Why I Wrote This Gold IRA Investing Guide: A couple of years back, when inflation hit 9 percent and my 401(k) looked like a bad magic trick, I decided to stop trusting Wall Street headlines and look for something real, something I could touch.

That led me to Gold IRAs. I opened one myself, tested rollovers, spoke with custodians, and watched how gold behaved while the dollar wobbled. This guide is everything I learned the hard way , in plain English.

If you?re wondering ?Is a Gold IRA really worth it? Does it actually protect against inflation?? stick around. By the end, you?ll know exactly what it is, how it works, and how to open one safely online.

No hype, no fear, just a first-hand take from someone who rolled up his sleeves and tested it.

- What Is a Gold IRA?

- How Does a Gold IRA Work?

- Types of Gold IRAs (2025 Update)

- Can You Hold Gold in an IRA? The Eligible Metals

- Fees & Costs Associated With a Gold IRA (2025 Update)

- ?Why Invest in a Gold IRA? Benefits & Risks

- ?Is a Gold IRA Really Inflation-Proof?

- ?My Honest Take: The Real Pros & Cons of a Gold IRA (2025 Update)

- Is a Gold IRA Worth It Overall?

- Is a Gold IRA Safe?

- Rolling Over a 401(k) Into a Gold IRA (Without Penalties)

- Gold IRA Storage Rules: Where Your Gold Actually Goes

- 10 Common Gold IRA Scams to Avoid (Learn From My Mistakes)

- ?

- Best Gold IRA Companies of 2025 (My Honest Impressions)

- Frequently Asked Questions About Gold IRAs (2025)

- My Final Verdict:?

What Is a Gold IRA?

A Gold IRA is a self-directed retirement account that lets you own physical gold, silver, platinum or palladium inside a tax-advantaged plan. Instead of holding paper assets that rise and fall with Wall Street, you own something tangible that?s been money for thousands of years.

The IRS requires that your metals stay in an approved vault, not under your bed or in a safe-deposit box. That rule keeps your IRA compliant and fully insured.

When I set up mine, the surprise was how easy it was once I chose a solid custodian. They handled the paperwork, wired the funds, and even showed me storage options.

How Does a Gold IRA Work?

A self-directed IRA (SDIRA) is basically a regular IRA with a wider menu. Instead of just mutual funds and stocks, you can hold ?alternative assets? like real estate, crypto, and precious metals.

You still get the same IRS rules, contribution limits, age requirements, tax advantages, but you choose the custodian and the assets. That freedom comes with responsibility: everything must stay in the custodian?s hands until you retire.

When I first heard ?self-directed,? I pictured myself hauling gold home. Nope. The IRS would slam you with penalties for that. A proper SDIRA keeps the metal in a licensed depository, you just own it on paper until withdrawal.

Real World Examples of Gold IRA Providers

Here is how these names actually behave once you pick up the phone, in plain talk.

Swiss America

Swiss America is an old school broker that has been around forever, steady on the phone, pushes simple gold and silver, and will talk IRA eligible pieces without drama.

Longevity and conservative messaging are the draw, not slick tech. Solid if you want hand holding and basic coins done cleanly.?

Gold Alliance?

Sales forward outfit with the usual IRA talking points and a heavy education push on their site, Gold Alliance does rollovers and sets you up with approved coins fast. Reviews are mixed across the web, so I ask very direct fee and spread questions before wiring a dime. Good for shoppers who want a quick start and will negotiate.

Berkshire Gold Group

Smaller player, limited third party footprints, you will likely get a very personal rep and simple product menu. Treat it like a boutique call, verify custodian, storage, and exact coin premiums in writing before moving money. If you like small and scrappy, kick the tires first.

Scottsdale Bullion and Coin?

Real people on the line, they do IRAs, rollovers, and plain bullion, and they publish market notes all year. When I asked nitty gritty questions, they slowed down and walked storage and product choices with me, which I like. Feels local, with national reach.?

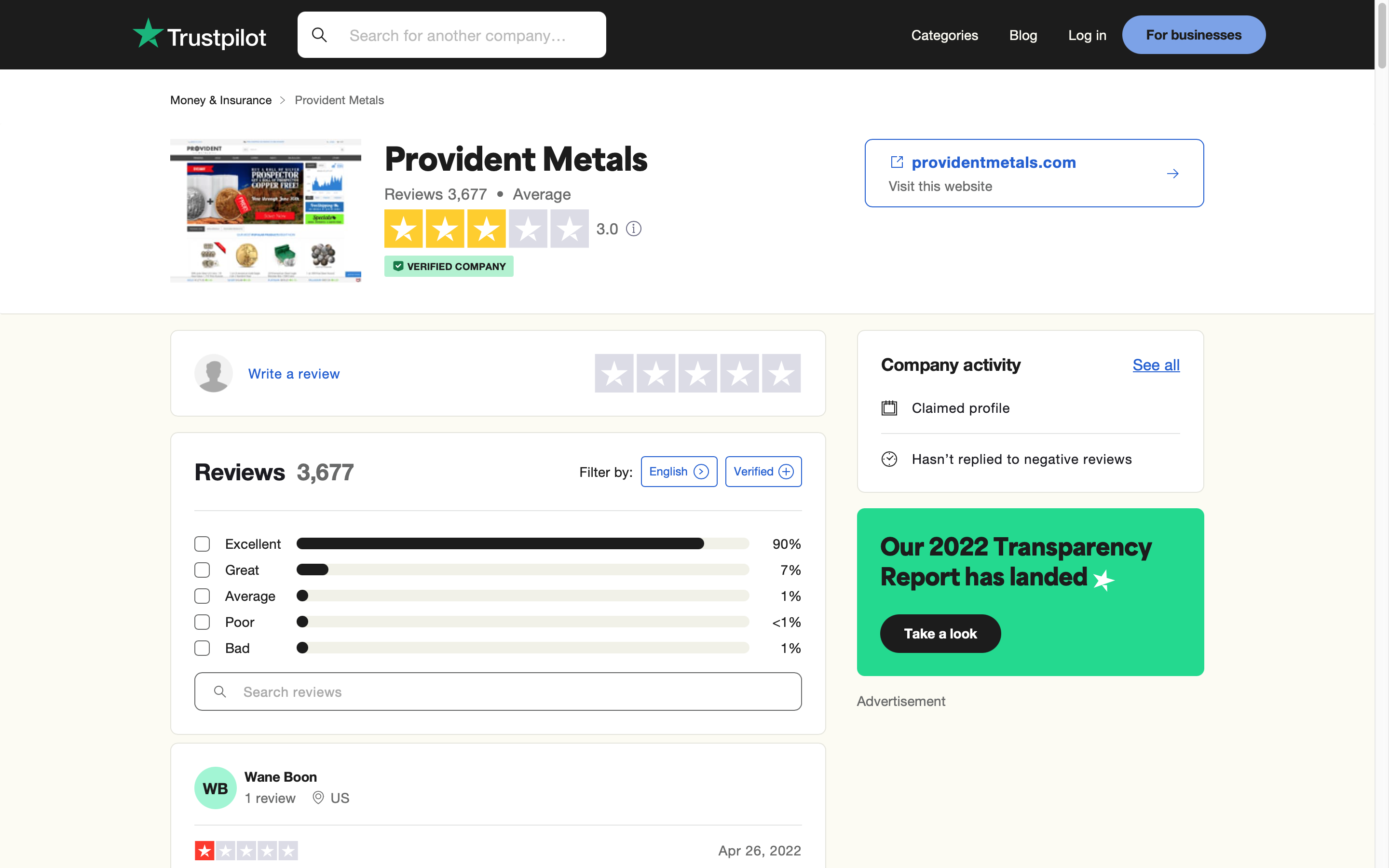

Provident Metals

Retail first, big catalog, and yes they can help route you into a self directed IRA via a partner custodian, then ship to an approved depository. Pricing on silver swings, so I always compare against two other dealers before I lock. Great for shoppers who want to pick exact pieces, then park them in an IRA.?

Miles Franklin

Miles Franklin is an old name in the space, sells IRA approved metals and can coordinate storage, they lean into education and service calls. If you like having a dedicated rep and a list of IRA eligible SKUs to choose from, it fits. I still confirm spreads and shipping windows before I fund.

USAGOLD

USAgold is a veteran dealer that explains gold IRAs clearly on their site, and will help you pick a trustee and get forms done, very traditional approach. I use them as a benchmark for process clarity, the pitch is patient and the steps are laid out. Good for investors who want a steady hand and fewer surprises.

Types of Gold IRAs (2025 Update)

When I first started digging into Gold IRAs, I thought they were all the same thing. Turns out, there are three different versions, and each plays by its own set of tax rules.

You?ll want to pick the one that matches where you are in life, your income, business setup, and whether you prefer tax breaks now or later.

I?ve opened and reviewed a few over the years, so here?s how they really work, plain and simple.

?1. Traditional Gold IRA

(The classic one, pre-tax money, pay taxes later)

This is the one most people start with.

You put in pre-tax dollars, which means you get a tax deduction now, and your gold grows tax-deferred until you start taking withdrawals in retirement.

At that point, Uncle Sam gets his cut.

What it feels like in real life:

When I opened my Traditional Gold IRA, the best part was watching the tax deduction lower my taxable income that same year.

You don?t see the benefit instantly, but when tax season rolls around, trust me, you feel it.

| Feature | Details |

|---|---|

| Who it?s for | People who expect to be in a lower tax bracket when they retire |

| Tax treatment | Contributions are tax-deductible now, taxed later when withdrawn |

| Contribution limit (2025) | $7,000 (under 50), $8,000 (50+) |

| Withdrawals | Taxed as ordinary income after age 59? |

| Best part | Tax break upfront + easy rollover from 401(k) or IRA |

| Heads-up | Early withdrawals (before 59?) hit with 10% penalty + taxes |

My take:

If you?re still in your earning years and want a break now, go traditional.

It?s simple, predictable, and feels familiar if you?ve ever had a 401(k).

2. Roth Gold IRA

(Pay taxes now, enjoy freedom later)

This one?s for the long-game players.

You contribute after-tax money, so you don?t get any tax break upfront, but your withdrawals down the road are completely tax-free (including your profits).

From experience:

The first year I switched part of my portfolio to a Roth setup, it stung a little, paying taxes upfront never feels fun.

But when you think 10, 20 years ahead, not having to pay the IRS a dime later is worth every penny now.

| Feature | Details |

|---|---|

| Who it?s for | Investors expecting to be in a higher tax bracket in retirement |

| Tax treatment | Pay taxes now, all future growth and withdrawals are tax-free |

| Contribution limit (2025) | $7,000 (under 50), $8,000 (50+) |

| Withdrawals | Tax-free after 59? (if account is 5+ years old) |

| Best part | Lifetime tax-free growth ? no surprises in retirement |

| Heads-up | No tax deduction upfront; higher earners may hit income limits |

My take:

The Roth is like eating your vegetables early, not fun now, but your future self will thank you.

It?s the one I recommend for people in their 30s or 40s who have time to let compounding do its work.

3. SEP Gold IRA

(For the self-employed, freelancers, and small business owners)

If you run your own gig, this one?s built for you.

A SEP (Simplified Employee Pension) IRA lets you stash away a bigger slice of your income, perfect if you?ve had a good year and want to shield some profit from taxes.

From my side:

Back when I freelanced, the SEP was a blessing. I could contribute way more than a regular IRA and still get the same gold exposure and tax-deferred growth.

| Feature | Details |

|---|---|

| Who it?s for | Self-employed individuals or small business owners |

| Tax treatment | Contributions are tax-deductible for the business |

| Contribution limit (2025) | Up to 25% of income or $69,000, whichever is lower |

| Withdrawals | Taxed as income at retirement |

| Best part | High contribution limits + easy setup |

| Heads-up | You have to contribute the same % for all eligible employees if you have staff |

My take:

If you own a small business or freelance, this is hands-down the most powerful one.

You save more, defer more, and still keep gold as your safety net. Just remember, big contributions also mean bigger responsibility if you?ve got employees.

Quick Recap (in plain English)

| Type | Pay Taxes | Withdrawals | Ideal For | Main Advantage |

|---|---|---|---|---|

| Traditional Gold IRA | Later (tax-deferred) | Taxed in retirement | Anyone earning a steady income | Tax break now |

| Roth Gold IRA | Now (after-tax) | Tax-free in retirement | Younger investors or those expecting higher taxes later | Tax-free future |

| SEP Gold IRA | Later (tax-deferred) | Taxed in retirement | Self-employed / business owners | Huge contribution limits |

My Honest Verdict

They all hold the same gold, what changes is when you pay the taxman.

If you want peace of mind now, Traditional.

If you?re thinking long-term and like sleeping knowing the IRS won?t touch your future gains, go Roth.

And if you?re running your own business, SEP all the way.

?I?ve used all three setups at different points in my career, and here?s the truth, the gold doesn?t care where it?s stored, but your accountant sure will.?

How Much Can You Contribute to a Gold IRA? (2025 Update)

This is one of the questions I get all the time ?How much can I actually put into a Gold IRA??

The short answer: the IRS keeps it simple, but strict. The limits are the same as any Traditional or Roth IRA.

?2025 Contribution Limits

For the 2025 tax year, here?s what the numbers look like:

Under 50 years old: You can contribute up to $7,000 per year.

50 or older: You get a ?catch-up? bonus ? your limit goes up to $8,000.

That?s total across all your IRAs , not just gold. So if you?ve already put $3,000 into a Roth IRA this year, you can only put $4,000 more into your Gold IRA.

?Where The Money Must Come From

Your contributions have to come from earned income, things like wages, salaries, or self-employment income.

You can?t fund it with investment gains, rental income, or your savings account.

For example:

If you earned $5,000 this year, your maximum contribution is $5,000. The IRS won?t let you stash more than what you actually earned.

Real Talk

When I first opened mine, I thought I could just move money around from my savings, nope.

The custodian reminded me it has to be tied to earned income. Rules are rules.

But once the account is open, you can roll over funds from an existing 401(k), Roth, or Traditional IRA, that?s unlimited and doesn?t count toward your yearly cap.

Quick Recap

Age Annual Contribution Limit (2025) Notes Under 50 $7,000 Total across all IRAs 50 or Older $8,000 Includes $1,000 catch-up contribution Earned Income Rule Can?t exceed what you earned Must come from wages, salary, or self-employment Rollovers No limit Transfers from 401(k) or IRA don?t count toward cap

If you?re serious about building a long-term safety net, it?s smart to max out your IRA every year, especially during high-inflation times like we?ve had lately.

Gold won?t make you rich overnight, but slow, consistent contributions build something way more valuable: security that doesn?t depend on anyone else.

Can You Hold Gold in an IRA? The Eligible Metals

When I first started, I almost bought vintage coins off a dealer. My custodian laughed and said, ?Nice souvenirs, but the IRS would disqualify your whole account.? Lesson learned.

These are the only IRS-approved metals that qualify for your gold IRA (99.5 % pure for gold, 99.9 % for silver).

- American Gold Eagle Coins (99.9 %)

- Canadian Maple Leafs

- PAMP Suisse & Valcambi bars

- Certain silver, platinum, and palladium coins

?No jewelry, collectibles, or foreign coins without purity certificates.

?Why Invest in a Gold IRA? Benefits & Risks

I?ve seen retirees watch their paper savings evaporate while gold quietly kept its weight in value. Here?s why people turn to it, and what to watch for.

Benefits of Investing in a Gold IRA

1. Hedge Against Inflation

Gold has outlasted every currency ever printed. When the dollar loses buying power, gold holds its own.

2. Diversification

It moves differently from stocks and bonds, that zig-zag pattern is your friend during market storms.

3. Long-Term Stability

From $270 in 2000 to over $4,000 today in 2025, not a moonshot, but steady climb and no zeroes.

4. Tangible Value

No login required. Gold doesn?t need a CEO or a server farm to exist.

5. Tax Advantages

Inside an IRA, gains grow tax-deferred or tax-free depending on the type you choose.

Risks & Trade-Offs

No Yield: It won?t pay dividends or interest.

Fees: Expect $100?$300 yearly for custody and storage.

Liquidity: Selling bars takes days, not minutes.

Scams: If a rep promises guaranteed returns or ?secret coins,? hang up. I?ve seen those calls.

?Is a Gold IRA Really Inflation-Proof?

Back in 2022 when CPI hit 9.1 %, my stock funds looked like a bloodbath. Gold didn?t soar, but it stood its ground, and that alone spoke volumes.

A 3,000-Year Track Record

From the Roman denarius to the US dollar, gold has always been the reset button for currencies. It doesn?t depend on politics or printing presses.

A Gold IRA simply lets you hold that stability inside your retirement account. When paper assets shake, your metals just sit there, quiet and unchanged.

Why Inflation Hurts Everything Else

Inflation is simple: your money buys less tomorrow than today. Bonds and savings are tied to that shrinking dollar. Gold isn?t. It?s priced globally, in real value, not faith.

Every time the Fed prints a trillion and calls it ?stimulation,? I check the gold chart. Usually, it?s quietly creeping up while everything else adjusts.

So Is It Truly Inflation-Proof?

Nothing on earth is 100 % inflation-proof, but gold is as close as we get. It holds value when currencies don?t. It won?t make you rich, but it?ll help you stay rich.

?My Honest Take: The Real Pros & Cons of a Gold IRA (2025 Update)

I?ve been around long enough to see gold go through every mood swing possible.

Some years it sits quiet, other years it explodes when Wall Street panics.

After setting up my own Gold IRA a few years back, here?s what I?ve actually learned, the good, the bad, and the stuff no one mentions on those shiny brochures.

The Pros (what actually feels good)

1. A real hedge against chaos

When inflation started eating into everything from groceries to gas, my paper assets bled. Gold? It just sat there? calm.

It doesn?t care about the Fed or interest rate drama. It?s like having that one friend who never panics.

2. Tax perks still apply

Even though it?s physical metal, the account still runs like a normal IRA tax-deferred growth if it?s Traditional, or tax-free on qualified withdrawals if it?s Roth.

It feels old school, but it?s still inside the IRS rules.

3. Diversification that actually works

Every portfolio theory out there preaches ?don?t put all your eggs in one basket.?

Well, this is the shiny metal basket. When stocks fall, gold often zig-zags the other way, balancing things out.

4. Tangible and private

I can literally visit the vault and see the bars with my name on them.

You don?t get that satisfaction with mutual funds or ETFs. No passwords, no hacking risk, just real metal under lock and key.

5. Rollover flexibility

I moved a portion of my old 401(k) into gold without paying a dime in taxes. Augusta handled the paperwork faster than my bank could process a simple wire. Smoothest transfer I?ve ever done.

6. Peace of mind

There?s something psychological about holding a timeless asset.

When headlines scream ?recession,? I sleep just fine knowing part of my nest egg isn?t made of paper promises.

The Cons (the reality checks)

1. It?s not magic

Gold doesn?t pay dividends, interest, or rent. It just sits there looking pretty.

If you?re expecting monthly returns, you?ll be disappointed.

2. Fees sneak up

Storage, insurance, custodian fees, they add up. My first year, I paid around $260 in total fees.

Worth it for peace of mind, but definitely pricier than a no-fee index fund.

3. You can?t keep it at home

Forget the fantasy of hiding gold bars under your bed.

IRS rules say it must stay in an approved depository. If you try ?home storage IRAs,? you?re asking for penalties.

4. Scams are everywhere

I once got pitched ?exclusive collector coins? for retirement.

Turns out they weren?t IRA-eligible and carried a 40% markup. Some companies prey on fear, learn to hang up fast.

5. Slow to cash out

If you need money quick, selling gold from your IRA isn?t instant.

It can take a few days for liquidation and transfer. Not ideal for emergency withdrawals.

6. Minimum investments

Most reputable companies require $10k?$50k to start.

It?s not pocket change, so you need to be sure this fits your overall plan.

Is a Gold IRA Worth It Overall?

If you?re after quick returns, look elsewhere. If you?re after sleep at night and a hedge against what governments do next, this is it.

When I rolled a slice of my 401(k) into gold (a process we?ll cover in Part 2), I wasn?t chasing growth, I was buying stability. Five years later, I?m glad I did.

Most planners I trust suggest 5?10 % of your portfolio in precious metals. Enough to hedge, not enough to worry.

Is a Gold IRA Safe?

I get this question all the time ?Is my money actually safe in a Gold IRA??

Here?s the truth, straight up: the gold is safe,? the paperwork is where people mess up.

Your metals are stored in IRS-approved vaults like Brink?s or Delaware Depository, fully insured against theft or damage.

They?re not sitting in your basement, and that?s a good thing.

What really matters is who you trust to set it up.

Pick a transparent, established custodian that works with approved depositories and shows you every form before a dollar moves.

Gold itself won?t disappear or go bankrupt. It?s been holding value longer than any currency on Earth.

So yes, a Gold IRA is safe, just make sure the people handling it are, too.

?Gold doesn?t crash, people do.?

How To Invest in a Gold IRA Online (Step-by-Step)

When I opened my first Gold IRA, I expected headaches and IRS forms flying everywhere. Turns out, it?s a pretty simple four-step process, if you pick the right company.

Here?s how it really goes:

Choose a Trusted Gold IRA Company

This is where most people either win or lose.

You want a company that?s transparent, educational, and not pushy.

If the first thing they do is try to sell you a $20,000 ?limited edition coin set,? hang up.

Look for:

-

Thousands of verified reviews (on Trustpilot, BBB, ConsumerAffairs)

-

Educational resources (videos, guides, webinars)

-

A clean fee structure (no hidden ?storage premiums?)

-

U.S. government-approved custodians and depositories

?I?ve personally spoken with reps from Goldco, Augusta Precious Metals, Birch Gold Group and many other companies, each time I asked tough questions about fees, delivery timelines, and buyback policies. Some handled it like pros. Others dodged. You?ll see who?s who below.

Fund Your Account

Once you pick your company, you?ll need to fund the account. There are three main ways:

Cash Contribution

You deposit directly, either a check, wire, or transfer. Simple but limited by annual contribution caps ($7,000 / $8,000).

IRA Transfer

If you already have an IRA, your custodian can send funds directly to your new gold IRA. No taxes, no penalties, and usually cleared within 3?5 business days.

401(k) Rollover

If you?ve left an employer and have an old 401(k), this is where it gets interesting.

Rolling Over a 401(k) Into a Gold IRA (Without Penalties)

I?ve done this myself, and honestly, it was smoother than most bank transfers.

Here?s the process:

-

Open your new Gold IRA, and your chosen company will help you fill out the setup forms.

-

Contact your old plan administrator, tell them you want a direct rollover (that phrase matters).

-

Funds move custodian-to-custodian, you never touch the money, so it stays tax-protected.

-

Your custodian purchases metals with those funds once the transfer clears.

?Tip: Avoid the ?indirect rollover.? That?s where the funds hit your bank account first, and if you miss the 60-day window, the IRS treats it as a withdrawal. I?ve seen people get burned badly on that one.

If you pick a good firm (like Augusta or Goldco), they?ll literally walk you through each step so nothing slips through the cracks.

Gold IRA Storage Rules: Where Your Gold Actually Goes

A lot of people picture themselves holding their IRA gold in a safe at home. I thought that too, until my custodian told me it?s completely illegal for IRA assets. The IRS requires that IRA metals stay in approved depositories, think secure, insured vaults that meet federal standards.

Some of the main ones:

-

Delaware Depository (used by Augusta, Goldco, Birch Gold Group)

-

Brink?s Global Services

-

IDS of Texas

Your metals are stored in your name, insured up to full value, and auditable anytime. Most companies even let you visit the vault if you really want to see your bars.

Gold IRA Custodians: Who Actually Holds Your Metal

Once I understood how storage actually works, the next thing that surprised me was who manages the account behind the scenes.

The vault isn?t the one reporting to the IRS, that job belongs to the custodian, the trust company that handles compliance, paperwork, and movement of funds between your 401(k) and the depository.

I?ve worked with and reviewed most of the big custodians firsthand. Some are sharp and responsive. Others make you chase signatures for weeks. Here?s what you need to know before you pick one.

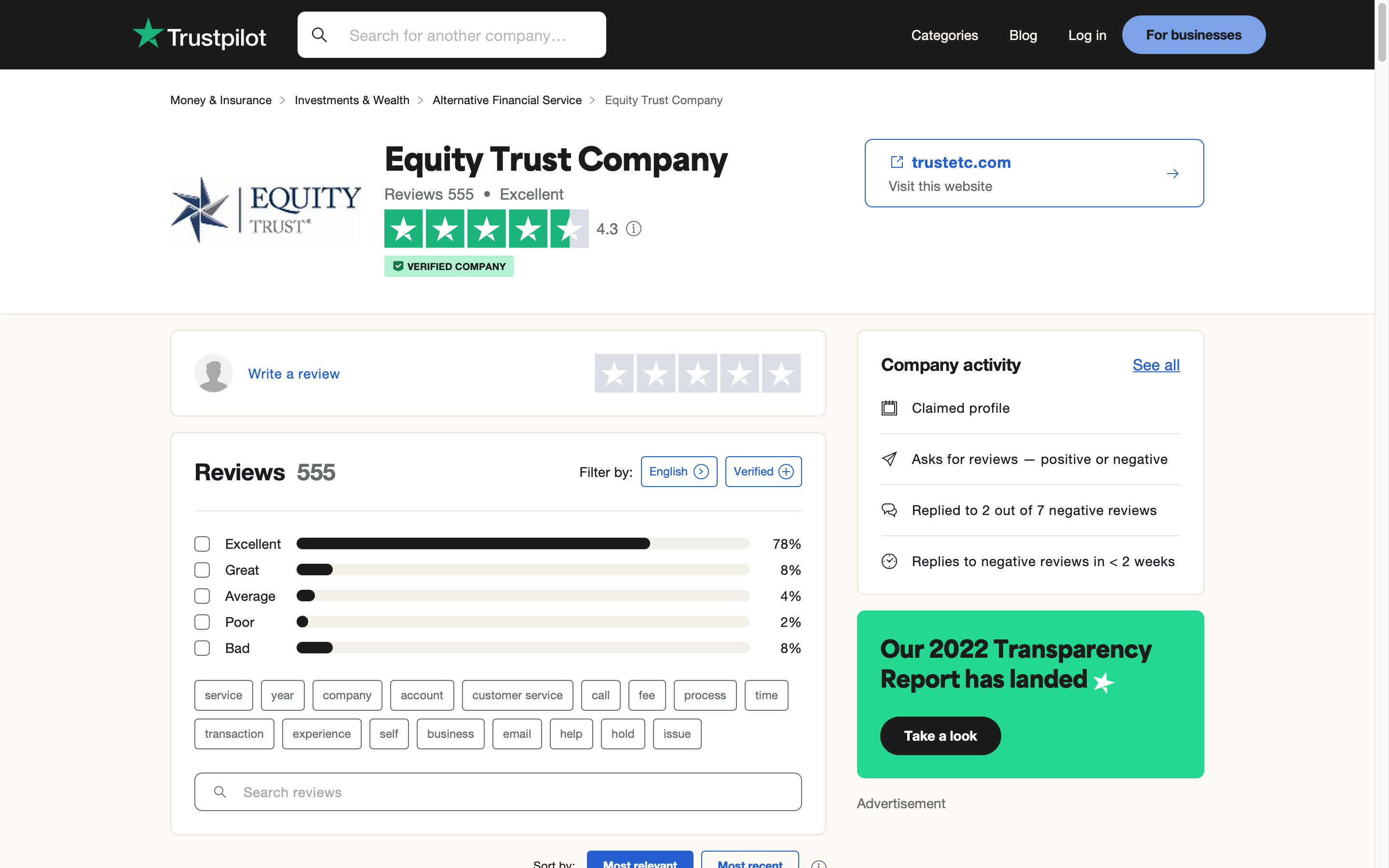

Equity Trust Company (Founded 1974)

One of the oldest self-directed IRA custodians in the U.S. They handle billions in retirement assets and are often paired with major dealers like Augusta and Goldco.

From my own experience, their onboarding is detailed but slower than average, expect several phone verifications and a few forms sent back and forth. Their systems are secure, their compliance is solid, and all metals stay in segregated, insured storage through partners such as Delaware Depository.

The biggest downside is pricing transparency, fees vary by account type and balance, and you?ll have to request the schedule. Still, they?re a legitimate, IRS-approved custodian with decades of trust-industry history behind them.

Verdict: Safe, established choice for large rollovers; just expect a few extra steps.

Strata Trust Company (Founded 2008, Texas)

Strata is newer but has become a favorite among smaller investors and firms like Birch Gold Group and American Hartford Group. They?re known for responsive support and a modern dashboard that lets you track your holdings online.

They?re owned by Horizon Bank and manage over $4 billion in assets, including precious-metals IRAs. Their approved depositories include Brink?s and Delaware Depository.

Fees are mid-range, about $100?$350 annually depending on the plan, and customer feedback has been mostly positive on Trustpilot (around 4.7 / 5).

Verdict: Reliable mid-tier custodian with smooth digital onboarding and clean compliance record.

Inspira Financial (Formerly Millennium Trust Company)

Millennium Trust rebranded as Inspira Financial in 2023 and now oversees more than $60 billion in assets. They?re one of the biggest names in the alternative-asset custodian world, handling not only gold and silver IRAs but also real estate, private equity, and even health-savings accounts.

Their scale brings stability, but also bureaucracy. Reviews are mixed, roughly 3.7 stars on Trustpilot but just 1 star on BBB, mainly over slow rollovers and customer-service delays.

If you choose Inspira, insist on a written fee schedule (setup, annual admin, and storage) and confirm segregated storage with your metals dealer.

Verdict: Legit but overloaded; best for investors already experienced with self-directed IRAs who don?t need hand-holding.

Perpetual Assets (Home-Storage ?LLC IRA? Promoter)

This company markets the idea of controlling your IRA gold or crypto directly through an LLC structure, often described as a ?Checkbook IRA? or ?Home Storage IRA.? It sounds tempting, but the IRS has explicitly ruled that taking physical possession of IRA metals at home violates IRS code 408(m) and can disqualify your entire IRA.

While Perpetual Assets is technically registered, it lacks transparency, reviews, and custodian partnerships that meet federal vault requirements.

Verdict: Avoid. Their model pushes legal gray zones that can trigger tax penalties and audits. Stick with an IRS-approved custodian and depository.

My Takeaway After Testing Them All

Who holds your gold matters just as much as who sells it. A great dealer paired with a bad custodian can turn a simple rollover into a paperwork nightmare.

If you value white-glove support and lifetime education, Augusta?s team paired with Equity Trust is the cleanest setup I?ve seen.

If you want digital speed and lower minimums, Strata fits better.

Either way, make sure your custodian uses segregated storage and provides a full fee list in writing before you wire a single dollar.

10 Common Gold IRA Scams to Avoid (Learn From My Mistakes)

Let?s talk real for a minute, this industry has sharks.

Here are the traps I?ve seen firsthand:

-

Home storage IRA offers, sounds tempting, but totally non-compliant. IRS penalties can be brutal.

-

High-pressure sales tactics, if a rep uses fear (?the dollar will crash next week!?), they?re selling emotion, not value.

-

Overpriced numismatic coins, not IRA-eligible, sold with 40% markups.

-

Hidden fees buried in ?administration costs.?

-

Fake reviews, always check multiple review sites.

-

Non-approved custodians, only use IRS-recognized ones.

-

No buyback policy, you?ll regret it later if the company won?t repurchase your metals.

-

?Special promotions? that expire in 24 hours. Real firms don?t rush you.

-

Promises of guaranteed profits, gold is stable, not magical.

-

Non-segregated storage confusion, demand your metals be segregated, not pooled. (Segregated storage means your specific metals are stored separately and labeled just for you, whereas non-segregated (pooled) storage means your metals are mixed in with other investors? holdings and you only own a proportion rather than the exact items. (Here is a great article that talks about the difference deeper)

I once had a salesman quote me ?spot price? for gold, then added a ?logistics fee? that magically raised it 7%. I hung up right there.

Protect Yourself: Checklist for Smart Investing

-

Ask for the actual cost the dealer paid for the coins (not just what they say). If they claim ?1-5% above cost,? verify documentation.

-

Compare quoted coin prices + mark-ups across multiple dealers. If one quote is much higher, ask why.

-

Confirm that the coins are IRS-eligible for gold IRAs (purity, type, depository rules).

-

Read the contract carefully?look for ?bid/ask spreads?, ?mark-up?, storage fees, buy-back terms.

-

Ensure the custodian and depository are approved for gold IRAs (not home storage or vague third-party vaults).

-

Resist hard-sell pressure. A trustworthy provider will give you time to think, ask questions, and consult.

-

Check for licensing, complaints, history of the dealer. Search for lawsuits or enforcement actions like the one against Red Rock.

-

Start with a smaller roll-over or purchase if you?re first time working with a company.

-

Get everything in writing: price quotes, delivery timelines, storage, insurance.

-

Ask for buy-back or liquidity terms: if you need to move out of the investment, how easy will it be?

Gold IRA Scam Companies to Avoid like the Plague

While investing in gold through an IRA can make sense for many, the space unfortunately attracts bad actors.

I?ve seen cases where people thought they were protecting their savings, but ended up overpaying for coins, getting locked into confusing contracts, or trusting reps who disappeared once the money cleared.

Below are a few real examples and what I personally learned digging through their stories and complaints.

| ? Company | ?? What Happened (in plain English) | ? First-Hand Insights / Lessons |

|---|---|---|

| Red Rock Secured (now American Coin Co) | The SEC sued them for charging retirees up to 130 % markups on gold and silver coins while claiming the markup was only 1?5 %. Over $50 million in investor losses. | Many people said the reps were friendly and patient right until they wired the money. After that, no callbacks, no transparency on pricing. It?s a classic case of smooth talk hiding a huge spread. |

| Metals.com (TMTE Inc. / Barrick Capital) | Regulators across 30 states uncovered a $185 million scam selling overpriced metals often 100?300 % above market to seniors via ?safe-haven? rollovers. | Several retirees said they got cold calls daily, with ?patriotic? pitches about saving America from Wall Street. The fear angle was powerful, but the pricing was daylight robbery. |

| Safeguard Metals LLC | Charged by 30 states and the CFTC for a $68 million fraud targeting older investors, pushing overpriced ?rare? coins that weren?t IRA-eligible. | The owners sent glossy brochures with words like safety and security. One victim said he trusted them because of the professional design, proof that good branding doesn?t equal honesty. |

| Monex Precious Metals | CFTC alleged thousands were misled with false claims and deceptive precious-metal trading pitches. | Even ?big names? can get it wrong. A slick TV ad doesn?t mean clean practices, always check for enforcement history before trusting size or reputation. |

| Lear Capital (2022 Settlement) | Faced a $6 million settlement with the SEC and multiple states for hidden fees and misrepresentation to IRA clients. | Several complaints mention they didn?t learn about 20-30 % commissions until after purchase. Always ask for a full invoice breakdown before you roll over a single dollar. |

?

Best Gold IRA Companies of 2025 (My Honest Impressions)

After seeing how bad actors operate, I became even more determined to find the firms that actually do things right.

I spent months calling reps, sitting through real sales calls, comparing storage options, and even testing rollovers myself.

Some companies were all talk, others genuinely cared about education, transparency, and long-term protection.

The difference was obvious once I looked past the marketing:

-

The honest ones slow down the call, explain every fee, and encourage you to read the fine print.

-

The shady ones rush you, dodge questions, or give vague answers about storage and pricing.

Below are the firms that passed every test, real experts, clean records, and client experiences that match what?s promised on the phone.

If you?re serious about rolling over your savings into precious metals, start with these.

| Company | Augusta Precious Metals (#1 Recommended) |

|---|---|

| Founded | 2012 |

| Minimum Investment | $50,000 |

| Fees | ~$50 setup, $100 admin, $100 storage (Delaware Depository ? segregated, insured) |

| Buyback Policy | Guaranteed and transparent |

| Ratings | BBB A+ / Trustpilot 4.9? / TrustLink 5? |

| Special Features | Lifetime support, 1-on-1 education, endorsed by Joe Montana |

| Ideal For | Conservative investors who want clarity & long-term trust |

| Company | Goldco |

|---|---|

| Founded | 2006 |

| Minimum Investment | $25,000 |

| Fees | ~$80 setup, $180 annual (admin + storage combined) |

| Buyback Policy | Same-day guaranteed buyback |

| Ratings | BBB A+ / Trustpilot 4.8? / TrustLink 4.9? |

| Special Features | Smooth 401(k) rollovers, free silver promos |

| Ideal For | Investors rolling over an old 401(k) or IRA |

| Company | Birch Gold Group |

|---|---|

| Founded | 2003 |

| Minimum Investment | $10,000 |

| Fees | ~$50 setup, $225 flat annual |

| Buyback Policy | Fair-market buyback anytime |

| Ratings | BBB A+ / Trustpilot 4.8? / TrustLink 5? |

| Special Features | Offers gold, silver, platinum & palladium |

| Ideal For | Diversifiers who want multiple metals |

| Company | Silver Gold Bull |

|---|---|

| Founded | 2012 |

| Minimum Investment | $5,000 (varies by purchase) |

| Fees | No setup fees for direct buys; IRA fees depend on custodian |

| Buyback Policy | 24-hour processing |

| Ratings | BBB A / Trustpilot 4.9? |

| Special Features | Real-time pricing, insured global delivery |

| Ideal For | Self-directed investors who trade metals directly |

| Company | American Hartford Gold |

|---|---|

| Founded | 2015 |

| Minimum Investment | $10,000 |

| Fees | ~$90 setup, $180 annual (admin + storage) |

| Buyback Policy | No-fee guaranteed buyback |

| Ratings | BBB A+ / Trustpilot 4.9? / TrustLink 5? |

| Special Features | Fast setup, free safe with qualifying accounts |

| Ideal For | First-time IRA buyers who want a guided experience |

| Company | Oxford Gold Group |

|---|---|

| Founded | 2017 |

| Minimum Investment | $7,500 |

| Fees | ~$50 setup, $175 annual (admin + storage) |

| Buyback Policy | Simple online request |

| Ratings | BBB A+ / Trustpilot 4.7? / TrustLink 4.8? |

| Special Features | Transparent pricing sheets online |

| Ideal For | Budget-friendly entry investors |

| Company | RC Bullion |

|---|---|

| Founded | 2010 |

| Minimum Investment | $10,000 |

| Fees | ~$100 setup, $180 annual |

| Buyback Policy | Processed within 3 business days |

| Ratings | BBB A / Trustpilot 4.8? |

| Special Features | Fast approvals, simple paperwork |

| Ideal For | Investors wanting quick IRA activation |

*Fees are approximate averages across verified 2025 disclosures; always confirm with the company before investing.

Quick Takeaways for 2025 Investors

-

Lowest Minimum Entry: Silver Gold Bull ($5k)

-

Most Educational / No-Pressure: Augusta Precious Metals

-

Best for 401(k) Rollovers: Goldco

-

Best Variety of Metals: Birch Gold Group

-

Fastest Setup: American Hartford Gold

-

Budget-Friendly Alternative: Oxford Gold Group

-

Quickest Funding Approval: RC Bullion

Frequently Asked Questions About Gold IRAs (2025)

Can I store my Gold IRA metals at home?

I wish I could tell you yes, but no ? the IRS doesn?t allow it. I asked the same thing when I opened mine. The metals have to stay in an approved vault like Delaware Depository or Brink?s, fully insured and under your custodian?s name. Keeps everything clean and compliant ? and honestly, safer than your closet.

What happens if I sell or withdraw from a Gold IRA early?

Been there. If you cash out before 59?, Uncle Sam takes his cut ? taxes plus a 10% penalty. The smarter move is selling inside your IRA, so it stays tax-sheltered. I?ve done it ? quick, painless, zero tax drama.

Are Gold IRAs FDIC-insured?

Nope. FDIC only protects cash in banks, not gold. But your metals aren?t naked ? they?re covered by private insurance from vaults like Lloyd?s of London. Think of it like art in a museum ? not government-insured, but fully protected.

Can I roll over a 401(k) or IRA into a Gold IRA?

Absolutely. That?s how I started mine. Just make sure it?s a direct rollover ? custodian to custodian. Don?t touch the money yourself, or the IRS will treat it like income. I?ve watched people learn that lesson the hard way.

How much gold should I hold in my portfolio?

Everyone?s different, but 5?10% is the sweet spot. Enough to steady your ship when markets go wild, not so much that you lose flexibility. When inflation hit 9%, that slice of gold in my portfolio was the only thing that didn?t flinch.

Which gold coins and bars are IRA-eligible?

The IRS is picky ? only 99.5% pure gold counts. American Eagles, Maple Leafs, or bars from PAMP and Valcambi are all good. Forget jewelry or ?rare? coins ? those will get your IRA disqualified faster than you can say audit.

What are typical yearly costs for a Gold IRA in 2025?

Expect about $200?$300 a year, all in. My setup fee was $50, admin around $125, and storage about $100. Worth every penny for peace of mind ? that?s one dinner out for a year of stability.

Can gold lose value like stocks?

Sure, gold moves ? just not like tech stocks on caffeine. It breathes slow. When the market tanks, gold usually chills or creeps up. You don?t buy it for thrills; you buy it so you can sleep.

What?s the safest way to start a Gold IRA?

Call two or three companies and grill them. Ask about total fees, storage, and buyback guarantees. The good ones take their time and explain everything; the shady ones rush you. I?ve hung up on a few ? trust your gut.

Will gold still hold value over the next decade?

If history means anything, yes. Gold?s outlived every currency, war, and central bank experiment. It won?t make you rich overnight, but it?ll keep your savings real when paper money forgets what value means.

My Final Verdict:?

Here?s my short answer: Yes, but only if you see it for what it is.

A Gold IRA won?t make you rich overnight. It protects what you?ve built, from inflation, government spending, and market chaos.

When I ran the numbers on my own portfolio, gold didn?t ?beat? the S&P, but it kept my net worth steady while others panicked. And that, my friend, is priceless.

?Gold doesn?t make you rich. It keeps you sane.?

My Personal Recommendation

After years of testing, comparing fees, and grilling reps, I still rank Augusta Precious Metals as #1.

Here?s why:

-

Zero-pressure approach

-

Transparent pricing

-

Lifetime support

-

4.9? reputation across thousands of verified reviews

They?ll teach you before they sell you, and that?s exactly what you want in a financial partner.

?Call Augusta Precious Metals for Your Free Gold Kit

(Or request it directly by calling Augusta at 855-444-7022. For transparency, I might earn a commission with no extra cost to you if you join some of the companies mentioned within this guide.)

Final Thought

You can?t control inflation, the Fed, or the next market correction.

But you can control what you hold.

A small slice of real, physical gold in a properly structured IRA might just be the calm anchor you need when the next storm hits.