks,? tampered assay cards, or slabbed coins folks claimed were wrong. The same threads are full of replies saying big dealers live/die by reputation and replace problems; others remind that secondary-market bars can arrive scuffed/loose and still be legit weight/purity. I treat these as edge cases and verify.

-

My rule: I test at home (scale, calipers, simple magnet slide) and use a PMV/Sigma at an LCS for pricier pieces. If anything?s off (weight/dimensions/purity signals), I document immediately and request an exchange/refund. Multiple commenters confirm dealers will ?make it right.?

How I?d buy from SD Bullion (simple playbook)

-

Price check first (SD vs. Monument vs. Bullion Exchanges; add any spot/first-time deals).?

-

Prefer new-from-mint SKUs when you care about pristine/assay; go secondary-market only if you?re fine with wear and potential open packaging.

-

During market spikes, expect slower ship. If timing matters (travel, gift), either choose expedited in-stock items or buy local that week.?

-

On arrival: weigh, measure, verify, then store. If anything?s wrong, contact support with photos/video + order #?

I don?t buy the ?they?re sending fakes? narrative. What I do buy: delays happen when the market goes nuts, secondary market looks secondary, and premiums move around. I price-check, order, verify on receipt, and I?ve seen enough datapoints to believe SD will fix legit issues, even if sometimes it takes a nudge when they?re slammed.

SD Bullion Review: Pros & Cons

Pros

- Free U.S. shipping on $199+ orders.?

- Broad catalog + generally sharp premiums.

- In-house depository option; 3 months free (non-IRA) then low monthly + % fee.?

Cons :

-

Not a white-glove IRA provider (partners with custodians; minimal guidance).

-

Mixed service reviews + periodic shipping delays during demand spikes.?

-

Vaulting uses a % fee can be pricey for large balances (consider flat-fee rivals).

Who SD Bullion Is Best For

SD Bullion is a good choice for investors who want low prices, fast online ordering, and a large selection of bullion products.

?If you already know what you want to buy and don?t need much guidance, SD Bullion offers some of the most competitive premiums in the industry. It?s a strong fit for cost-focused buyers, repeat bullion investors, and anyone who prefers a simple, no-frills online shopping experience with multiple payment options, including Bitcoin.

Who Should Consider Alternatives?

SD Bullion may not be the best match for investors who want high-touch support, especially if they?re new to precious metals or need step-by-step help setting up a Gold IRA.?

Unlike some competitors in this space, the company does not provide a full-service IRA program. Moreover, its customer service reviews are more mixed compared to its top competitors.?

If you prefer a more guided experience, dedicated account representatives, or bundled IRA setup and storage, you may find better options with firms like Augusta Precious Metals, Goldco, Noble Gold, JM Bullion, or APMEX

?SD Bullion vs. Augusta Precious Metals: A Side-By-Side Comparison

| Feature | SD Bullion | Augusta Precious Metals |

| Year Founded | 2012 | 2012 |

| Business Type | Online bullion dealer | Premium Gold IRA company |

| Reputation | Low-cost, high-volume dealer | White-glove service, top-rated |

| IRA Services | Works with outside custodians; minimal guidance | Full-service Gold IRAs with personal specialists |

| Product Selection | Large online catalog; many non-IRA products | Primarily IRA-approved gold & silver |

| Pricing | Among the lowest premiums in the industry | Higher premiums; premium service |

| Storage Options | In-house vault (SD Depository) + external | IRS-approved vaults (Delaware, Brinks, etc.) |

| Customer Service | Mixed reviews; some complaints | Exceptional reputation; almost zero complaints |

| Ideal For | Self-directed, price-focused buyers | Investors wanting education, transparency & tailored IRA help |

| Minimum Investment | No minimum purchase | Typically $50,000 for IRAs |

Is SD Bullion a Scam? The Bottom Line

SD Bullion is not a scam. Overall, the company enjoys solid ratings, especially for pricing.

But no company is perfect ,and SD Bullion has had some complaints about its customer service, and for occasional fulfillment issues.

Of course, if you?re a pretty self-sufficient investor and you don?t need a lot of handholding, customer service usually isn?t much of an issue, as long as you can get any fulfillment or delivery issues properly addressed.?

Thank you so much for reading my SD Bullion review! If you have any comments or questions, feel free to leave them in the comments section.

And for further reading, and to explore leading alternatives, please check out our article, The Top 5 Gold Companies for 2025!

Frequently Asked Questions About SD Bullion

Is SD Bullion legit?

Yes. SD Bullion is a well-established precious metals dealer founded in 2012. The company has shipped millions of orders and holds strong ratings with the Better Business Bureau and Trustpilot. However, like many large online bullion dealers, it has some customer-service complaints. They are currently the subject of a class-action lawsuit over ?lowest price? advertising claims.?

Is SD Bullion safe to buy from?

Generally, yes. SD Bullion is considered reputable, and most customers report successful transactions. The biggest risks noted in reviews involve customer service, fulfillment delays, or confusion over cancellation and restocking fees.?

As with any bullion dealer, paying attention to order confirmations and delivery tracking is important.

How long does SD Bullion take to ship?

Most domestic orders ship within a few business days after payment clears. Shipping times vary by payment method: credit cards, PayPal, and Bitcoin clear faster, while checks and e-checks take several days. Orders over $199 ship free within the U.S.

What happens if SD Bullion goes bankrupt?

Your stored metals should remain your property. Precious metals in the depository are held in segregated accounts and are not part of SD Bullion?s corporate assets. While?

You may face temporary delays during legal or administrative proceedings. SD Bullion?s creditors would not be entitled to take your metals.

Does SD Bullion offer discounts?

Yes. SD Bullion offers cash-discount pricing on certain payment methods such as e-check and bank wire. Bitcoin purchases also carry a small discount, though credit cards and PayPal do not. Discounts vary by product and payment method.

Can I return gold to SD Bullion?

Yes. SD Bullion allows returns within three business days of receiving your order. Returned items are subject to a restocking fee?typically 5% or $35, whichever is higher. (SD24K jewelry carries a 10% restocking fee.)